On March 28 we asked whether the USD's FX market domination was over. We cited two events whose potential outcomes would likely diminish the greenback's unchallenged status as the global reserve currency: moves by various central banks to convert some reserves from USD to euro and China's planned launch of yuan denominated oil futures contracts.

China launching a yuan-denominated oil futures contract in particular has potential to re-rout significant investment away from dollar-denominated assets in favor of those denominated in yuan. Not only is China the world's second largest economy (and growing at more than double the rate of that of the US, with tonight's GDP expected at 6.8 percent YoY growth for the first quarter) it's also the world's single largest oil consumer.

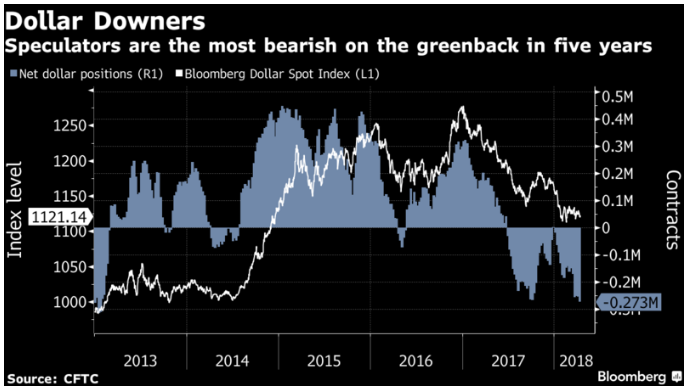

Meanwhile, the Commodity Futures Trading Commission reported Friday that hedge funds increased the most net short dollar positions since August 2011.

What might be the catalyst for such bearish dollar sentiment? If anything, the dollar should have received a boost from Fitch's AAA rating reaffirmation last week.

Perhaps last Sunday's Washington Post Op Ed by former Fed Chair Yellen and other economists played a part in the sudden dollar bearish sentiment. The authors of the Op Ed warn that the recent tax cuts heralded by the market were delivered at the wrong time, "turning economic logic on its head." That's because the US is currently at or close to full employment and has been demonstrating consistent economic growth, requiring no boost.

Now that the arrow has been released, there is nothing left in the arsenal in the event of an economic downturn. Additionally, the tax cuts will inflate public debt, adding 1.6 trillion to the deficit over the next decade.

Furthermore, some holes in Fitch's logic may be contributing to the increased bearish dollar sentiment. In its report, Fitch warned that "the outlook for public finances has deteriorated since the last review." If this is the case, why did the credit agency keep the AAA rating?

It claimed that the US has the world's highest "debt tolerance," due to the dollar's status as the global reserve currency. This reasoning however, may prove to be problematic due to the various global central bank moves to change the weight of their currency reserves, compounded by yuan-denominated oil contracts. These two factors may eradicate the very thing that Fitch is relying on to offset rising public debt.

On March 28 we published a weekly chart showing the formation of a symmetrical triangle. We can get a better appreciation for the outcome of an upside breakout of the EUR/USD pair to the symmetrical triangle in the chart above. It would include an upside breakout to its falling channel since July 2008, when the world bought dollars as a safe haven.

While developing the symmetrical triangle, the 50-week MA crossed above the 200-week MA, executing a weekly golden cross, and the 100-week MA is climbing as well. Should the price break out of the falling channel, it may suggest a macro uptrend for the euro, sending the dollar significantly lower.