As long as the US Stock rally continues to defy conventional wisdom of the majority - for example a bull market in stocks cannot coexist with a bear market in bonds, bearish calls (1, 2, 3) will continue. The will keep most of the public fearful to buy stocks until prices rise significantly.

Charts must be viewed within the context of sentiment, price, leverage, and time, and the cycle of accumulation and distribution.

Chart

Comments

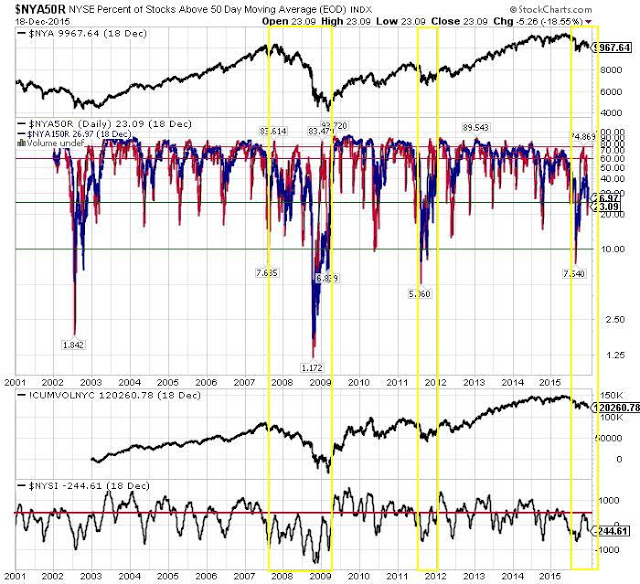

The number of NYSE stocks above their 50- and 150-day moving average (NYA50R and NYA150R) are 23.09% and 26.97%, respectively (chart). Readings below 25% are considered oversold. The inability of NYA150R to close above 60% and the (McClellan) Summation Index to hold 500 suggests a weak rally from oversold. Weak rallies, either within protracted declines or corrections, are highlighted by yellow boxes. The present rally needs to kick it up a few notches (show more strength) while the doing is good (seasonal strength) or smart money will run for cover.