The US dollar gained on Wednesday, hitting a 2-1/2 month high, posting its strongest month since November 2016, after Donald Trump won the presidential election.

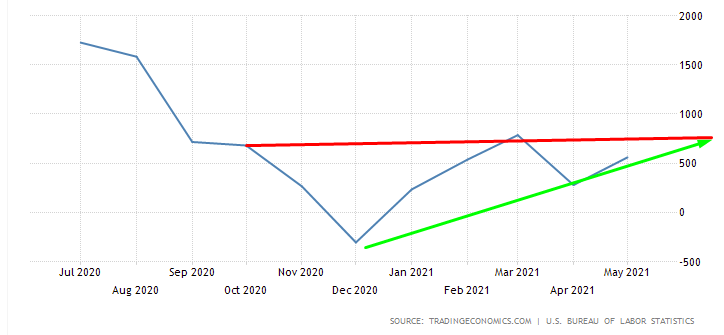

Starting on June 6, and escalating after the Federal Reserve blindsided markets when the central bank indicated it was quickening its pace to higher interest rates, the dollar has risen 2.25%. Today’s advance may suggest investors expect Friday's US job creation data will be robust, extending the overall rising trend for this metric since it bottomed in December 2020.

Should that occur, it would support the developing narrative that a V-shaped economic recovery is in process.

The dynamic on the dollar's technical chart tells a similar story.

The dollar opened higher yesterday, extending its advance for a seventh straight day, the longest period of appreciation for the currency in quite some time. It is completing a possible bullish pennant, right after crossing the 200 DMA which is being used as a base, suggesting bulls are taking on the Mar. 31, 93.45 peak.

If the greenback continues higher, it will have completed a large double-bottom.

Trading Strategies

Conservative traders should wait for the price to complete a potential return-move, triggered by the first bullish exit, and wait for evidence of newfound demand atop the pattern.

Moderate traders would also wait for a buying dip, if not for further confirmation of the uptrend.

Aggressive traders could enter at will, provided they have drawn a plan that justifies their entry. Here’s an example:

Trade Sample – Immediate, Aggressive Trade

- Entry: 92.25

- Stop-Loss: 92.00

- Risk: 25 pips

- Target: 93.25

- Reward: 100 pips

- Risk:Reward Ratio: 1:4

Author's Note: This above is a sample, meaning it is not the one true way to approach this trade. It's also not the analysis which is in the body of the text. If you don’t read and understand it, please don’t leave a comment based on the sample. The analysis is our interpretation. Even if it’s correct, it relies on statistics. We don’t own a crystal ball. So, we can't know what will result from this one trade. Also, our interpretation could be wrong altogether. Trading success or failure is not measured by any single or even a few trades. Rather, it's measured by an ongoing track record that seeks to get on the side of statistics. You need to develop your own style, based on your budget, temperament and, of course, timing, and write a trading plan accordingly. Till you learn how to do that, feel free to take our samples—if they match your risk tolerance—for the purpose of learning, not profit, or you will get neither. Guaranteed. And there's no money back.