Century Communities (NYSE:CCS) just made a new all-time high and yet it is STILL a cheap stock. CCS sits at a 0.5 price/sales ratio, 1.1 price/book ratio, 10.7 trailing P/E, and 7.6 forward P/E. Home builders typically hit 1.0 price/book ratios at the BOTTOM of a recessionary cycle. The response to CCS’s latest earnings report was a great example of the market’s reluctance to buy into the company’s story. The stock traded up 3.3% in response to earnings and then promptly lost those gains in a week’s time.

Century Communities (CCS) broke out to new all-time highs a full three weeks after posting earnings. Another scramble to catch up is underway…

As I stated in my last Housing Market Review, I put CCS back on my buy list pending the results of this earnings report. I took the market’s reluctance as a buying opportunity, but I failed to get back in until CCS powered its way toward a new all-time high.

The headline results from the Q4 earnings report for CCS on February 14, 2016 were strong.

For 2016, CCS earned a record $2.33/share which represented a 23.9% increase over 2015. These results marked an incredible 14-year run of positive annual results. Management provided guidance on 2017 earnings in the conference call (from the Seeking Alpha transcript):

“…we expect net income trends to be seasonally similar to 2016. Our first quarter will experience our lowest closing and net income. After the first quarter we expect earnings to grow as the year progresses.”

Revenue grew 38.9% year-over-year to reach almost a billion dollars. The company expects to grow revenue to $1.0-$1.2B in 2017. Adjusted homebuilding gross margin percentage stayed roughly flat going from 21.9% in 2015 to 21.7% in 2016. CCS ended the year with one more open community from 2015’s 88 open communities. The company expects to grow this aggressively in 2017 to 90 to 100 open communities at the end of 2017. These communities will grow home deliveries from 2016’s 2,825 to 3,000 to 3,300. Growth in contracts and backlog came almost entirely from organic growth led by Nevada, Central Texas and Colorado.

The year-over-year strength in fourth quarter results highlighted the momentum CCS enjoys:

- Net income: +14.6% to $0.71/share

- Home sales revenues: +43% to $292.4M

- Home deliveries: +26% to 812 homes

- Net new home contracts: +25% to 569 contracts, led by Nevada, Central Texas and Colorado

- Adjusted homebuilding gross margin: +39% to $62.6M

- Backlog dollar value: +12% to $302.8M

CCS provided important commentary on costs. The company suggested that the boom in apartment building that has created some strain on available labor is coming to an end:

“…consistent with other people is we are seeing continued pricing pressure from some of our trade partners, that’s not anything new, it’s something that we’ve been experiencing now for probably going on upwards of couple years.

We are seeing some early signs though as the apartment construction is starting to slowdown in some of the markets. We are seeing a free up of some labor as a result of that and we think that is a trend and will continue.”

I hope to keep tabs on these trends because a slowdown in apartment building in a strong economy implies that households are increasingly choosing home buying over renting. Such a transition would provide an additional tailwind for homebuilders.

In 2016, CCS made some aggressive growth moves and plans to continue to look for acquisition opportunities in 2017. Here are the highlights of its expansion in 2016:

- Salt Lake City: acquired 47 lots and scaled up to 1,500.

- Carolinas, Georgia, Florida: 50% interest in Wade Jurney Homes.

- Charlotte, NC: bought 57 lots and the control of 556 additional lots.

- Wholly-owned financial services division for title and mortgage services.

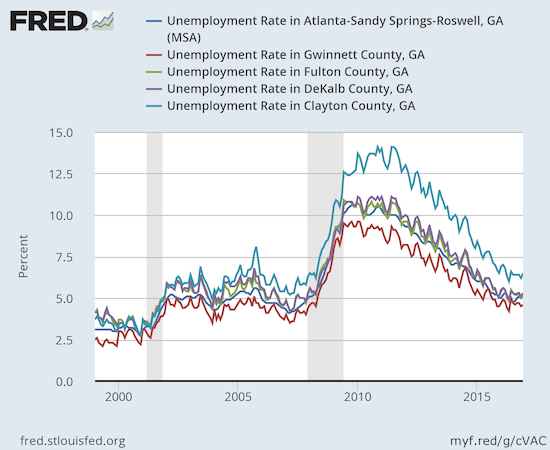

CCS is clearly not just about Atlanta anymore although it remains the second largest builder in the metro area. This expansion and regional diversification is important because the Atlanta metro area’s employment situation seems to have stalled out a bit. Unemployment has failed to improve over the last year as the pre-recession lows remain just within reach.

Unemployment in the various counties of the Atlanta metro area has yet to achieve pre-recession lows.

CCS has been very active and dynamic in its existing regions. CCS provided select metrics that highlighted the best of each market. CCS also emphasized it will continue to search for M&A opportunities in 2017.

- Las Vegas: Home deliveries doubled in Q4. Strong home price appreciation.

- Central Texas (Austin): Net contracts up 36% year-over-year.

- San Antonio: A “steady pace” of sales.

- Houston: Demand “steady” below $250K. More than doubled controlled lots to 1,169 as part of a strategy to capture demand from first-time buyers.

The growth in Houston is particularly interesting. CCS confirmed that Houston is on the mend and the worst of the collapse in oil is already behind the region. Moreover, CCS is seeing first-time buyers step up into the market – a great sign of economic health. CCS is so confident that first-timers have become an increasing focus. From the transcript of the conference call:

“Continuing on our strategy to increase our percentage of entry-level offerings, our recent investment in Wade Jurney Homes allows us to leverage its unique business model, which requires less capital investments and yields quicker asset terms.

…as we mentioned playing off the entry level standpoint in the U.S. right now where everybody seems to be migrating down to that and there is certainly tremendous amount of demand there.

But the entry level buyer continues to come back into the market and we want to be able to have that as a large percentage of our business.”

Around 45 to 50% of CCS’s business is in the first-time market. This concentration works as long as the job market remains robust.

Finally, the balance sheet looks strong: total long-term debt of $455, total liquidity of $360M. The $12.1M million raised in Q4 from selling 578,000 shares went into investments into land acquisitions.

Overall, like so many homebuilders, CCS remains a stock to buy on the dips. CCS offers the bonus of good growth and solid fundamentals for cheap.

Be careful out there!

Full disclosure: long CCS