Two charts today, both from Goldman Sachs and both focusing on the same topic: U.S. equity valuations.

During the early stages of the bull market, it is difficult to find a bull, as was the case throughout 2009. That is why the old adage goes along the lines that "bull markets climb a wall of worry". However, near the end of the bull market, everyone is a bull. Expectations of higher prices and higher earnings are the consensus forecast year after year. Sometimes, expectations are so bullish that they are literally extrapolated into the sky.

Goldman Sachs Portfolio Strategy Research writes:

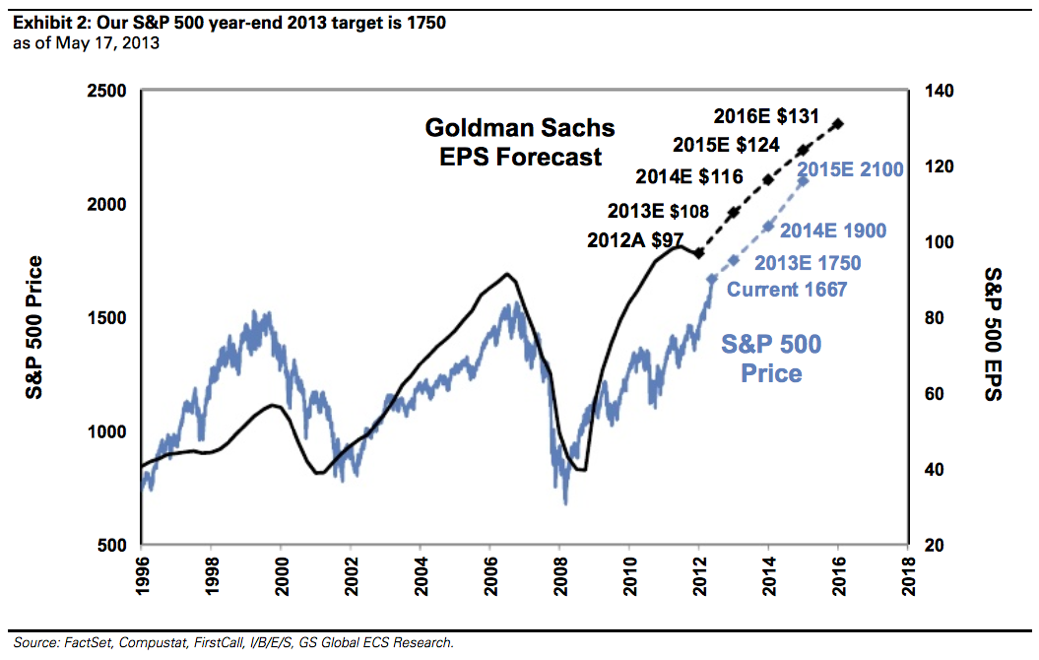

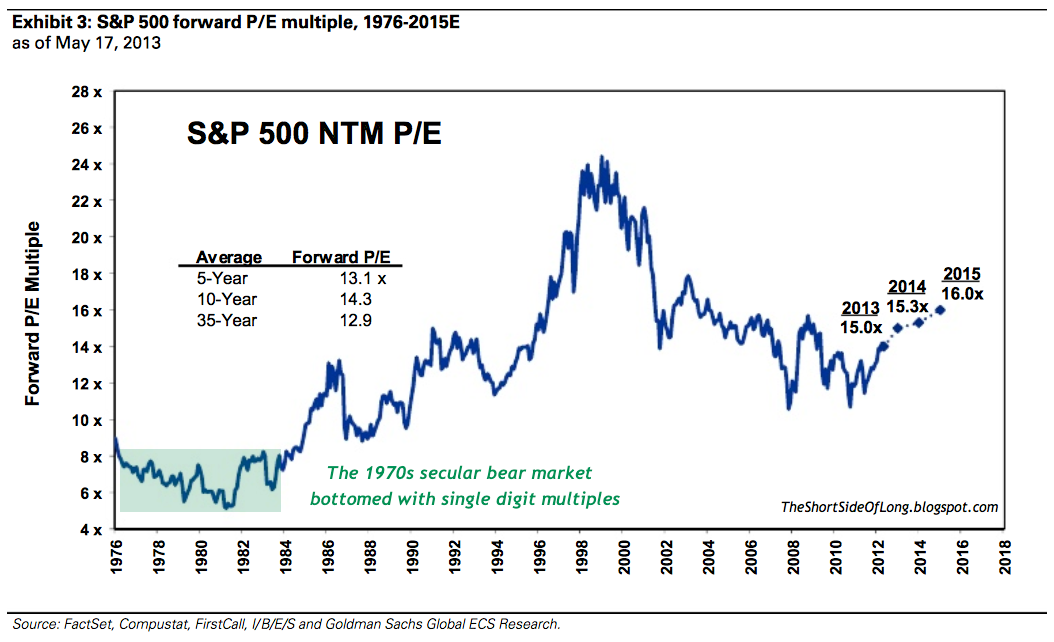

Our positive 2013 outlook for S&P 500 has played out much faster than we expected. Our earnings estimates remain unchanged but we raise our dividend estimates and index return forecasts for 2013 through 2015. We expect S&P 500 will rise by 5% to 1750 by year-end 2013, advance by 9% to 1900 in 2014, and climb by 10% to 2100 in 2015. Our 2013 return implies a year-end P/E of 15.0x, a one multiple point premium to our fair value estimate. We forecast dividends will rise by 30% during the next two years. Dividend yield is likely to stay around 2%, in line with the 20-year average. (highlights added)

Is The Secular Bear Market In U.S. Stocks Over?

Is the secular bear market over? Should we expect rising multiples? Goldman seems to think so. However, it is interesting to note that every other secular bear market trend eventually bottomed in single digit PE ratios, apart from the current one. Either this will be a historical anomaly falling into a "this time is different" narrative or the current secular bear market is not over just yet....

Time will tell.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Chart Of The Day: Earnings Expectations

Published 05/30/2013, 12:02 PM

Updated 07/09/2023, 06:31 AM

Chart Of The Day: Earnings Expectations

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.