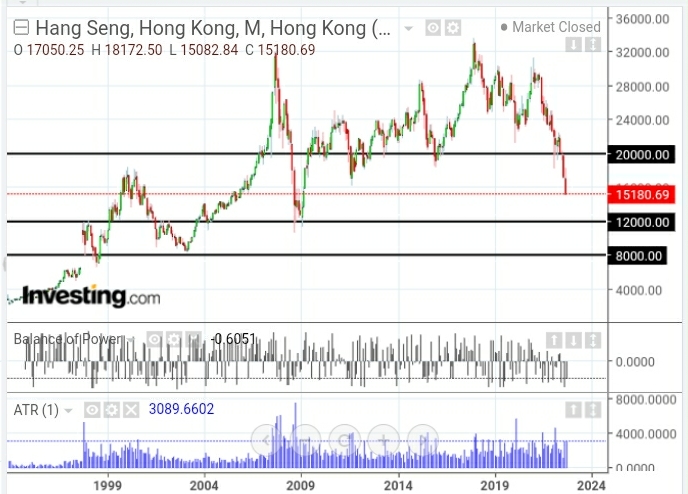

In my post of March 14, I described a scenario where a drop and hold below 20,000 on China's Hang Seng Index could see it plunge to 16,000, or lower.

It, subsequently, swirled around that level, finally closing below at the end of August, as shown on the following monthly chart.

It has since plummeted and closed on Monday at 15,180.69...losing 6.3% on the day.

Sellers are in control, as downside volatility is increasing.

Should price remain below 20,000, it could easily drop to 12,000, or even lower to 8,000.

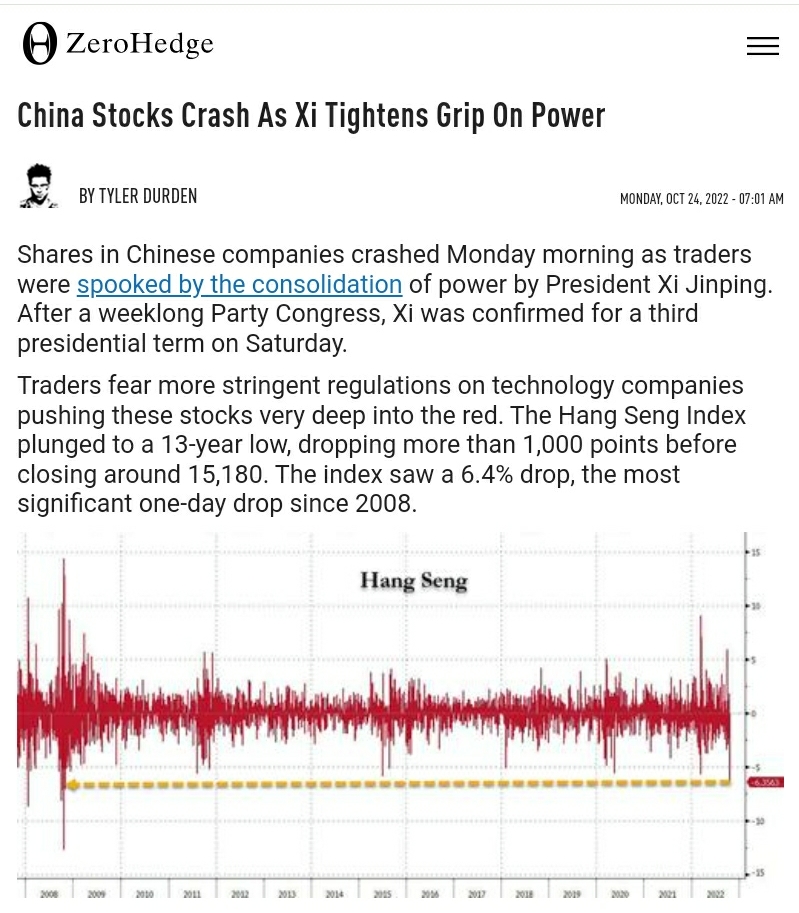

Monday was a bad day for all Chinese indices.

There are numerous major issues, with which China is grappling, including their property market, technology sector, zero COVID-19 policies, inflation, currency, support for Russia in their war with Ukraine, etc.,...none of which can be readily resolved...and none of which would be attractive to new foreign investment.

The following article describes some of those.

N.B. Further China weakness may drag other world markets (or their financial institutions) lower, if they are already heavily invested, directly or indirectly, in any of those markets.

So, bear in mind the remarks I made in my post of October 22.