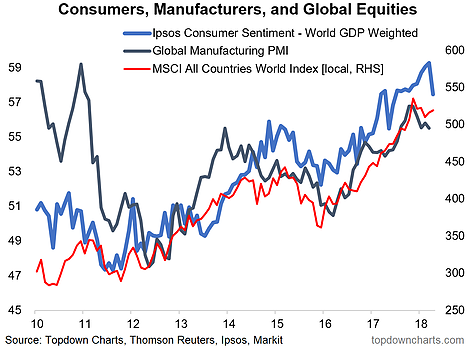

This chart makes use of the Thomson Reuters Ipsos consumer sentiment indexes, which I have aggregated into a GDP weighted global composite. The global composite consumer sentiment index took a dive in June - and in some ways looks like a delayed reaction. Previously the index had been moving higher vs the global manufacturing PMI and the MSCI All-Country World Equity Index, which had both been moving lower. Emerging markets were the biggest contributor to the fall in the global index, with the EM composite down -2.3 points to 60.8, although DM also fell (-1.4 to 54.0). It is just one month of data in what has sometimes been a volatile indicator, but it looks more consistent with what's been going on with the manufacturing PMI and global equities, so it's another sign of a softening in global growth momentum. I'm still running a constructive outlook on global growth, but am mindful of some of the softer data prints like this one...