This article was written exclusively for Investng.com

Following the SNB’s surprise decision to hike rates by 50 basis points on Thursday, the USD/CHF tanked some 360 pips from the high to the day’s low. But that could just be the start. In light of the sudden change in its policy setting, and stating that the franc is no longer overvalued, we are likely to see further strength in the currency going forward, especially against its weaker rivals. But even against the dollar, we could see the franc rally further, potentially causing the USD/CHF to drop to the 0.95 handle again.

At the end of March, when rates were still in consolidation mode, I noted that there was a good chance the USD/CHF could follow the footsteps of the USD/JPY and stage a sharp recovery. The reason was that the BOJ and SNB were the last remaining dovish central banks out there. But now the BOJ is on its own, which makes the CHF/JPY a good long candidate.

From a technical perspective, the USD/CHF does appear a little oversold in the short-term outlook, so a bit of a recovery shouldn’t come as surprise as we have already seen today. But I feel the SNB’s move was a game-changer and so reckon we will see further falls for this pair in the days to come. Admittedly, the dollar is still very strong but probably not enough to continue its long-term uptrend against the franc without a deeper pullback first.

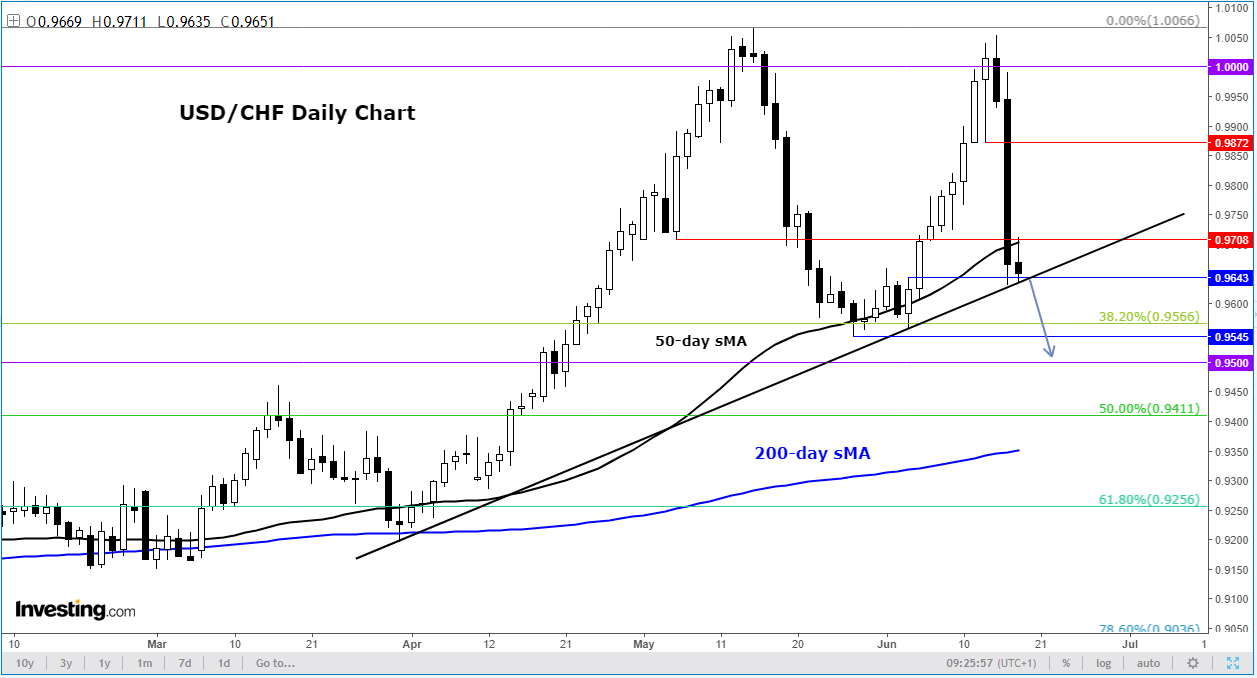

At the time of writing, USD/CHF was testing support around 0.9640/50 area, which was the base of the last breakout and where we have the rising trend line converging with price. But the 50-day average is retaken by the bears and several support levels broke down on Thursday, including 0.9700/10 area, which has now turned into resistance.

A break below the above-mentioned support area would make the bulls nervy, and this could trigger fresh technical selling. Some of the trapped bulls’ stops are undoubtedly resting beneath the May low at 0.9545. This means that the USD/CHF could tap into that pool of liquidity in a sharp move, and potentially drop to 0.9500 before deciding on its next move.

So, given the SNB’s move on Thursday, I no longer expect the USD/CHF to appreciate past parity again. However, if, for some reason, it does, then at that point it will have reclaimed all the SNB-related losses. This would be the “failure of failure” setup, and as such a very strong bullish signal. Therefore, if we get there again, I would have to admit I am wrong. It is always best to have a contingency plan when it comes to trading, even if you are highly convinced about something happening. Never forget this.