CF Industries Holdings, Inc.’s (NYSE:CF) fully-owned subsidiary, Terra Nitrogen GP Inc., will exercise its rights to purchase all the 4,612,562 publicly traded common units of Terra Nitrogen Company, L.P. (“TNCLP”) on Apr 2, 2018, for cash consideration of $84.033 per unit or roughly $390 million. CF Industries plans to fund the purchase with cash in hand.

The move will enable CF Industries to simplify its corporate structure and considerably reduce administrative costs associated with operating of TNCLP. Per the company, this is a positive step toward CF Industries’ efforts to reduce its controllable costs.

The purchase price of the deal has been decided in regard to the TNCLP’s partnership agreement, which considered the average daily closing prices per common unit from Jan 5, 2018 to Feb 2, 2018. Post the closure of the deal, TNCLP units will cease to be listed or publicly traded on NYSE.

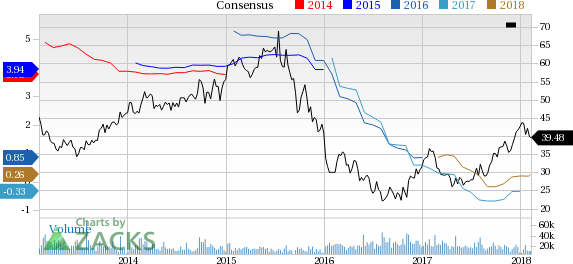

Shares of CF Industries have moved up 6.3% in the past three months, outperforming the industry’s 1.7% dip.

CF Industries witnessed a rapid increase in the global price of urea during the third quarter compared to second, which was driven by considerably lower Chinese exports, higher production and energy costs, a weaker dollar and strong global demand.

The company expects lower Chinese urea export volumes to continue and volatility in nitrogen prices in global markets to continue through 2018.

Moreover, CF Industries expects nitrogen demand to remain steady globally, which should be partly driven by rising global population and industrial growth on the back of increased adoption of emission control, recovering mining sector and synthetic nitrogen products.

CF Industries is poised to gain from its efforts to boost production capacity. It is also enjoying the benefit of abundant natural gas supply.

Zacks Rank & Stocks to Consider

CF Industries currently carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Methanex Corporation (NASDAQ:MEOH) , Steel Dynamics, Inc. (NASDAQ:STLD) and The Mosaic Company (NYSE:MOS) , each sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Methanex has an expected long-term earnings growth rate of 15%. Its shares have soared 29.2% over the last six months.

Steel Dynamics has an expected long-term earnings growth rate of 12%. Its shares have moved up 24.9% over the last six months.

Mosaic has an expected long-term earnings growth rate of 9.5%. Its shares have rallied 19% over the past six months.

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

Methanex Corporation (MEOH): Free Stock Analysis Report

CF Industries Holdings, Inc. (CF): Free Stock Analysis Report

Mosaic Company (The) (MOS): Free Stock Analysis Report

Steel Dynamics, Inc. (STLD): Free Stock Analysis Report

Original post

Zacks Investment Research