Yesterday was meant to be the quietest day of the week and turned into one that many people in the market will not forget. Rumours had been in the market for a couple of weeks that a coordinated response from central banks to unjam funding markets was possible and it came through yesterday. The Federal Reserve alongside 5 other central banks (Bank of England, ECB, Bank of Japan, Bank of Canada and Swiss National Bank) all announced a plan to allow banks to borrow dollars at lower rates than previously. Cutting these swap costs are equivalent to interest rate cuts and the fact that these central banks are now basically providing unlimited US dollars to banks with which to fund themselves, the central banks will be hoping this is a turning point in the crisis.

We do not know what caused this move, we may never know, but the smart money is on the fact that yields on 1 yr German debt went negative yesterday morning (i.e. paying Germany to lend it money). This may have been a signal that the money markets were a short shove away from complete collapse. It also signals that the world’s central bankers have had enough of the political mud-slinging intransigence that has been the typical response to the world’s problems. This isn’t a new plan of course and we have seen cuts to these swap rates in the past and they have not worked. Maybe this buys a Europe a little time because it certainly doesn’t fix the long-term structural issues in the Eurozone.

In currency land we saw huge moves away from the US dollar with GBP and EUR gaining about a per cent against the greenback and GBP/EUR slipping back into the 1.16s. It seems that these pressures are already dissipating however, with Italian, French and other European debt yields rising already this morning following falls yesterday.

This does however seem like the beginning of another round of monetary policy easing from the world’s central banks and other moves into the markets. The obvious second task for the ECB is to bring bond yields lower and news reports yesterday suggested that the ECB is considering a big increase in its Securities Markets Program including targeting explicit government bond yields. The hope is that by setting a credible target in conjunction with a long-term bank liquidity facility, it can ensure governments retain access to bond markets; banks will borrow to buy bonds at attractive yields knowing any losses are capped. We expect that something of this ilk may be announced at the ECB’s next meeting on Dec 8th, alongside a cut in interest rates.

Away from the bank intervention there was not much to really speak of yesterday although China did cut its “reserve requirement ratio” which is a portion of cash that banks must set aside and not lend to businesses or consumers. A cut of that allows these banks to lend more and give a boost to productivity. Chinese economic indicators have been slipping and last night’s PMI from the manufacturing sector showed that China’s manufacturing activity slipped for the first time since February 2009.

Those same PMIs from other nations will be the main focus of the markets today as, although this liquidity plan may help banks in the short term, it does not solve any underlying growth issues. Manufacturing is expected to fall in the UK, Italy and Spain whilst remaining weak in Germany and France. Poor figures could eliminate yesterday’s good will instantaneously.

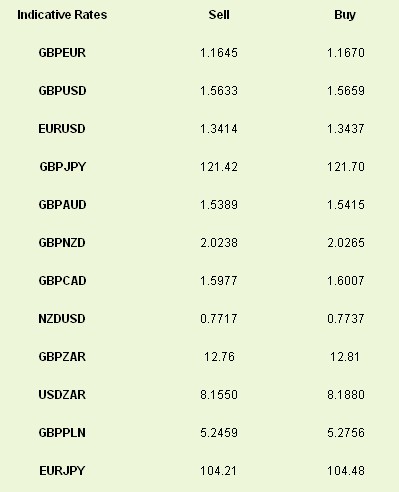

Latest

exchange rates at time of writing

We do not know what caused this move, we may never know, but the smart money is on the fact that yields on 1 yr German debt went negative yesterday morning (i.e. paying Germany to lend it money). This may have been a signal that the money markets were a short shove away from complete collapse. It also signals that the world’s central bankers have had enough of the political mud-slinging intransigence that has been the typical response to the world’s problems. This isn’t a new plan of course and we have seen cuts to these swap rates in the past and they have not worked. Maybe this buys a Europe a little time because it certainly doesn’t fix the long-term structural issues in the Eurozone.

In currency land we saw huge moves away from the US dollar with GBP and EUR gaining about a per cent against the greenback and GBP/EUR slipping back into the 1.16s. It seems that these pressures are already dissipating however, with Italian, French and other European debt yields rising already this morning following falls yesterday.

This does however seem like the beginning of another round of monetary policy easing from the world’s central banks and other moves into the markets. The obvious second task for the ECB is to bring bond yields lower and news reports yesterday suggested that the ECB is considering a big increase in its Securities Markets Program including targeting explicit government bond yields. The hope is that by setting a credible target in conjunction with a long-term bank liquidity facility, it can ensure governments retain access to bond markets; banks will borrow to buy bonds at attractive yields knowing any losses are capped. We expect that something of this ilk may be announced at the ECB’s next meeting on Dec 8th, alongside a cut in interest rates.

Away from the bank intervention there was not much to really speak of yesterday although China did cut its “reserve requirement ratio” which is a portion of cash that banks must set aside and not lend to businesses or consumers. A cut of that allows these banks to lend more and give a boost to productivity. Chinese economic indicators have been slipping and last night’s PMI from the manufacturing sector showed that China’s manufacturing activity slipped for the first time since February 2009.

Those same PMIs from other nations will be the main focus of the markets today as, although this liquidity plan may help banks in the short term, it does not solve any underlying growth issues. Manufacturing is expected to fall in the UK, Italy and Spain whilst remaining weak in Germany and France. Poor figures could eliminate yesterday’s good will instantaneously.

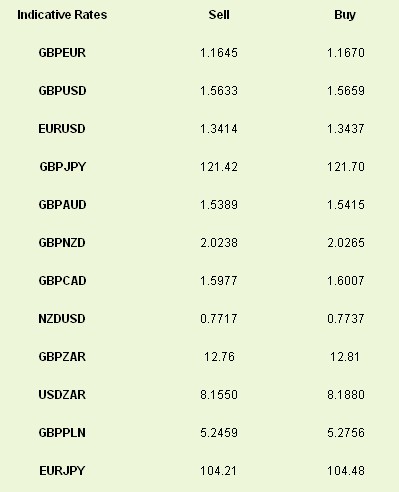

Latest

exchange rates at time of writing