Today we are going to take a look at a developmental biotech, which well-known biotech institutional investor firm Baker Brothers LLC has a substantial position in. The company is developing a blood test which is designed to inactivate a broad range of viruses, bacteria and parasites that may be present in donated blood. This includes established threats such as hepatitis B and C, HIV, West Nile virus and bacteria, as well as emerging pathogens such as influenza, malaria and dengue.

Cerus Corporation, (CERS) is a biomedical products company that focuses on developing and commercializing the INTERCEPT Blood System to enhance blood safety. The company's INTERCEPT Blood System is based on its proprietary technology for controlling biological replication and is designed to target and inactivate blood-borne pathogens such as viruses, bacteria, and parasites. This is completed while preserving the therapeutic properties of platelet, plasma, and red blood cell transfusion products.

Inactivation of Pathogens: InterceptBacteria

Viruses and parasites have plagued humans throughout history. Many of these pathogens use blood cells to replicate, grow, and transfer from host to host. HIV is one prominent example of a virus that is transferred from person to person through blood. Since many people require blood transfusions worldwide, it is important to keep blood free of pathogens. The amount of blood that is transfused throughout the world is staggering. For example, a cancer patient typically receives 120 units of platelets, a Thrombotic Thrombocytopenic purpura (TTP) patient receives 200 units of platelets, and a Sickle cell disease patient receives about 1000 units of platelets.

Furthermore, about 100 million transfusions occur worldwide annually. Cerus uses a molecule called amotosalen to stop a pathogen from reproducing in platelets and plasma. When amotosalen is activated by ultraviolet light, it deactivates the DNA or RNA that these pathogens need to replicate and function. Cerus also uses a molecule called S-303 to deactivate pathogens in red blood cells.

The Intercept System is approved in Europe, the Middle East, and Asia, and over 2 million units have already been sold. The product has been on the market in Europe for over 10 years and the company has compiled valuable clinical and market data.

Catalysts

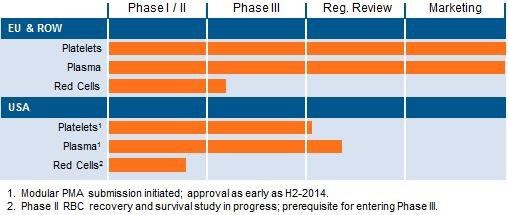

The company is now attempting to receive approval for the product in the United States. Cerus has already completed Phase III trials for the Intercept System for the platelet and plasma indications. On December 4, 2013, the company submitted a Pre-market Approval ((PMA)) application to the FDA for the plasma indication. Using the FDA's 90-day guideline for review, Cerus should expect to hear about approval by the end of February or very early March for that indication. The company also stated that it is planning to submit the last module of the PMA for platelets by March 2014. Using the same timeline, that would put potential partial approval of the product by May 2014.

Since the company has extensive data from the European Union, the FDA has allowed the company to submit without undergoing more trials. Approval for this product in the United States would increase sales and better position the company to further its trials for the use on red blood cells. Cerus expects both products to be approved and marketed by the second half of 2014. The company seems confident in receiving approval because they just announced additions to a North American sales team. If all things go as planned, 2014 could be an inflection point for the company.

Income Statement

Revenue (TTM):

40.95M

Revenue Per Share :

0.64

Qtrly Revenue Growth (yoy):

27.80%

Gross Profit :

16.17M

Balance Sheet

Total Cash (mrq):

53.33M

Total Cash Per Share (mrq):

0.76

Total Debt (mrq):

3.64M

Total Debt/Equity (mrq):

10.21

Current Ratio (mrq):

1.75

Book Value Per Share (mrq):

0.51

Cash Flow Statement

Operating Cash Flow :

-23.01M

Levered Free Cash Flow :

146.62K

Cerus burns roughly $5.1M a quarter and has over $50M in cash on hand. This equates to about 10 quarters of capital, so we do not think it's likely the company will need to raise cash anytime soon. Cerus does take in around $40M a year in revenues from selling its systems overseas, where they are currently approved.

One thing we like related to Cerus is that The Baker Brothers LLC, who we have followed into many positions, have a significant stake in the company.

