This article was written exclusively for Investing.com

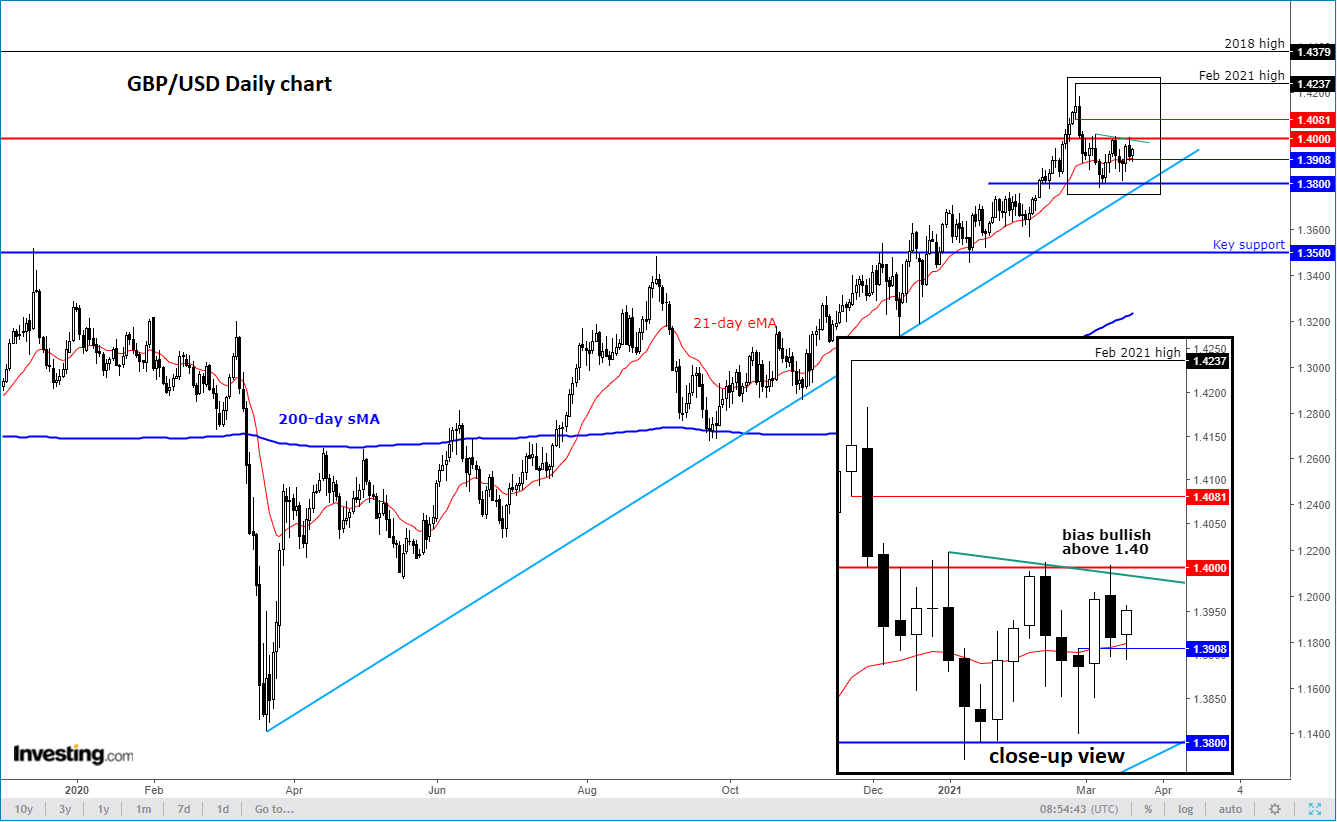

This week, we heard from the US Federal Reserve and Bank of England. As both central banks were somewhat surprisingly quite dovish—despite rising bond yields amid expectations of rising inflation—the GBP/USD has remained in the upper end of its 200-pip range between 1.38 and 1.40.

Federal Reserve Chair Jerome Powell said the US central bank does not intend to hike interest rates through 2023, while the Bank of England struck a similar tone, saying the Monetary Policy Committee “does not intend to tighten monetary policy at least until there is clear evidence that significant progress is being made in eliminating spare capacity and achieving the 2% inflation target sustainably.”

As result, the GBP/USD has remained in no man’s land. But where is it heading from here?

I think the GBP/USD will head further higher over time as confidence returns to the UK economy when lockdowns are lifted further in the coming months. In the short-term, tough, there is a risk we may see a deeper pullback given the dollar’s recent good run of form against a number of foreign currencies. The fact that the price has been unable to climb back above the key 1.40 handle is providing the technically-focused-bears some optimism too. So how would you trade the GBP/USD?

Well, given my longer-term bullish view and indeed the longer-term bullish trend, I would rather look for bullish setups than bearish. So, as things stand, what I would like to see is for the GBP/USD to break above 1.40 to the upside and hold there. If this condition is met, then we may see a sharp continuation higher, with the February high of 1.4237 being the minimum target. Alternatively, another way of looking for long setups would be to wait for an even deeper retracement and then a reversal signal at or around a key support level (e.g. a hammer candle off the bullish trend line).

Meanwhile in terms of looking for sell setups, it is important to remember that at this stage you would be going against the underlying longer term bullish trend. As such, if you do sell the GBP/USD, I would keep my stop loss relatively tight (perhaps 10-20 pips above 1.40) and would be quick to exit on first sign of strength.

Perhaps the direction of the trend will become clearer in the coming days. We will have a number of Fed speakers throughout next week, as well as some important UK data in the first half of the week. But as mentioned, the bulls must wait for 1.40 to be cleared or until we see some nice bullish price action at lower levels, before looking for any potential trades.