A flurry of news concerning natural gas could confuse traders.

French TotalEnergies (EPA:TTEF) and Italian Eni (BIT:ENI) supermajors discovered a vast natural gas deposit, which will help Europe reduce its reliance on Russian natural gas. However, unfortunately, it will take some time until it's ready to be delivered. So, it doesn't alleviate Europe's energy crisis at the moment.

Also, the idea that Canada would become a natural gas supplier to Europe is fizzling, as it will take three years before new projects necessary for long-term supply will come online. Also, long-term investing in liquified natural gas conflicts with the West's priority to develop cleaner energy sources.

Meanwhile, Europe is committed to cutting 15% of its natural gas consumption. Denmark already reduced its consumption by almost 29.3% in the year's first half to reduce soaring prices, which could not come at a worse time for the continent.

The slump in the euro, which has fallen below parity to the dollar for the first time in 20 years, has exacerbated the spike in commodity prices. Moreover, I predict the single currency is headed lower yet, further compounding the rising cost of NG.

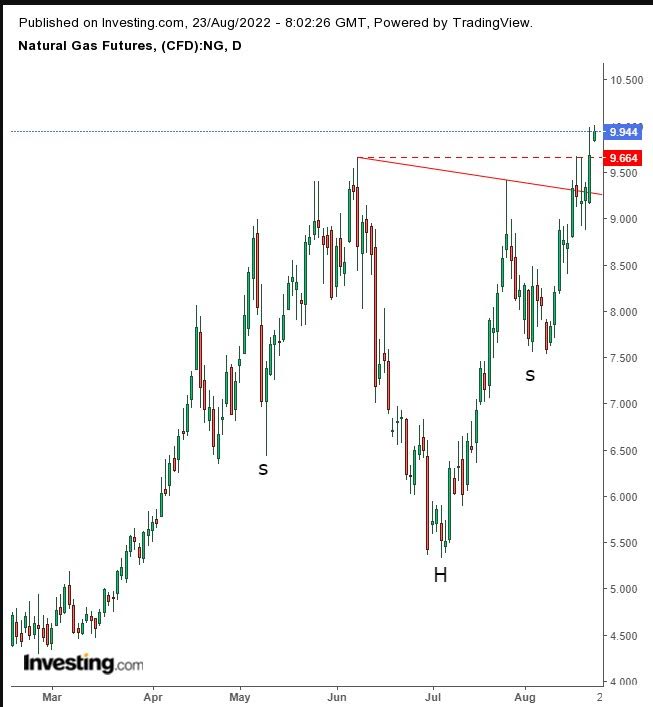

The contract opened higher, creating a breakaway gap despite the news of the natural gas discovery off Cyprus by the two energy majors, demonstrating that traders do not consider it relevant at this time.

A rising gap, especially one that breaks away from congestion, is bullish, meaning there were only buyers at those prices. Furthermore, the gap's location reinforces a large H&S continuation pattern.

Implied Target

Like in a reversal H&S, traders measure the pattern's height at its lowest point. That is the lower part of the neckline. They expect the same interest within the design will trigger a similar move on the other side. Therefore, I forecast the medium-term activity to be $3.965 from the $9.290 breakout point, targeting $13.255

The price has been rising for the third week, forming tall green candles on the weekly chart. If NG maintains its gains into the weekly close, it will complete Three Advancing White Soldiers, a three-candle bullish pattern, showing long-term strength.

However, they often precede short-term declines, during which the candles' first or second provide support. Such a scenario would jive with a return move following the breakout completing the H&S continuation pattern, as the neckline coincides with the second candle.

Trading Strategies

Conservative traders should wait for the return move that reinforces the neckline's support before committing to a long position.

Moderate traders would risk buying the contract upon a dip for a better entry, if not further confirmation.

Aggressive traders could enter a contrarian, short position, then follow up with a long position, along with the rest of the market. A coherent money management system is essential for successful trading. A trading plan should incorporate your timing, budget, and temperament. In case you don't know how to do that yet, here are generic examples for practice:

Trade Samples

Aggressive Short Position

- Entry: $10

- Stop-Loss: $10.25

- Risk: $0.25

- Target: $9.25

- Reward: $0.75

- Risk-Reward Ratio: 1:3

Moderate Long Position

- Entry: $9.25

- Stop-Loss: $8.75

- Risk: $0.50

- Target: $13.25

- Reward: $4

- Risk-Reward Ratio: 1:8

Disclaimer: The author currently does not own any of the securities mentioned in this article.