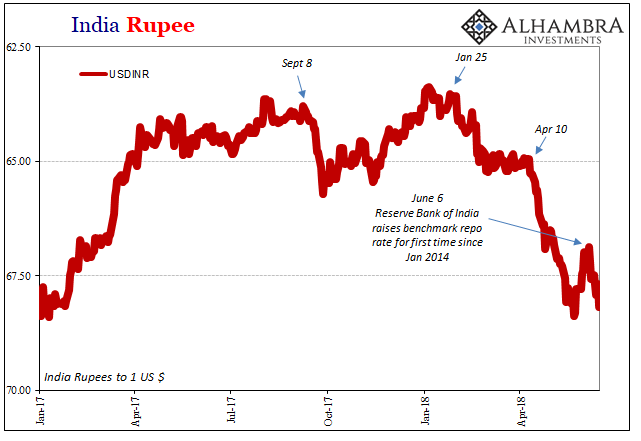

Well before Jerome Powell changed his dots a little, or the ECB chickened out, the Reserve Bank of India had already acted. For the first time since January 2014, on June 6 the RBI raised its benchmark repo rate. Rather than reverse the rupee’s slide it appears to have renewed it. The euro may have routed yesterday and hogged all the attention, but it stopped rising around June 7.

Central banks often have to walk a fine line between helping by introducing a policy position (assuming they can ever actually help) and making things worse through nothing more than taking action which ends up instead confirming market fears. It would seem that last rate hike has fallen among the latter category.

The rupee has been a canary in the “dollar” mine all year. It has turned lower first, before the rest of them as even the most troubled have followed it to sink alongside growing “dollar” pressure and tension. Why India?

In a lot of ways, it doesn’t make sense. India is the shining example out of the EM set. Its economy is actually functionable and legitimately growing, unlike most of the rest of the world, including the US and Europe where mere positive numbers are treated as cause for (largely political) huge media celebrations. Maybe it’s as simple as if it can happen to India, where won’t it happen?