Key Takeaways

- The World Economic Forum (WEF) recognized Chainlink as one of the “technology pioneers” of 2020.

- Following the announcement, the price of Link jumped over 13%.

- Now, several metrics suggest that LINK is poised for further gains.

Decentralized oracle network Chainlink is in the spotlight for the value that its emerging technology brings to DeFi, which could set the stage for further gains.

Chainlink Stands Out As a Technology Pioneer

The World Economic Forum (WEF) has recognized Chainlink as one of the “technology pioneers” of 2020. The decentralized oracles firm is one of 100 companies that are leading various emerging technologies and innovations across different sectors.

Sergey Nazarov, Chainlink’s co-founder and head of SmartContract.com, said he was “thrilled” about the acknowledgment of such a prestigious organization and is preparing to contribute to the Forum’s initiatives over the next two years.

“Using smart contracts on the blockchain to bring enforceable guarantees to contractual obligations has widespread social and economic benefits. We’re proud to play a role in bringing accountability and automation to global and local economies, and we look forward to contributing to Forum dialogues on this challenge,” said Nazarov.

By joining the WEF’s Global Innovators community, Chainlink will play a key role in bringing their “cutting-edge insights” to some of the most important conferences worldwide to help navigate transformations across different industries.

The recent endorsement is a clear sign of the importance of Chainlink’s decentralized oracles technology and its verifiable randomness functions, both of which can serve as a bridge between on-chain and off-chain data.

Although MakerDAO is also among the blockchain startups that were added to WEF’s list, LINK appears to have benefited the most from the announcement. The price of this altcoin jumped over 13% in the past 24 hours, while multiple indexes show that it may advance higher.

Strong Support, Weak Resistance for LINK

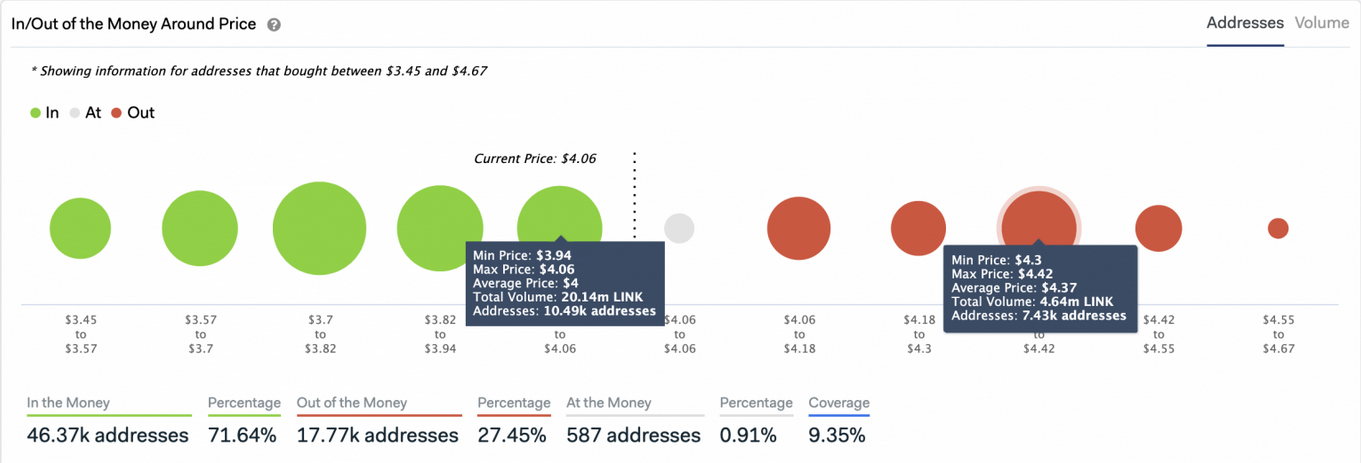

Indeed, IntoTheBlock’s “In/Out of the Money Around Price” (IOMAP) model reveals that Chainlink is currently sitting on top of a massive supply barrier that may absorb any downward pressure.

Based on this on-chain metric, roughly 10,500 addresses bought more than 20 million LINK between $3.9 and $4. This significant support wall could have the ability to hold in the event of a sudden correction preventing Chainlink from decreasing in price.

On the flip side, the IOMAP cohorts show that the most critical resistance hurdle ahead of this altcoin sits between $4.3 and $4.4. Here, approximately 7,500 addresses bough over 4.6 million LINK.

A further spike in demand behind Chainlink that allows it to slice through this area of resistance would enable it to retest early June’s high of $4.6, given that there isn’t a significant barrier between these price points.

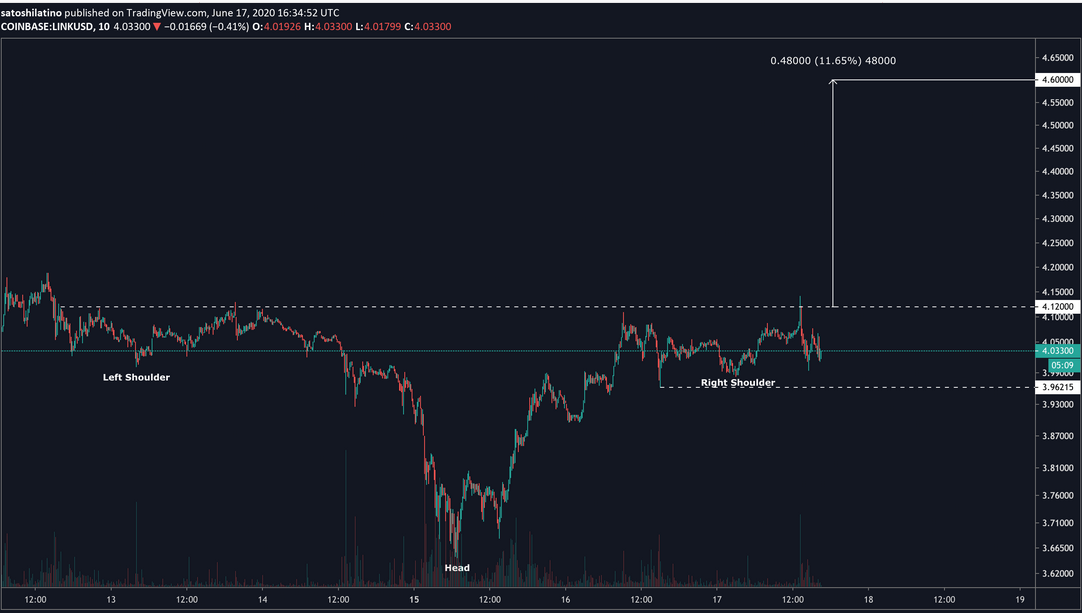

The development of an inverse head-and-shoulders pattern on LINK’s 10-min chart adds credence to the bullish outlook. This technical formation is considered to be one of the most reliable trend reversal patterns.

An increase in the buying pressure behind Chainlink that pushes it above the neckline at $4.12 could signal a break out of the head-and-shoulders pattern. The upward impulse might have the strength to send this cryptocurrency up 11.65% to around $4.6.

This target is determined by measuring the distance between the head and the neckline and adding it to the breakout point.

It is worth mentioning that a downward impulse that sends LINK below $3.96 could jeopardize the bullish outlook.

As Chainlink continues to prove its utility to solve real-world problems, retail investors appear to be giving it their vote of confidence. Data from Santiment reveals that the number of addresses holding 0.1 to 10,000 LINK is at all-time highs.

If this pattern of performance continues then sooner rather than later the decentralized oracles token will resume its historic uptrend.