Traders sat and waited for “Central Bank Thursday” yesterday with markets quiet for most of the session. The morning session was dominated by news from Germany with an auction of 5yr debt showing how much cash is still flying into safe haven assets. This was the first auction of 5 year German debt that yielded less than 1% and demand was strong; shifting EUR8.97bn against a targeted EUR4bn. This comes in the same week that a 6 month paper auction from Germany was sold with negative yields i.e. paying to lend money to Germany and shows that despite soothing talk from some members of the EU political class, the market is still very concerned about solvency going forward.

This comes a couple of hours after the initial estimate of German GDP for Q4 last year was revealed as “roughly” -0.25% and could be revised lower. This is bad news for the entire Eurozone; if Germany’s not growing, nobody will be. While we do not believe that we will see a recession in Germany, a slip in its output will only exacerbate the problems in the rest of Europe.

Sterling had one of its toughest days in a while yesterday with GBPUSD losing around a per cent while GBPEUR has fallen by around 50bps overnight. The dollar was strong through the day as safe havens were bought as a result of the ratings agency Fitch issuing comments on the future of the Eurozone. The ratings agency said that the ECB should ramp up its buying of troubled Eurozone debt to support Italy and prevent “cataclysmic” euro collapse. The use of “cataclysmic” is interesting; this is proper flamethrower language and may be used as a rocket up the ECB before their meeting today. There was little reaction to this in the rates markets however with Italian and other peripheral debt yields trading lower over the course of the session.

While it is “Central Bank Thursday” today we are not expecting much from either the Bank of England or the European Central Bank. The Bank of England is expected to hold rates at 0.5% and asset purchases, quantitative easing, at £225bn. The emphasis of the MPC is to keep policy loose at the moment and we think that another expansion of asset purchase will be announced in February. Members of the MPC will likely be encouraged by upcoming inflation data which should show a significant slowing of price increases as a result of last year’s VAT increase slipping out of the year-on-year basket. The next CPI reading is due Tuesday and will be the last one with the 2.5 percentage point increase in VAT within it.

Similarly we expect the ECB will keep things quiet at their meeting today with only a handful of analysts expecting any movement from the board. We believe that it is too soon after December’s rate cut and launch of the 3yr LTRO and instead we will see Mario Draghi update the market on the performance of the lending operation whilst simultaneously downgrading growth estimates for Eurozone through 2012. Regardless of how quiet the meetings are, we will be live with our monthly webinar, analysing the effects and looking forward over the next few months for the pound. You can register here completely free.

Alongside the central bank announcements we have UK industrial and manufacturing production at 09.30. These are likely to be poor given the decrease in manufacturing that we have seen in developed economies through Q4 and the UK is no exception to this. The good data could continue in the form of US retail sales this afternoon however; sales are expected to have rallied by 0.3% in the month of December.

We also have bond auctions from Italy and Spain this morning with the former selling short term paper, no longer than a year, and Spain looking at 3yr money.

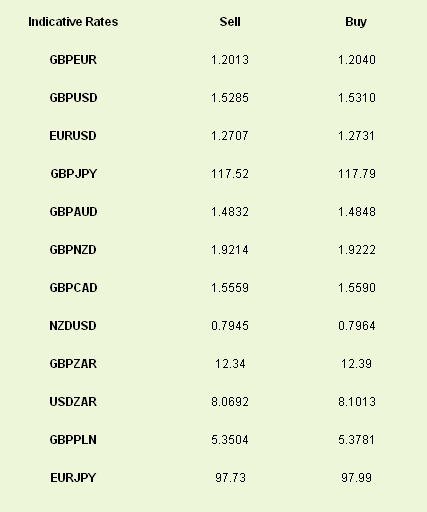

Latest exchange rates at time of writing

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Banks Likely to Sit on Their Hands Today

Published 01/12/2012, 07:40 AM

Updated 07/09/2023, 06:31 AM

Central Banks Likely to Sit on Their Hands Today

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.