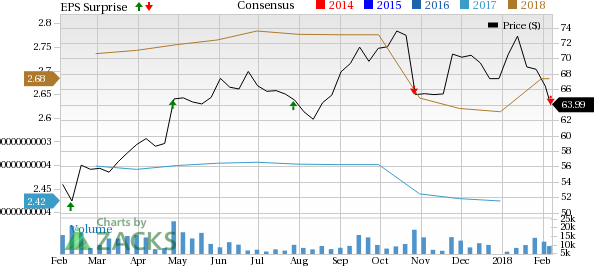

Cerner Corp. (NASDAQ:CERN) reported adjusted fourth-quarter earnings of 58 cents per share, down from 61 cents in the year-ago quarter. The figure also missed the Zacks Consensus Estimate by 3 cents.

Revenues of $1.314 billion rose above 4% year over year but marginally missed the Zacks Consensus Estimate of $1.33 billion.

Over the last six months, Cerner has had a favorable run on the bourses. The stock has returned 1.3% compared with the industry’s gain of 0.8%.

Segment Details

System Sales in the fourth quarter rose 3.2% to $363.5 million, on a year-over-year basis. It was driven primarily by growth in licensed software.

Support, Maintenance and Services accounted for revenues worth $922 million, up 4.7% on year-over-year basis and in line with management’s expectations.

Reimbursement Travel sales amounted to $28 million, up 12.2% compared with the year-ago quarter.

Bookings: An All-time High

The upside in revenues can be primarily attributed to an increase in bookings in the fourth quarter. Bookings were $2.329 billion, up 62% on year-over-year basis. The company reported full-year bookings at a record of $6.325 billion, up 16% compared with the 2016 level.

Margins

Gross margin in fourth quarter is 82.6%, flat year over year.

Operating margin for the reported quarter is 20.5%, which contracted 280 basis points (bps) on a year-over-year basis.

The downside was caused by surge in operating expenses, which rose 9% year over year. The growth is driven by personnel expense related to revenue-generating associates and non-cash items.

Financial Position

Operating cash flow in the fourth quarter was $384.9 million compared with $338 million from the year-ago quarter.

Cerner exited the fourth quarter with cash and cash equivalents of $371 million.

Long-term debt, including capital lease obligations, was $527 million, down slightly on a sequential basis.

2017 At a Glance

In 2017, domestic revenues grew 8% and non-U.S. revenues rose 3%.

Full-year 2017 revenues were $5.142 billion, up 7% compared with 2016.

Adjusted earnings per share were $2.38, compared with $2.30 in 2016.

Gross margin was 83.4%, which contracted 40 bps from 2016.

In full-year 2017, System Sales accounted for 26.4% of total revenues, while Support, Maintenance and Services contributed a whopping 71.7%. The Reimbursement travel segment represented a mere 2% of total revenues.

Guidance

Cerner expects first-quarter 2018 revenues between $1.315 billion and $1.365 billion. The Zacks Consensus Estimate of $1.35 billion for the same, falls below the projected range.

For 2018, revenues are projected in the range of $5.450-$5.650 billion. The Zacks Consensus Estimate of $5.59 billion for the same, lags the projected range.

First-quarter 2018 adjusted earnings per share is projected in the range of 57-59 cents. The figure lags the Zacks Consensus Estimate of 64 cents.

Full-year 2018 adjusted earnings per share is estimated in the range of $2.57-$2.73. The figure is higher than the Zacks Consensus Estimate of $2.68.

Further. the company expects first-quarter 2018 new business bookings in the range of $1.250-$1.450 billion.

Our Take

Cerner ended the fourth quarter on a mixed note. The company saw significant surge in bookings and growing revenues. However, dwindling earnings is a concern. Moreover, sales margin was partially affected, thanks to lower margins on technology resale, resulting from higher mix of device resale.

Per management, large and complex opportunities in their pipeline, drove bookings in the reported quarter. This is likely to drive bookings in the quarters ahead.

Zacks Ranks & Other Stocks to Consider

Cerner carries a Zacks Rank #2 (Buy).

A few other top-ranked stocks that reported solid results are PetMed Express (NASDAQ:PETS) , PerkinElmer (NYSE:PKI) and Becton, Dickinson and Company (NYSE:BDX) . While PetMed sports a Zacks Rank #1 (Strong Buy), PerkinElmer and Becton, Dickinson carry a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

PetMed recently reported third-quarter fiscal 2018 results. Adjusted earnings per share was 44 cents, up 88.3% from the prior-year quarter. Revenues in the reported quarter rose 13.7% on a year-over-year basis to $60.1 million.

PerkinElmer reported fourth-quarter 2017 adjusted earnings per share of 97 cents. Adjusted revenues were approximately $641.6 million, up from $567 million in the year-ago quarter.

Becton, Dickinson reported first-quarter 2018 adjusted earnings per share of $2.48, up 3.9% at constant currency. Revenues were $3.08 billion, up 3.7% at constant currency.

Zacks Top 10 Stocks for 2018

In addition to the stocks discussed above, would you like to know about our 10 finest buy-and-hold tickers for the entirety of 2018?

Last year's 2017 Zacks Top 10 Stocks portfolio produced double-digit winners, including FMC Corp (NYSE:FMC). and VMware which racked up stellar gains of +67.9% and +61%. Now a brand-new portfolio has been handpicked from over 4,000 companies covered by the Zacks Rank. Don’t miss your chance to get in on these long-term buys.

Access Zacks Top 10 Stocks for 2018 today >>

PetMed Express, Inc. (PETS): Free Stock Analysis Report

Cerner Corporation (CERN): Free Stock Analysis Report

PerkinElmer, Inc. (PKI): Free Stock Analysis Report

Becton, Dickinson and Company (BDX): Free Stock Analysis Report

Original post