Certain about Uncertainty

Overnight, US economic data disappointed as retail sales fell for second consecutive month, nudging the December US interest rate hike probability to fall below 50%.

The focus now shifts to CPI which could have a significant impact on rate hike expectations, even more so in the wake of the tepid Retails Sales print.

A benign inflation print will likely reverse much of the recent yield curve damage and put the USD on the defensive. The Atlanta Fed GDPNow indicator plumbed to only 3% from 3.3% Sept 9.

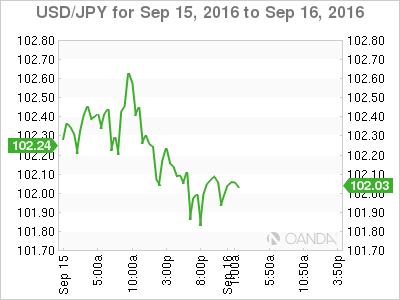

Japanese Yen

The market looks as if it is giving up on the long USDJ/PY as US economic data points south, and with a minuscule chance the BOJ will reach a mandate consensus from their policy review, it would suggest that downside risk is gaining favor. The bar is always high for the BOJ and traders are now distressed over an another headline that the BOJ is split over the mechanisms for providing additional stimulus.

But given the BOJ’s penchant for a surprise, the only certainty is to expect more uncertainty in the build-up to next week’s BOJ meeting. Indeed, the market is more anxious about the BOJ decision rather than the Fed decision, which at this stage is all but priced out for a September rate hike.

There’s a growing consensus that the BOJ will refrain from moving deeper into NIRP this meeting, but will keep all options open for November and will forward guide that choice at next week’s meeting. There’s a severe lack of confidence over BOJ policy brewing this morning.

Coupled with the lack of confidence in the BOJ and with the Feds likely sitting tight due to political uncertainty regarding the US presidential election, USD/JPY is very vulnerable, which brings intervention options back to the fore.

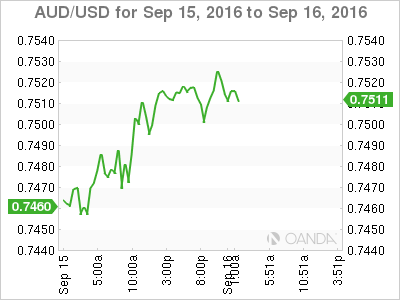

Australian Dollar

Yesterday’s domestic data had little influence on price action and while we should have expected some downside follow through on the mixed domestic employment data, with risk stabilizing, the recent sell-off ran out of gas as the AUD found near term support.

Last night, disappointing US economic data propelled the AUD/USD through .7515 as carry trade momentum picked up with the September US rate hike probability dropped to 12% and December moved below 50% for the first time since the “lollygagger” of hawkish Fed Speak filled the airwaves last week.

Also, as US election polls suggest Donald Trump is gaining momentum, with heightened political uncertainty it plays into the notion the Feds will remain lower for longer, underpinning the Australian dollar.

Regardless, I expect commodity currencies to trade heavy, but the Carry Aspect for the Aussie will likely take its cue from tonight’s US CPI print.

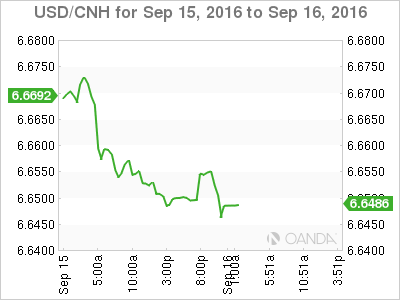

If there was any doubt that the PBOC iron hand was taking hold, with the release of the PBOC yuan positions, foreign currency holdings plummeted to its lowest level since August 2011, which indicates that the PBOC was active selling USD in defense of the yuan.

Apparently, this overt intervention is designed to keep the yuan on an even keel before the SDR inclusion. Holiday thinned trading conditions are keeping traders sidelined, even more so ahead of next week’s crucial Central Bank meetings.

Ringgit The ringgit had a respite from positive bond flow and weaker US economic data but is still carrying the burden from plummeting oil prices.