It has been more than a month since the last earnings report for CF Industries Holdings, Inc. (NYSE:CF) . Shares have added about 9.8% in that time frame, outperforming the market.

Will the recent positive trend continue leading up to the stock's next earnings release, or is it due for a breakout? Before we dive into how investors and analysts have reacted of late, let's take a quick look at its most recent earnings report in order to get a better handle on the important drivers.

CF Industries Q2 Earnings & Revenues Beat Estimates

CF Industries posted net earnings of $3 million or a penny per share in the second quarter of 2017, compared with a profit of $47 million or 20 cents recorded a year ago.

Barring one-time items, adjusted earnings came in at 10 cents per share for the quarter, compared with earnings of 33 cents a year ago. Analysts polled by Zacks were expecting loss of 8 cents on average for the quarter.

Sales dipped roughly 0.9% year over year to $1,124 million in the quarter. The figure, however, beat the Zacks Consensus Estimate of $1,031 million. Sales declined in the quarter as volumes were offset by lower average selling prices in most segments.

The company said that strong second quarter performance reflects high utilization rates, record sales volume and cost efficiencies.

Segment Review

Sales for the Ammonia segment rose roughly 8.7% year over year to $389 million in the reported quarter. Ammonia sales volumes rose 33% year over year to 1.2 million tons owing to additional production volumes from the new capacity expansions at Donaldsonville and Port Neal complexes. Average selling prices declined 17.8% year over year to $338 per ton due to excess global nitrogen supply.

Sales for the Granular Urea segment rose roughly 7.9% year over year to $259 million. Sales volumes increased roughly 53% year over year to 1,221,000 tons, driven by additional volume available from the new urea capacity at the Port Neal nitrogen complex. Average selling prices for granular urea declined 14.2% year over year to $212 per ton owing to elevated global nitrogen supply.

Sales at the UAN segment fell 22.7% year over year to $286 million. UAN sales volume fell roughly 11% year over year to 1,631,000 in the quarter due to unfavorable weather conditions in North America which resulted in late planting, delayed UAN purchases and applications. Average selling prices went down about 13.4% year over year to $175 per ton, hurt by elevated global nitrogen supply.

Sales at the AN segment went up 24.4% year over year to $112 million. Sales volumes rose about 19% to 539,000 tons and average selling prices increased 4.5% year over year to $208 per ton, owing to a new long-term AN supply agreement which started in 2017.

The Other segment’s sales rose around 2.6% year over year to $78 million. Sales volumes were 17% higher in the reported quarter at 503,000 tons. Average selling price decreased 11.3% to $155 per ton due to high levels of global nitrogen supply.

Financials

CF Industries’ cash and cash equivalents were $2,001 million at the end of the second quarter, dipping 0.3% year over year. Long-term debt was $4,986 million, down around 10% year over year.

Outlook

CF Industries anticipates nitrogen pricing environment to be challenging through the balance of 2017 and also in 2018, as the global markets continue to adapt to considerable capacity increase in the recent years.

According to CF Industries, the North American market is likely to remain import-dependent in the foreseeable future. UAN and urea imports through May were down 10% and 22% respectively. However, many shipments arriving after April did not enter distribution channel because of higher imports during the first quarter, which resulted in significant urea price declines. The company also noted that North America is entering into a period of seasonally lowest demand and prices, and substantial imports could pressure selling prices in the third quarter.

CF Industries expect 6.2 million metric tons of nameplate urea capacity to start-up in 2017 and 2018, and the global supply is expected to slow in the longer term.

For 2017, the company expects new capital expenditures of around $400 million.

How Have Estimates Been Moving Since Then?

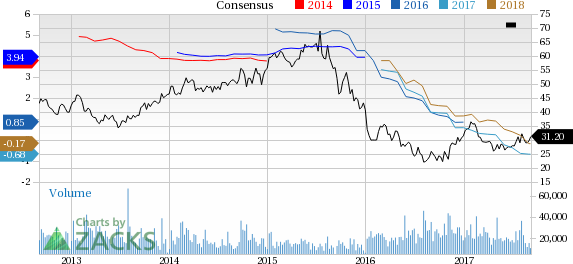

Following the release, investors have witnessed a downward trend in fresh estimates. There has been one revision lower for the current quarter. In the past month, the consensus estimate has shifted lower by 42.2% due to these changes.

CF Industries Holdings, Inc. Price and Consensus

VGM Scores

At this time, CF Industries' stock has a nice Growth Score of B, though it is lagging a lot on the momentum front with an F. The stock was allocated a grade of C on the value side, putting it in the middle 20% for this investment strategy.

Overall, the stock has an aggregate VGM Score of D. If you aren't focused on one strategy, this score is the one you should be interested in.

Our style scores indicate that the stock is more suitable for growth investors than value investors.

Outlook

Estimates have been broadly trending downward for the stock. The magnitude of this revision also indicates a downward shift. Notably, the stock has a Zacks Rank #3 (Hold). We expect in-line returns from the stock in the next few months.

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Original post

Zacks Investment Research