by Pinchas Cohen

Bitcoin is on the rise. Investors can't seem to get enough of the cryptocurrency. It's been driven up yet again for a total gain of 130% this year.

It traded above $2,200 on Monday, 9% higher on the day and up 15% from Friday's closing price of $1,913 which was a fresh high at that point. Bitcoin is up 397% from one year ago.

And it's not just Bitcoin's price that's rising. More and more companies appear willing to assume exposure to the volatile digital currency. Soon you might even be able to use them to buy airline tickets from Japanese carrier Peach Aviation, for starters.

It’s also become a safe haven currency for political risk. Ironically, right now its biggest group of buyers are Japanese nationals, holders of that other popular safe haven currency, the yen. And here's another irony: of all the agencies trying to rein in irregularities surrounding Bitcoin trading and selling, Japanese regulators are some of the strictest.

Nevertheless, virtual currencies—with Bitcoin currently at the head of the class—are perhaps today's most explosive growth trade. As Fortune recently noted:

“If you bought $5 of Bitcoin 7 years ago, you’d be $4.4 million richer.”

Too Late To Ride Price Higher?

The worst feeling for an investor is that of sitting on the sidelines, watching other people profit. This might be just such an occasion. Or it might be better to wait. What to do?

Yesterday, Bitcoin's price gapped up 3.10%, climbing an additional 18.57% intraday, though the currency closed 'just' 10.92% higher, at 2149.6299.

A rising gap means there were only buyers, no sellers. Traders may see that as a bullish sign. However, not every rising gap is bullish.

An area gap, which occurs within a trading range is meaningless, but an exhaustion gap, which may have taken shape yesterday, occurs after an extraordinary rise in price, is actually dangerous. It reflects the irrational exuberance of the participating public (sometimes referred to as 'dumb money'), who come in only after hearing all the good news, but end up buying only after the smart money and trading professionals have already enjoyed the rally.

The unsuspecting public joins at the top, right before the aforementioned smart money—who have already enjoyed and benefited from the crazy ride up—are all in and merely waiting for a good opportunity to come along so they can dump it all on the not-so-smart next buyer.

Exhaustion Gap Or Upcoming Buying Opportunity

Yesterday’s exhaustion gap is followed today by what may prove to be a hanging man, a candlestick that, with a following confirmation of a lower close, suggests the bulls gave it all they got and the bears are taking over. That psychology would fit perfectly with the psychology of the exhaustion gap.

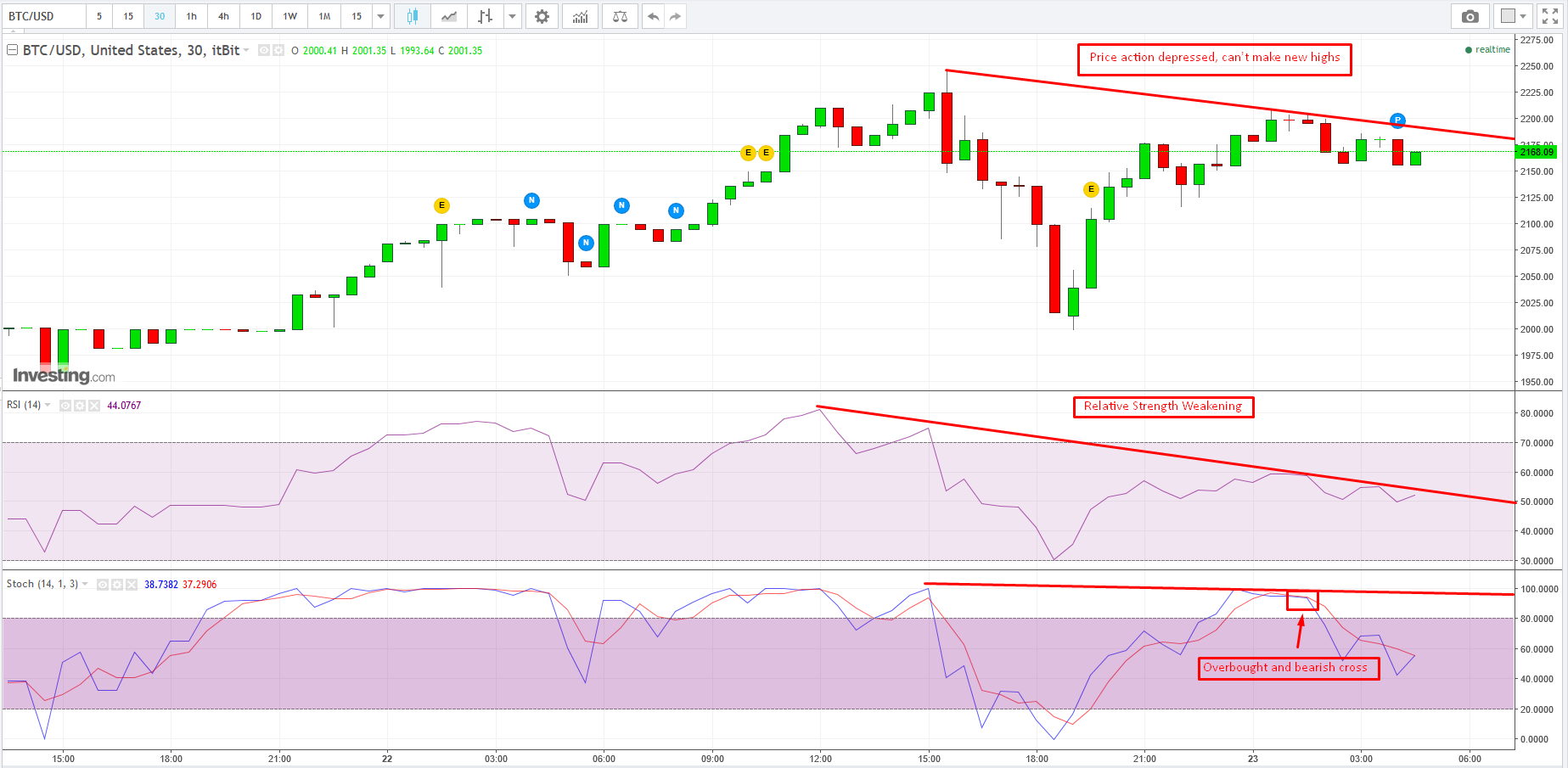

But let’s take a closer look at the 30-minute chart.

The price reached a high of 2297.9951 yesterday at 14:00 EDT, but since then it has been unable to make higher highs, putting the trend into question. The relative strength of the price is trending down, as it’s weakening. In addition, stochastics have been oversold and executed a bearish cross, along with trending down overall, like the RSI (relative strength index).

Even if you believe in the long-term future of Bitcoin, you might want to wait for a correction, both in price and momentum. But, since we mentioned the longer term, let’s take a look at Bitcoin's weekly chart.

Six consecutive weekly gains! Maybe we should all buy Bitcoin and watch it rise in value, forever. Though we jest, following the herd is not necessarily always a bad thing. It can protect you from predators.

Just don’t follow it during a stampede. Wait for a correction. To say that the RSI is oversold is an understatement. It's reached its all-time-high. Stochastics are oversold, threatening a bearish cross and a double bottom. This is the weekly chart, so expect a robust correction if and when it happens.

When to get in? Well, that’s anybody’s guess, but since the price may have spiked, we’d be concerned about a blow off. We wouldn’t touch it before price returns to its last uptrend line of late March, at least, which would put it probably at $1650, the support of Bitcoin's May 15 low, when it declined 6.72%.