By Pinchas Cohen

Bitcoin – Digital Gold or "Creeptocurrency"?

Bitcoin cut through $10,000 for the first time, like a knife through hot butter.

In the early 2000s, forex became “the next big thing.” In the 2010s, binary options became “the next big thing,” and now cryptocurrencies are “the next big thing.”

One glaring warning sign of a bubble is data available with Google Trends demonstrating a world-wide search for “buy Bitcoin with credit card.” A market axiom is that when the non-professional public participates in a market, it’s topping out. When people are buying past their means to max out their credit cards because they bank on making a quick profit before the month is out, it’s the cherry on top, from a contrarian perspective.

Does Bitcoin Have More Room To Climb?

The public stereotypically joins a market because of all the profits it has already made its investors. Non-professionals are considerate enough to come in and give their hard-earned cash as profit to early investors, letting them cash out.

Bitcoin has gained 900 percent this year, making it the poster boy for markets that attract the public after they have already climbed.

There are those, however, who believe that Bitcoin has a lot more room to climb. Fund manager Michael Novograts – whose 20 percent network in cryptocurrencies has him put his money where his mouth is – sees the possibility for Bitcoin to reach $40,000 by the end of 2018. Although past results are not indicative of future performance, he was the man who forecast Bitcoin’s rise to $10,000. Credit should be given where credit is due, but we still don’t recommend buying Bitcoin on credit.

Bitcoin's Advance Is Becoming Unsustainable

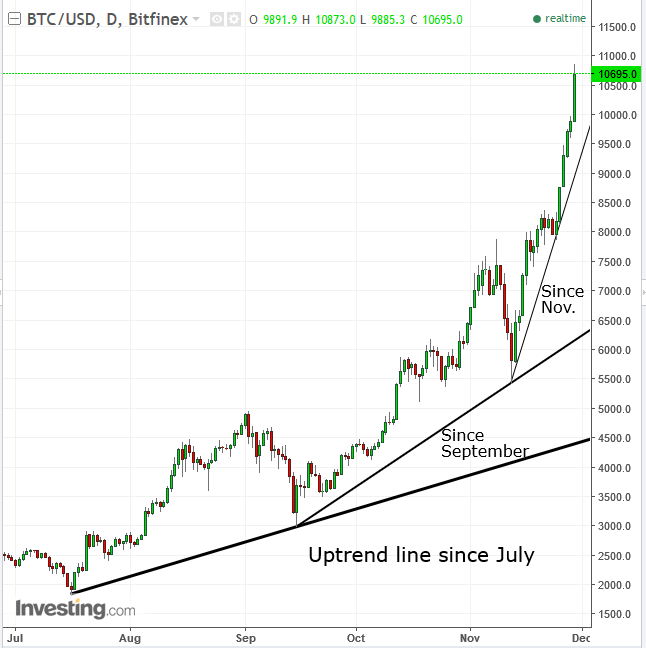

Bitcoin’s advance is becoming steeper and steeper, making it less and less sustainable, similar to when the public runs out of credit.

While Bitcoin’s utility ensures innate value, the overwhelming majority of ICO’s have been created for the sole purpose of receiving money from unsuspecting investors, not to actually create a functioning currency. Some of the people running these companies come from the imploding binary options industry. To draw a parallel to the 2000 dotcom crash –– while the big, known tech companies were not erased, most of the startups were. As well, while Bitcoin does possess inherent value, the ever-steeper uptrends are not sustainable, making a correction ever more likely.

Trading Strategies

Conservative traders would wait to enter a long position, upon a return to the flattest, most sustainable uptrend line since July.

Moderate traders might be content to enter a long position with a correction to the secondary uptrend line since September.

Aggressive traders should wait for a retracement at least to the third uptrend line, coinciding with the round, psychological $10,000 milestone support.