Cerus Corp

13

-

$6.39

$56,820,000

8,455,306

The Bakers own nearly $8.5M shares of Cerus.

Among the companies that the Bakers own is Halozyme Therapeutics Inc, (HALO). Halozyme recently engaged in a secondary offering which often times means the stock price drifts below the offering price. This has not been the case with Halozyme, as the secondary was priced at $13, but the stock currently trades a little over $14 a share in just a little under a week since the offering. We think the offering has gone so well in part because Halozyme has very promising technology, and especially because we believe the company will be acquired this year. The Bakers are up over $23M on Halozyme at this time.

The Bakers also hold Vanda Pharmaceuticals Inc, (VNDA) which has been making some news lately in the developmental biotech segment.

Vanda received a positive recommendation at an Adcom meeting on November 14, 2013 for its developmental drug Hetlioz, and has just recently received FDA approval to market the drug on January 31.

Hetlioz is designed to treat Non-24-Hour Disorder (Non-24) in the totally blind. Non-24 is a serious, rare and chronic circadian rhythm disorder characterized by the inability to entrain (synchronize) the master body clock with the 24-hour day-night cycle. This is a very interesting drug, no question. However, after news of the FDA approval, the stock gapped up to as high as $15.57, before being sold off hard to under $11.50. We feel the stock might be at a short term bottom here and might make for a nice entry point for those who find interest in the company.

The Baker Brothers own about 4.8M shares of Vanda, valued at about $52M.

Last year, the Bakers made a significant bet on ACADIA Pharmaceuticals Inc, (ACAD) when the stock was selling for under $2 per share. On November 27th, 2012, the company reported positive data results for its drug pimavanserin, which is designed to treat Parkinson's disease psychosis (PDP). The news prompted a huge rally in the stock that has mostly continued to this day. Since PDP is a serious unmet need, the speculation continues to swell around ACADIA. Eventual FDA approval which could come in 2015 would further rally the stock, perhaps even 100% or higher from its current level.

The Baker Brothers hold 19,955,126 shares of Acadia which are valued at over $548M for a total current gain of almost $186M.

XOMA Corporation, (XOMA) is one of the Baker Brothers top 10 holdings. They own about 23M shares valued at over $103M. Xoma is expecting to release Phase III data for Gevokizumab in 1Q 2014.

In October of 2013, Xoma reported positive data from two Phase II clinical studies that are part of the company's broad gevokizumab proof-of-concept ("POC") program.

The company used to be a high flier, with its price reaching triple digits years ago. Since then, the company and its stock has fallen on hard times, reaching as low as $1.04 in December of 2011. Many investors we have spoken with believe the company is now headed back on the right direction as the stock has recently hit a 52 week high of $8.99 on Jan 13, 2014.

The Bakers have done well on many more stocks that we will list in future articles. The above examples show that the Bakers have a great track record in biotech, especially with their top 15 holdings, and Cerus represents the Baker's 13th largest holding. We feel this is significant, notwithstanding that Cerus has generally been under the radar.

Thus, If everything goes right for Cerus, and all of its modules receive marketing clearance from the FDA, Cerus has a good shot to reach a stock price of over $20 a share in the next year or so. However, the FDA has balked a bit in the past on tests that involve platelets. But, with the Affordable Healthcare Act (ACA) rolling out and President Obama's directive to the FDA in 2011 instructing the organization to be a bit more accommodating to new technologies, the chances for Cerus might be better than some might think. Many of the biotechs with large stock increases over the past two years are squarely related to both the ACA and Obama's 2011 directive.

Cerus is definitely a high-risk/high-reward investment. However, we feel as the upcoming catalyst is approached, biotech traders will bet the stock up, perhaps to as high as around $8. So, at the very least there is opportunity with the company in the short term, and a large reward long term if things go right with the FDA.

Disclosure: I am long CERS.

Disclaimer: This article is intended for informational and entertainment use only, and should not be construed as professional investment advice. They are my opinions only. Trading stocks is risky -- always be sure to know and understand your risk tolerance. You can incur substantial financial losses in any trade or investment. Always do your own due diligence before buying and selling any stock, and/or consult with a licensed financial adviser.