By Pinchas Cohen

The Reserve Bank of New Zealand meets today at 17:00 EDT for an interest rate decision, followed by a monetary policy statement and rate statement, to be concluded by a speech by Governor Wheeler, at 18:00 EDT.

While interest rates are expected to remain steady at 1.75 percent, the focus is on tone. Investors have been forming the expectation the RBNZ will assume a dovish stance, adopting a slower interest-rate path.

This follows disappointing economic data, which reduced inflation expectations, prompting traders to reduce bets the bank will raise rates any earlier than 2019.

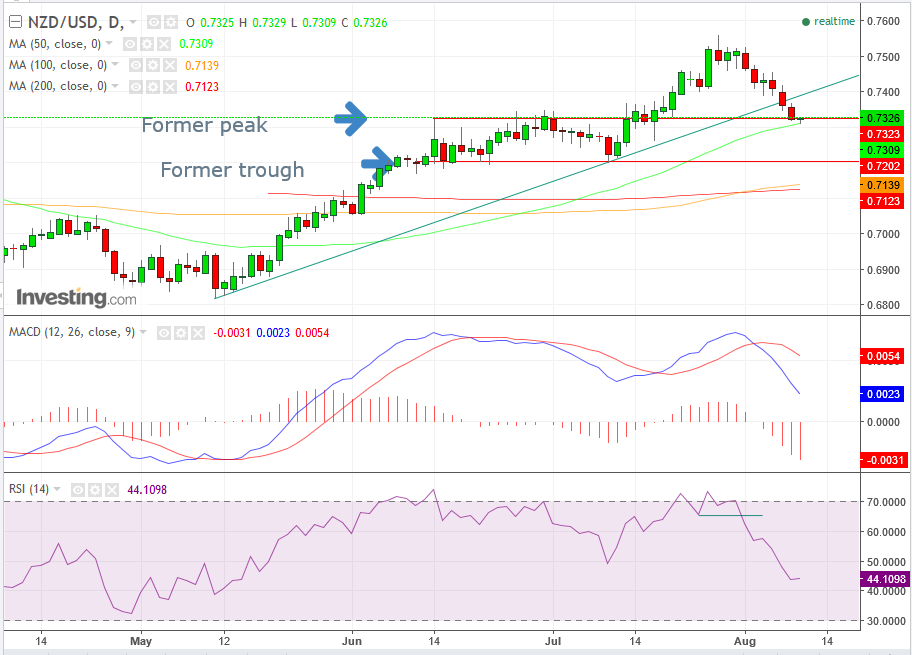

The kiwi declined 3 percent since its July 27, $0.7560 high, falling below an uptrend line since mid-May on Monday. While that raises a red flag, the true test is the trend’s peak-and-trough integrity. The former June-July $0.7300 peak is expected to provide price support. However, the last line in the sand is the $0.7200 June-July trough.

The pair is now finding support and bounced on the 50 dma (green) from its $0.7309, the very pip where the 50 dma is positioned. Additional support may be found with the golden cross, when the 100 dma (orange) crossed over the 200 dma (red) recently.

However, that was on August 3, before the price crossed below the uptrend line. Should crossing below the uptrend line act as a catalyst to a further decline, the moving average interplay will follow.

That comparison between moving averages of different periods can be seen via the MACD, which provided a sell signal when its longer moving average crossed below its shorter one on the same day of the golden cross, suggesting the price would follow. And it did. In addition, the leading momentum RSI provided a sell signal even two days earlier, on August 1st, when it completed a double top from an oversold condition.

Trading Strategies

Conservative traders should wait on a short for confirmation of a trend-reversal, when a series of two peaks-and-troughs are registered. That could happen only after the price will fall below the June-July $0.7200 trough. Alternatively, they may go long if the July 27, $0.7560 peak is overcome, with a minimum target of $0.7700, where it’s expected to meet the former, April 2015 peak.

Moderate traders may chance a short on the violated uptrend line but should wait for a return-move to retest the violated uptrend line, or at least to the psychological round $0.7400 expected resistance. Alternatively, they may short upon a close beneath the 50 dma, with a minimum objective of the $0.7200 former trough.

Aggressive traders should wait for the same parameters as the moderate traders but may risk a long right now, relying on the support of the 50 dma, former peak and on the fact that return-moves often follow trend line violations, before entering into a short position – based on the above parameters.