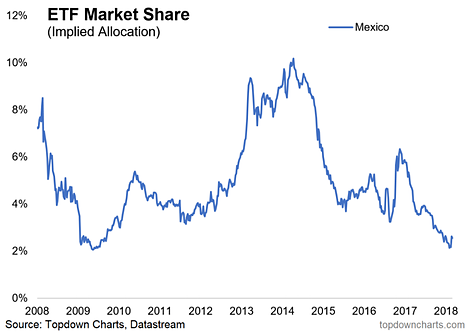

This week it's a look at ETF market share - which is basically another way of saying implied country allocations. There are a few standouts across the countries within emerging markets when you look at implied country allocations, but Mexico is a particular standout for a number of reasons.

The chart comes from a report on Mexican Equities where we discussed the valuation picture, cyclical outlook, currency view, and of course the geopolitical aspects. Indeed, just looking at the chart makes you think it could be a contrarian opportunity as the implied allocation has dropped back to GFC levels.

A brief note on methodology - for the ETF market share indicator, aka implied asset allocation, what we have done is taken the AUM (assets under management) for all Emerging Market Equity ETFs, for countries only. So it does exclude the AUM of broad or regional emerging market ETFs - which allocate based on an index i.e. run passive allocations, so aren't necessarily representative of any active decision or sentiment process. And then it's simply looking at AUM by country against all EM country ETF AUM... i.e. ETF market share or implied country allocation.

As for the so-what, when you think about country allocations like this what we are looking for is extremes. We are looking for either what might be "crowded trades", or "under-owned" situations. Basically looking at it as a potential contrarian signal... a signal which will either source an initial idea that undergoes additional analysis to build a well rounded investment thesis, or a signal which complements an existing case. For Mexico it's a bit of both, and when you think about the damage done to Mexican stocks by all the politics and the risk around NAFTA, at least on first glance it looks pretty interesting.