Chart Industries, Inc. (NASDAQ:GTLS) yesterday announced that it has acquired Skaff Cryogenics & Cryo-Lease, LLC (Skaff) from Bob and Steve Prefontaine. The buyout consideration was $12.5 million, funded entirely through available cash on hand.

Skaff primarily engages in repair services as well as in remanufacturing of cryogenic tanks, including stationary tanks, micro bulk, portable station and trailers. In addition, it deals with the reselling of vaporizers and tanks and providing leasing options for cryogenics equipments. Its customers are mainly North American gas suppliers, distributors and end users. This New Hampshire-based company was founded in 1979.

Synergistic Benefits From Skaff Buyout

Chart Industries will integrate the acquired assets with its Distribution & Storage segment. Skaff’s revenues in 2017 is estimated to total $6.5 million while earnings before interest, tax, depreciation and amortization (EBITDA) margin is likely to be more than 21%.

The buyout will enable Chart Industries to strengthen its foothold in the Northeastern United States while Skaff’s leasing business will be an added opportunity. This acquisition is expected to be accretive to Chart Industries’ EBITDA margin and earnings per share as well as generate meaningful cost synergies in the quarters ahead.

Inorganic Expansion Fuels Growth

Chart Industries prefers to invest in acquisitions to gain access to new customers, regions and product line. The company added Hetsco, Inc. to its portfolio through its subsidiary Chart Lifecycle in January 2017 while acquired VCT Vogel GmbH and Hudson Products Corporation in September. VCT Vogel buyout complements the company’s existing mobile equipment businesses and has also been strengthening its foothold in Switzerland, Southern Germany and Austria. On the other hand, the Hudson Products acquisition is enabling the company to gain exposure in heating, ventilation, and air conditioning, petrochemical and power generation end markets.

We believe that a diverse product portfolio along with new business wins will help the company deliver solid results in the quarters ahead. Including the impact of VCT Vogel and Hudson Products buyouts, the company increased its revenue guidance to the $940-$975 million range in October. The previous sales projection was $875-$925 million. Adjusted earnings are anticipated to be within 75-90 cents per share versus the prior forecast of 65-80 cents.

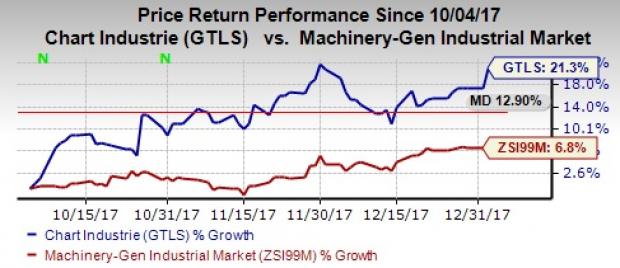

In the last three months, Chart Industries’ shares have yielded 21.3% return, outperforming 6.8% gain recorded by the industry it belongs to.

Zacks Rank & Stocks to Consider

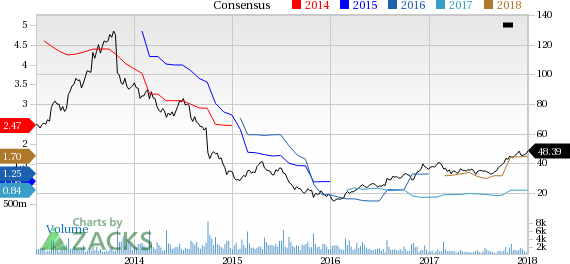

With a market capitalization of nearly $1.4 billion, Chart Industries currently carries a Zacks Rank #3 (Hold). Over the last 60 days, the Zacks Consensus Estimate on the stock remained stable at 84 cents per share for 2017 (results not yet released) and increased 1.2% to $1.70 for 2018.

Chart Industries, Inc. Price and Consensus

Atlas Copco AB (ATLKY): Free Stock Analysis Report

Sun Hydraulics Corporation (SNHY): Free Stock Analysis Report

Chart Industries, Inc. (GTLS): Free Stock Analysis Report

EnPro Industries (NPO): Free Stock Analysis Report

Original post

Zacks Investment Research