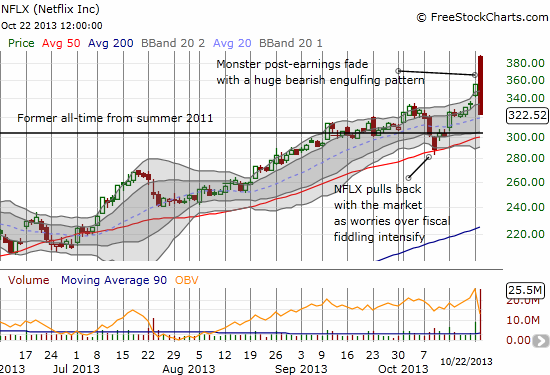

On September 23rd, I noted a bearish engulfing pattern on Netflix (NFLX) that seemed to indicate the stock was finally printing a top. At the time I warned as well as noted the following:

“Mind you – this technical call is no slam dunk. NFLX has had a stellar year with multiple up gaps and now a very smooth uptrend since the July lows. It has been a remarkable turn-around from an ugly close to 2011 and a 2012 which broke 2011′s low after a fake-out rally earlier in the year. Netflix’s bottom was essentially secured by a timely investment by Carl Icahn in November, 2012…

At some point, investors who have captured these nice profits in NFLX will sell. Even Icahn must be licking his chops by now with NFLX’s valuation back to the sky high levels of 90 forward P/E, 4.7x sales, and 16.7x book. Trailing P/E is 376. I think it is safe to say the minute word gets out Icahn is selling, NFLX will plunge like a rock. This likelihood alone should motivate Icahn to completely liquidate once he does sell. In the meantime, insiders are happily unloading stock into these stratospheric levels.”

NFLX never confirmed the bearish engulfing pattern as the downward momentum stopped on a dime, so I never made a trade. The stock resumed its upward surge and made new highs for the year before renewed pressure took NFLX down to a successful retest of its 50-day moving average (DMA). This brief pullback delivered very belated selling pressure. From there, it was a rally into earnings that included an ominous 6.4% leap to fresh all-time highs before NFLX announced earnings. That surge seemed to indicate that someone “knew” something about earnings. Sure enough, NFLX soared in after-hours trading as much as 10% or so on more investor/trader excitement.

But what has followed looks like topping action redux. NFLX gapped up at the start of regular trading a healthy 9.3%, but it was all downhill from there. By the time the carnage ended, NFLX had printed a monster bearish engulfing pattern and a -9.2% close, a mirror image of extremes. This is the worst post-earnings fade I have seen in a very long time, maybe ever.

This action is so dramatic, I HAVE to show the intraday action. It has all the look of a major seller who wanted to lock in profits in a hurry. Perhaps this is the exact kind of selling by none other than Icahn that I referenced above?!?

The link is to his Schedule 13D filing with the SEC announcing the sale of shares. Icahn rode that bad boy for a year from about the 60s to just under $400 or so. That is great stuff. And I bet he timed this so he would register these gains as long-term capital gains!

Note that Icahn did not sell his entire stake as I thought he would when selling time arrived. However, he must know that few investors will be interested in taking NFLX higher knowing he is in the process of getting out. Would YOU want to be the person left holding Icahn’s bag? What can take NFLX higher now? The next main hope would be for all the bearish analysts to start upgrading the stock, grooming a new set of replacement investors. I cannot imagine THAT happening either. According to Schaeffer’s Investment Research, only 5 analysts rate NFLX a buy or strong buy. Seventeen (17) analysts are neutral and 5 analysts are at sell or strong sell. That is a rare amount of pessimism for such a high-flying stock.

I was much too slow in the morning to make a move on NFLX even though I was bearish going into earnings. The only thing that stopped me from buying speculative puts ahead of earnings – besides that skyhigh premiums – was the absolute lack of analyst bullishness. Now, I can only hope for some kind of relief bounce to improve the risk/reward balance of chasing NFLX downward. I will be truly amazed if NFLX manages to beat out this latest topping pattern.

Be careful out there!

Full disclosure: no positions