Leading cable TV operator, Charter Communications Inc (NASDAQ:CHTR). (NYSE:T) , primarily offers three services – video, high-speed data and voice over its broadband cable systems to both residential and business customers.

We are concerned about Charter Communications’ operations in a saturated and competitive multi-channel U.S. video market. Like other cable operators, the company continues to lose subscribers to online video streaming service providers because of their cheap source of TV programming. Notably, in the second quarter of 2017, the company lost 90,000 video customers in the residential segment.

On the other hand, the twin buyouts of Time Warner Cable and Bright House Networks have strengthened the company’s foothold in hybrid fiber coax (HFC) and fiber networks. The company is also adopting various initiatives to improve its Spectrum products and cloud-based user interfaces. Also, accelerated residential and commercial customer growth, investments in business services division and rollout of several initiatives should aid the upcoming results.

Charter Communications currently carries a Zacks Rank #4 (Sell). The company competes with AT&T Inc. (NYSE:T) , DISH Network Corp. (NASDAQ:DISH) and Comcast Corp. (NASDAQ:CMCSA) in the intensely competitive pay-TV industry. AT&T and DISH Network have Zacks Rank #4 while Comcast carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

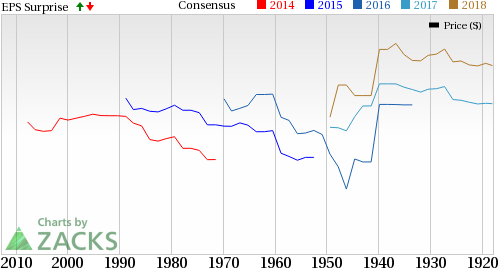

The company has generated negative average earnings surprise of 23.47% in the previous four quarters. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Charter Communications lags earnings estimate in third-quarter 2017. Our consensus EPS (earnings per share) estimate was $1.04 while the company reported EPS was just 19 cents. Investors should note that these figures take out stock option expenses.

Revenue: Charter Communications generated total revenues of $10,458 million, which fell below the Zacks Consensus Estimate of approximately $10,485 million.

Key Stats to Note: During the third quarter of 2017, residential high-speed Internet subscribers rose by 249,000 to 22.282 million. Voice subscribers grew 27,000 to 10.405 million. However, video subscribers decreased by 104,000 to 16.542 million.

Stock Price: At the time of writing, the stock price of Charter Communications was down nearly 2% in the pre-market trade on Nasdaq. Clearly the initial reaction to the release is negative. The company lost significant numbers of video customers. Both its top and bottom lines have failed to meet the Zacks Consensus Estimates. We believe this unimpressive performance is the primary reasons for this initial negative sentiment.

Check back later for our full write up on this Charter Communications earnings report later!

Looking for Stocks with Skyrocketing Upside?

Zacks has just released a Special Report on the booming investment opportunities of legal marijuana.

Ignited by new referendums and legislation, this industry is expected to blast from an already robust $6.7 billion to $20.2 billion in 2021. Early investors stand to make a killing, but you have to be ready to act and know just where to look.

See the pot trades we're targeting>>

AT&T Inc. (T): Free Stock Analysis Report

DISH Network Corporation (DISH): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research