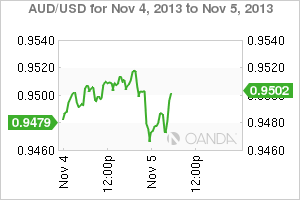

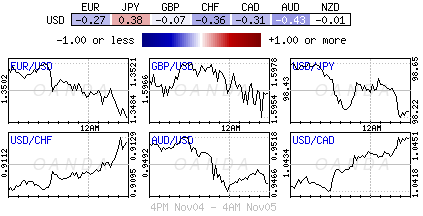

Who ever shouts the loudest tends to be heard first, and for the longest time. This week in Capital Markets policy makers are required to perform all the 'jawboning' and few are leaving little to chance. The net effect is that central banks are doing their own currency value tweaking – from the loonie to the Aussie and back to the Euro. The forex market is currently following a "proactive" policy stance rather than a reactive, whose global success is still open to debate. If nothing else, policy makers are willing to mix it up a tad to see what best sticks. It's either that or we start shouting currency wars again. AUD/USD" border="0" height="200" width="300">

AUD/USD" border="0" height="200" width="300">

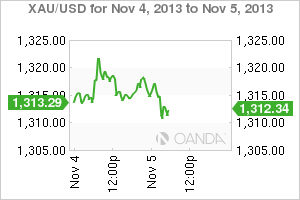

This is a busy week on the Central Bank front with three high profile monetary decisions to be announced – RBA, BoE and ECB. No changes in any rate announcement are expected, it’s the talk and copy preceding these meetings that investors are more interested in. Earlier this morning the Reserve Bank of Australia followed their policy script to perfection, carefully adding a few adlibs where appropriate.  XAU/USD" border="0" height="200" width="300">

XAU/USD" border="0" height="200" width="300">

Governor Stevens at the RBA followed through with what was anticipated, keeping rates on hold (+2.5%), however the following rhetoric, more powerful than projected, has been able to guide the AUD a tad lower. Yet, the currency weakness was not all Stevens' responsibility – Chinese Premier Li sounding a warning on his country's economic growth (needs an annual rate of +7.2%) and easy credit concerns, highlighted the fine line between the regions growth and social stability issues. This Chinese 'jawboning' had an effect on all of the country's larger trading partners. In the RBA statement, they said its monetary policy was appropriate, adding that their currency remained "uncomfortably high." A strong clear message that policy makers remain a bit nervous about the AUD own strength. From the RBA's perspective what's been missing is a clear "easing statement in the statement itself." The first early swipe to drive the AUD lower has been successful to a degree – the remainder of this week needs to be played out (NFP employment reports) before the markets can get a better understanding of the potential depth of any currency retracement. EUR/USD" border="0" height="200" width="300">

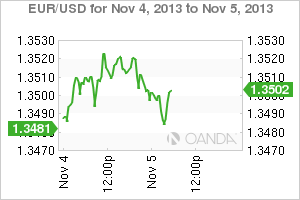

EUR/USD" border="0" height="200" width="300">

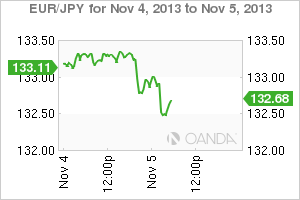

Another Central Banker on the immediate hot seat is the ECB's Draghi. From his perspective deflation risk is complicating his regions recovery. Deflation is not an isolated phenomena – global inflation remains relatively benign. Last month the markets witnessed the Euro-zone inflation slowing to +0.7%, the lowest level since November 2009 and the ninth-consecutive month that the rate has been less than the ECB’s ceiling. The ECB is facing down a deflation threat with few options left to fight it with. Last week saw the 17-member single currency fall the most against the dollar since July 2012. The current deflation woes have prompted speculation that the ECB will invoke policies from a reduction in its benchmark lending rate (+0.5%), to adding fresh liquidity to the financial system, or broad-based asset purchases similar to those by the Bernanke's Fed this coming Thursday. EUR/JPY" border="0" height="200" width="300">

EUR/JPY" border="0" height="200" width="300">

Capital Market players are expecting Draghi to be fairly dovish. Investors have already begun to position for that, either by cutting the EUR longs or initiating new EUR short positions. The question that many are trying to answer is whether 'this' deep EUR loss witnessed since last week, a signal that this is more than a corrective move in the dollar? Investors are required to sit through more "dirty" data over the coming weeks. It's true, the EUR does face strong resistance at 1.3835 areas – peaking at its two-year high last week and has since fallen to trade well below 1.3500.

The problem for the EUR is that there is ample room for the currency to fall much further as the heavy dose of "pro-Euro positions" acquired this year is beginning to unwind. In the options market, the rising prices for EUR "puts" suggest that the single currency downfall could gather further momentum. Coupled with a less than dovish Fed and an ECB only getting more dovish suggests that the EUR could be persuaded to peek below 1.3350 sometime soon. GBP/USD" border="0" height="200" width="300">

GBP/USD" border="0" height="200" width="300">

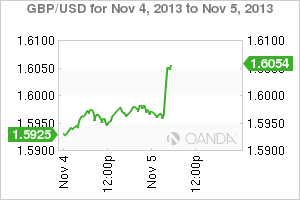

Yesterday, Sterling managed to get a boost higher on the back of UK construction PMI rising to a six-year high (59.4 in September). Today the similar theme continues, the pound has roared higher after the October services PMI came in at a 16-year high (62.5 vs. 59.6) – tripping a plethora of stop-losses above the psychological 1.6000 big handle. The currency is now focusing on the next immediate target of 1.6077 outright. The PMI reading is consistent with stronger GDP growth and given that the labor market slack is being used up at a faster pace due to this growth is also consistent with a lower unemployment rate than seen by Governor Carney's forward guidance. Maybe its now time for the BoE to change its views on when UK interest rates may potentially rise?

For investor sanity purposes, sterling, along with other G10 currency pairs have the potential to break out of their multi-month consolidation range as year-end approaches. The last six-week of the calendar year is historically a trending period in FX. Expect this to commence once investors get a better handle on the ECB and Fed's mandates this week.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Banks Manhandle Their Currencies

Published 11/05/2013, 06:49 AM

Updated 07/09/2023, 06:31 AM

Central Banks Manhandle Their Currencies

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.