This article was written exclusively for Investing.com.

This morning’s release of softer Eurozone PMIs underscores the impact supply bottlenecks are having on economic activity, and the reason why the European Central Bank may continue to overlook above-target inflation.

As the ECB’s loose policy will likely remain in place for a while yet, this should provide a solid backdrop for European markets. Consequently, the likes of the German DAX could break to new highs in the not-too-distant future.

While several major central banks have already tightened their policies and with the Fed set to taper QE in the next month or two, the ECB remains stand pat and is therefore considered a more dovish central bank. This is especially the case given that Bundesbank President Jens Weidmann has announced that he will step down after more than a decade in the post. Weidmann’s resignation—apparently for personal reasons—means the central bank will be left without one of its most hawkish policy makers to influence policy decisions, increasing the likelihood of a slower withdrawal of support next year.

For what it is worth, next week’s policy decision is going to offer very few clues about the monetary policy outlook given that the new staff projections will be published at the ECB’s next meeting in December. Undoubtedly, the risks to inflation have picked up further since the September projections were made, but as ECB President Christine Lagarde said at the weekend, she still views the rising price pressures as largely being transitory.

With the ECB’s various stimulus measures ongoing, European stock markets have continued to find support on the dips.

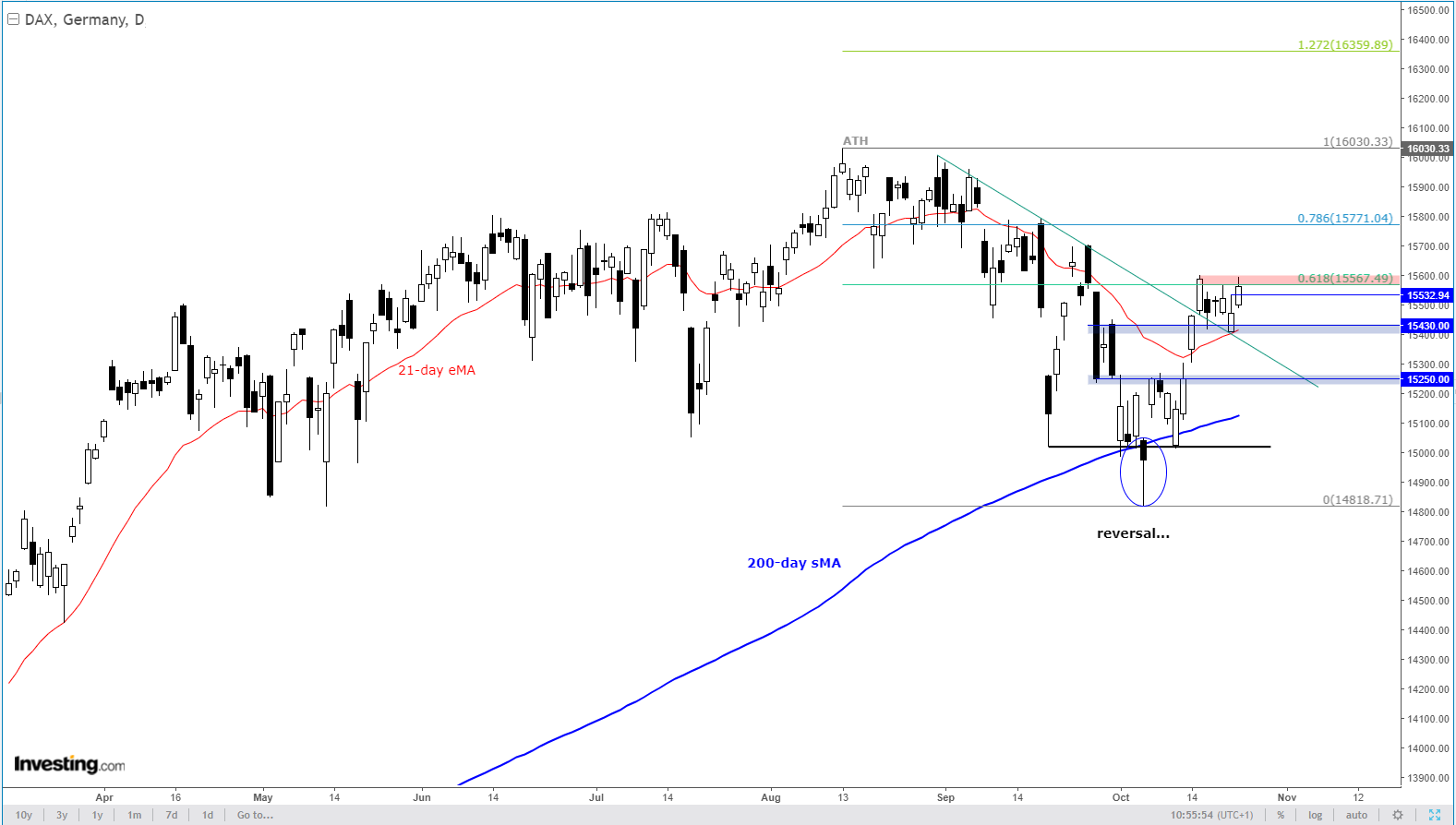

Indeed, the DAX is looking constructive, and it may follow its US counterpart in nearing or surpassing its record high that was formed at 16030 back in August.

The German benchmark index started its reversal when the breakdown below the 200-day average proved to be a bear trap in the first full week of October, following the slump in September. As the index quickly reclaimed the technically-important average and built a base above it, the next question was whether it would go on to break its bearish trend that had capped previous recovery attempts. Well, after breaking above it last Friday, it has spent all of this week holding the breakout without making any further movements to the upside.

While the lack of further upside follow-through is not something bullish investors would have expected after last week’s performance, this can still be regarded as bullish consolidation.

A bullish consolidation as described above allows short-term oscillators (such as the RSI, MACD etc.) to work off their overbought conditions through time, rather than price action. With the index no longer overbought on the lower time frame, and the technical backdrop still bullish on the higher time frames, traders would be more inclined to look for long setups than short under such conditions.

I therefore expect the DAX to kick on from here and head towards its old highs again. For further confirmation, a daily close above the shaded red zone on the chart, which would also push us above the 61.8% Fibonacci level, would be ideal.