This week it's gold and real yields. A really important thing happened with interest rates in November last year which should be front of mind for investors thinking about gold. It is a reasonably well established understanding that gold prices trade inversely to real yields, and I'll explain why shortly.

What happened in November last year was that a key measure of real yields moved from negative to positive. And that's not positive for gold!

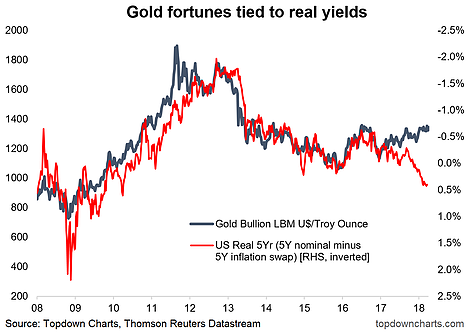

The chart in question comes from a recent report we wrote on the outlook for gold prices (and silver). Basically what you see is the 5-year real yield (US 5-Year Treasury Yield minus US 5-Year Inflation Swap... a pure market based measure of real yields), shown inverted against the gold price (because real yields tend to move inversely with gold prices). A large bearish divergence has opened up on this chart, and if you took it literally gold prices could be headed below $1000.

As for the economic rationale (finding a nice correlation in the charts is one thing, finding one that makes economic sense is another), the main line of thinking is that as real yields move higher the opportunity cost of holding gold (i.e. a non-interest bearing asset) increases. So in a sense the value of gold drops as real yields move higher.

Correlations like these can and do break down at times, and there is every possibility that the gap in the chart closes by real yields going back below zero. However as the Fed hikes interest rates and continues the transition from QE to QT, real yields are likely to remain elevated.

To be fair, not all people think about gold in this way. In fact many people think of gold as a risk hedge (e.g. as I am writing stocks were down -3% vs gold up +1.5%), and indeed, probably a big explanation as to why gold has diverged from real yields is hedging demand as investors worry about a potential bear market and heightened geopolitical risks. But even if that is your thinking, the idea of opportunity cost is still relevant, and indeed you might even think of it as simply the cost of hedging (remembering that there is no free lunch in markets!).

I would be cautious in treating gold as a hedge though, because when an asset class is facing significant headwinds like this it may not end up behaving in the way you expected. For example, bonds faced considerable headwinds late last year, and ended up initially falling at the same time that stocks fell. So not only is there no free lunch, there are also no certainties in markets! If nothing else this article should give pause for thought on how you manage risk.