The U.S. Shale Oil Industry is in serious trouble, even without the negative impacts of the global contagion. While it’s no secret that shale oil wells suffer high decline rates, what is taking place in the country’s largest oil field is quite alarming. The rate at which shale oil production is declining in the Permian should worry investors.

In just three months, Permian shale oil production from 2019 declined a stunning 23%. Thus, if no new wells were added in 2020, the Permian region would have lost 23% of its oil production… IN THREE MONTHS!!

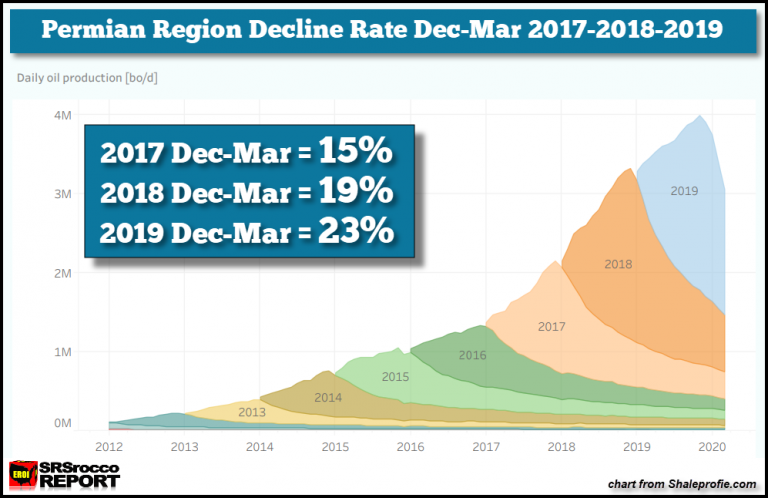

Here is the CHART OF THE WEEK showing how much faster shale oil production is declining in the Permian:

The chart above was taken from Shaleprofile.com. I subscribe to the service, and I have to say, it’s worth its weight in gold. There is so much excellent information provided on the Shaleprofile.com Dashboard. Each year is shown in a different color. Furthermore, you can see the decline rate for each year.

Permian shale oil production brought online in 2019, peaked in December 2019 at 3,982,000 bopd (barrels per day). I have rounded all the production figures. By March 2020, Permian oil production fell to 3,052,000 bopd. Again, in just three months, the 2019 production (LIGHT BLUE) fell a stunning 930,000 bopd, or 23%.

Now compare 2019’s production falling 23% in three months versus 19% for the same 2018 period and 15% for 2017. Moreover, if we look at how much daily oil production was lost during these three months for 2015-2019, it’s rising exponentially:

Permian Dec-Mar Oil Production Declines

2015 Dec-Mar = -143,000 bopd

2016 Dec-Mar = -173,000 bopd

2017 Dec-Mar = -323,000 bopd

2018 Dec-Mar = -646,000 bopd

2019 Dec-Mar = -930,000 bopd

Can you imagine running a business where you lose 23% of your product in just three months? Even worse, can you imagine being an investor in a business that loses 23% of its production in three months… LOL. Unfortunately, many investors still don’t understand the RAPID DECLINE rate that plaques the shale oil industry.

Watch for BIG BAD NEWS to come out shortly in the U.S. Shale Oil Industry. If you are an institution or individual investor plowing back into Shale Stocks because they look OVERSOLD… you have my sympathies.

I will be putting out another article comparing the TWO LARGEST OIL FIELDS in the world. The first is Saudi Arabia’s Ghawar Oil Field that produced 3.8 million barrels per day in 2018 versus the U.S. Permian Basin that produced 3.5 million barrels per day. The comparison is quite EYE-OPENING.