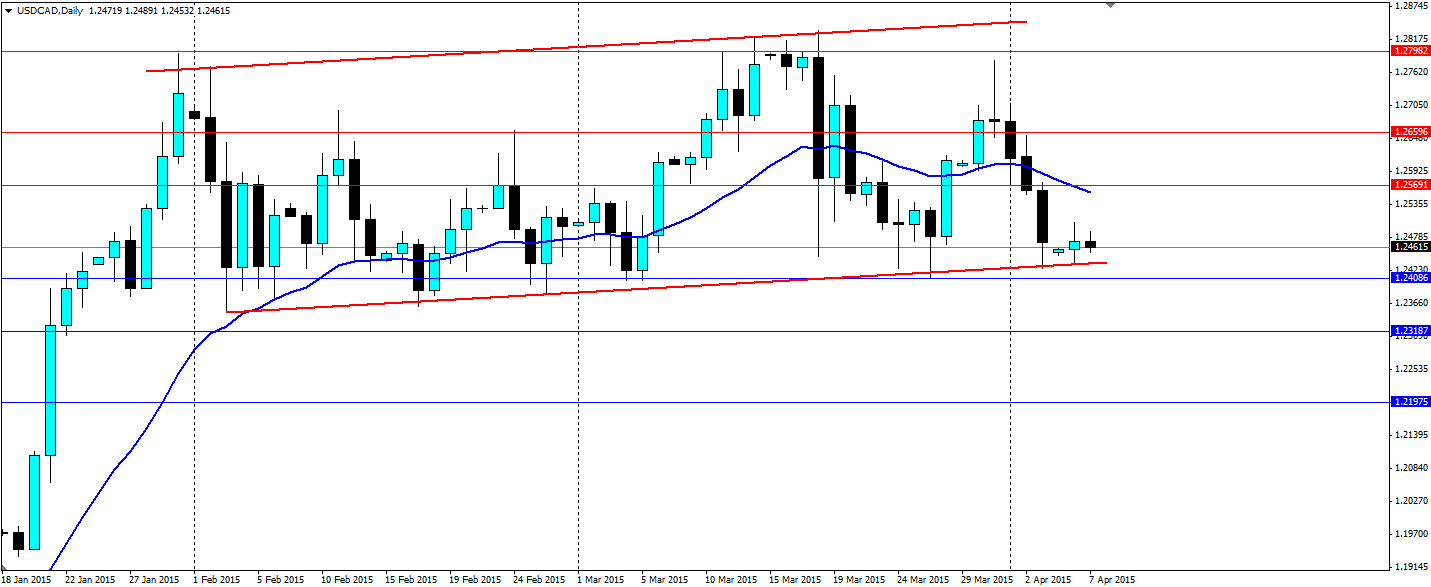

The long term channel that has been in play for several months on the USD/CAD pair continues to hold. The present level of the price presents more than one opportunity for traders.

Source: Blackwell Trader

A rise in oil prices and a disappointing US Nonfarm payrolls has sent the USD/CAD pair back towards the lower end of the current channel. The market is expecting the Crude stockpiles in the US to show the smallest growth since November. This would add weight to the argument that the oversupply in the US is beginning to slow and the oil markets have found a bottom. Recent events in Iran sent the price of oil lower as a lifting of sanctions would see Iranian oil flood the market, but this may take some time to eventuate, adding buying pressure after the fall.

US dollar strength is not gone just yet and the price of oil will likely hover at this level for some time. This will likely lead the channel holding as the market ebbs and flows. The first option to play the channel is to take a long position with a stop loss not far below the channel. This option will look for a bounce off the bottom of the channel as has happened several times recently.

The second option is to set a stop entry just below the channel to catch the momentum of a breakout lower. A stop loss should be set just inside the channel to minimise the downside of a false breakout. This strategy will only come into play if we see a large fundamental shift in either the oil markets or the US economy.

A rejection off the bottom of the channel and a continuation of the range will look for resistance at 1.2569, 1.2659 and 1.2798 with the top of the channel also acting as dynamic resistance. A downside breakout will find support at 1.2408, 1.2318 and 1.2197. 1.2028 will also be a final target for a breakout given that this is 402 pips away which is the width of the channel.

The USD/CAD pair has been following a clear channel for some months. This is likely to hold in the near term which presents traders an opportunity to buy at the bottom. A breakout is also an opportunity to trade this pair, with a short position to catch momentum.