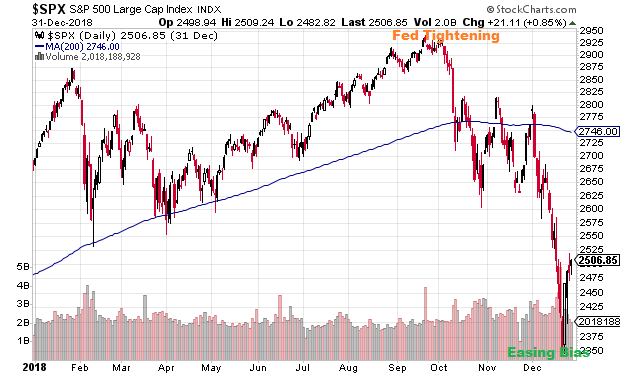

One year ago, investors learned that there’s a limit to how high interest rates could climb on Federal Reserve tightening before the stock market would collapse. Mercifully, the Fed reversed course and sent risk assets back to new heights.

Rightly or wrongly, Federal Reserve committee members are still choosing to manipulate the cost of capital lower. The hope is that by keeping stock prices at elevated levels, consumers and businesses will both spend in ways that keep the economic expansion alive.

The fear? A rapidly deteriorating stock market would erode consumer and business confidence, leading to a recession.

Despite easy money Fed policies, executives in corporate America may already be losing faith. The CEO Confidence Index, a measure of CEO sentiment about the economy 12 months into the future, has been waning.

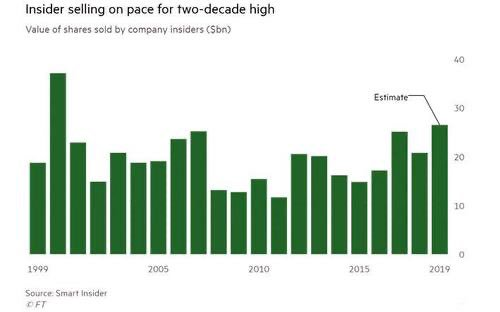

In a similar vein, executives seem to be acting on those sentiments. How? They’re selling their personal shares at the fastest pace since the tech bubble burst in 2000.

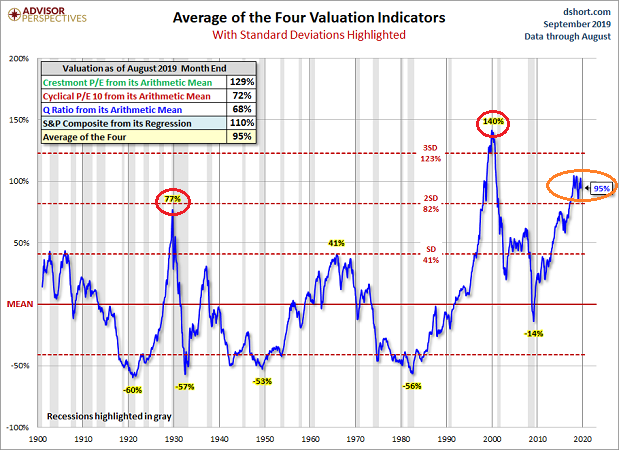

Are these corporate insiders onto something? Traditional metrics suggest that overvaluation, while not quite as alarming as it had been in 2000, may be more severe than it was in 1929 or 2008.

There’s more.

Back in 2000, the dot-com IPO train derailed before the rest of stock market felt the pain. Today? Participants are rethinking astronomical valuations for companies that struggle to turn profits.

Uber (NYSE:UBER), WeWork, Peleton, Crowdstrike (NASDAQ:CRWD). Are they really worth it? Even the Renaissance IPO ETF (NYSE:IPO) is hinting at a pullback.

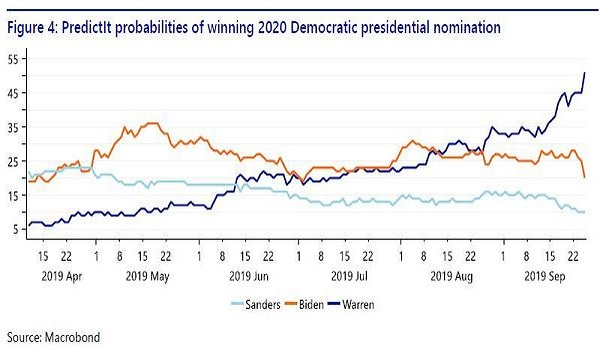

Some blame Trump’s trade war for the downturn in business leader confidence as well as the trepidation in the IPO world. Others suggest that the electability of Elizabeth Warren is bad for stocks due to a likelihood of higher taxes and the reversal of corporate tax reductions.

Both may be at play.

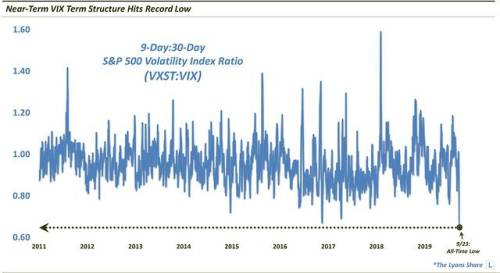

Nevertheless, the stock market has been noticeably calm as of late. Some might even call it, “complacent.”

Consider the relationship between the short-term volatility measure (VXST) and the CBOE Volatility Index (VIX). According to Dana Lyons, since the inception of the VXST in 2011, there have been a mere 3 instances where the VXST:VIX ratio dropped below .70. At a reading of 0.659 on September 23, the ratio registered its lowest reading ever.

It’s not that stocks can’t get beyond mounting concerns. On the flip side, I continue to emphasize “safer” spaces for a late-stage business cycle.

For example, the electric power holding company Duke Energy (NYSE:DUK) offers 5.125% Junior Subordinated Debentures (NYSE:DUKH) issued in $25 denominations. A 5% yield and an investment grade rating for a utility is not too shabby when 10-year U.S. Treasuries offer 1.68%.

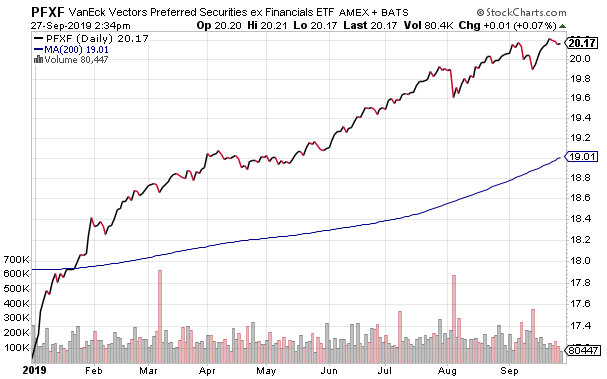

Similarly, ETF enthusiasts have seen capital appreciation as well a 5%-plus income stream in the preferred arena. Throughout the year, I have pointed to VanEck Vectors Preferred Securities ex Financials ETF (NYSE:PFXF).