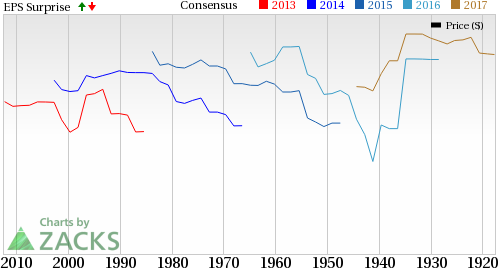

Charter Communications Inc (NASDAQ:CHTR). (NYSE:T) reported disappointing financial results in second-quarter 2017, wherein both the top and the bottom line lagged the Zacks Consensus Estimate.

GAAP net income in the reported quarter was $139 million compared with net income of $3,067 million in the year-ago quarter. Quarterly earnings per share of 52 cents per share were well below the Zacks Consensus Estimate of 81 cents.

Second-quarter 2017 total revenue of $10,357 million increased 3.9% year over year but missed the Zacks Consensus Estimate of $10,388 million.

Residential segment revenues came in at $8,287 million compared with $7,987 million in the year-ago quarter. Within the Residential segment, Video revenues totaled $4,124 million, flat year over year. Internet revenues came in at $3,513 million, up 12.1% from the prior-year quarter while Voice revenues were $650 million, down 10.9% year over year.

Commercial revenues totaled $1,472 million, up 9.5% year over year. Within the Commercial segment, small and medium business revenues were $924 million, up 9.7% year over year. Enterprise revenues came in at $548 million, up 9.3% on a year-over-year basis.

Advertising revenues were $381 million, down 5.8% year over year. Other revenues came in at $217 million, down 6.8%.

Quarterly operating costs and expenses were $6,510 million compared with $6,427 million in the year-ago quarter. Second-quarter adjusted EBITDA (earnings before interest, tax, depreciation and amortization) was $3,847 million compared with $3,542 million in the year-ago quarter. EBITDA margin came in at 37.1% compared with 35.5% in second-quarter 2016.

In the second quarter of 2017, Charter Communications generated $2,945 million of cash from operations compared with $1,590 million a year ago. Free cash flow in the reported quarter was $2,598 million compared with $1,396 million in the year-ago quarter.

At the end of the reported quarter, Charter Communications had $694 million of cash and cash equivalents and $63,248 million of outstanding debt compared with $1,535 million and $62,464 million, respectively, at the end of 2016. The debt-to-capitalization ratio at the end of the reported quarter was 0.57 compared with 0.54 at the end of 2016.

Charter Communications currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.The company competes with AT&T Inc. (NYSE:T) , Verizon Communications Inc. (NYSE:VZ) and Comcast Corp. (NASDAQ:CMCSA) in the intensely competitive pay-TV industry.

Subscriber Statistics

Residential Segment: As of Jun 30, 2017, Charter Communications’ residential high-speed internet subscribers rose by 231,000 to 22.033 million. Voice subscribers grew 14,000 to 10.378 million. However, video subscribers decreased by 90,000 to 16.646 million.

Monthly residential revenue per customer was $109.46 compared with $109.74 in the prior-year quarter. Single Play penetration was 40.2%, Double Play penetration was 25.6% and Triple Play penetration was 34.1%.

Commercial Segment: As of Jun 30, 2017, Charter Communications had 425,000 video, 1,285,000 high-speed internet and 847,000 voice subscribers. During the reported quarter, the company added 14,000 video customers, 36,000 high-speed internet and 38,000 voice customers. Monthly small and medium business revenue per customer was $210.64 compared with $214.52 in the prior-year quarter. Enterprise customers were 0.103 million, up 14.4% year over year.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

AT&T Inc. (T): Free Stock Analysis Report

Verizon Communications Inc. (VZ): Free Stock Analysis Report

Comcast Corporation (CMCSA): Free Stock Analysis Report

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research