Leading U.S cable TV operator, Charter Communications Inc. (NASDAQ:CHTR) , primarily offers three services – video, high-speed data and voice over its broadband cable systems to both residential and business customers.

We are impressed with Charter Communications’ merger with Time Warner Cable and Bright House Networks, which have strengthened its foothold in hybrid fiber coax and fiber networks. This should also help Charter Communications better address small, medium-sized and large businesses. Notably, the Time Warner Cable and Bright House deals have benefited Charter Communications in terms of geographic expansion and operating cost synergies, which in turn, should boost its bottom line and free cash flow in the upcoming quarterly results.

On the flip side, Charter Communications continues to operate in a saturated multi-channel U.S. video market. Moreover, the company faces stiff competition from online video streaming service providers as they provide an extremely cheap source of TV programming. Furthermore, gaining customers from competitors is a difficult task as most pay-TV operators are offering innovative packages. Moreover, the company has a leveraged balance sheet.

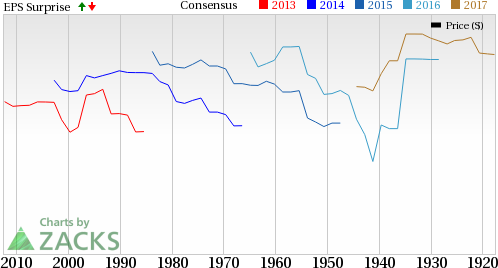

Charter Communications currently carries a Zacks Rank #3 (Hold). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here. The company has suffered a massive positive average earnings surprise of 94.11% in the previous four quarters. We have highlighted some of the key stats from this just-revealed announcement below:

Earnings: Charter Communications lags earnings estimate in the second-quarter 2017. Our consensus earnings per share (EPS) estimate were 81 cents while the company reported EPS was 52 cents. Investors should note that these figures take out stock option expenses.

Revenue: Charter Communications generated total revenue of $10,357 million, which fell below the Zacks Consensus Estimate of $10,388 million.

Key Stats to Note: During the second quarter of 2017, residential high-speed internet subscribers rose by 231,000 to 22.033 million. Voice subscribers grew 14,000 to 10.378 million. However, video subscribers decreased by 90,000 to 16.646 million.

Check back later for our full write up on this Charter Communications earnings report later!

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artifical intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Charter Communications, Inc. (CHTR): Free Stock Analysis Report

Original post

Zacks Investment Research