Markets, and FX in particular, are still very much in a holding pattern ahead of the substantial event risk that lies towards the end of the week. Although we expect that any departures from previous communications will be minor, the lien that the Bank of England, European Central Bank and the Fed especially have over the psyche of market participants at the moment. Both accompanying statements and policy are likely to remain unchanged this week from these big three.

One central bank that has already rocked the boat though has been the Reserve Bank of Australia after Governor Glenn Stevens gave a speech that suggested that the inflation outlook in Australia may still allow for further interest rate cuts by the bank.

Previous communications from the central bank seemed to suggest that the fall in the value of the AUD had done enough to stymie things; it appears not and we now foresee another 25bps of cuts to Aussie interest rates at the bank’s September meeting; this will take the rate to a record low of 2.5% and will mark a 2.25% cut in rates since November 2011.

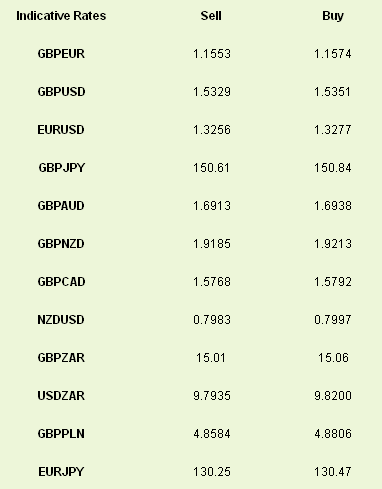

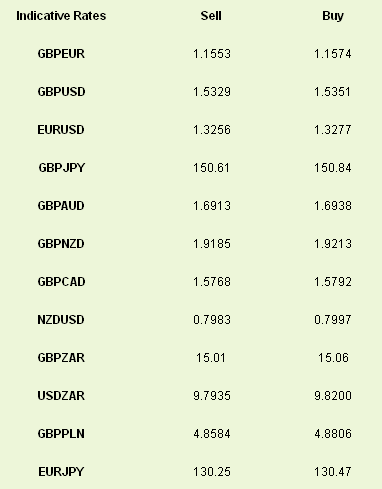

Our bearishness on the AUD remains, needless to say and in the near-term it looks very likely to break below the 0.90 level against the USD and above the 1.70 level in GBPAUD.

A few hours before the Fed announcement tomorrow we will get the provisional Q2 GDP for the US economy. It is expected to be around the 1.0% annualized mark, compared to 1.8% in Q1; a stark reminder of the effects of the sequestration that saw job losses and a huge dip in government spending.

I will also be looking to see what the Fed’s preferred inflation scale, PCE, is looking like; there is little chance that inflation is moving higher and still remains, in my eyes, a barrier to QE tapering.

The overall mood in the markets, however is one of caution and, as such, your typical havens of USD, JPY and CHF have been in demand in the past 24hrs.

The most interesting data today will be from the Eurozone with Spain’s Q2 GDP due to show a contraction of 1.8% lower compared to this time a year ago, a fall of 0.1% on the quarter. US consumer confidence may give USD a shove higher this afternoon following Friday’s better than expected increase in the University of Michigan confidence number.

One central bank that has already rocked the boat though has been the Reserve Bank of Australia after Governor Glenn Stevens gave a speech that suggested that the inflation outlook in Australia may still allow for further interest rate cuts by the bank.

Previous communications from the central bank seemed to suggest that the fall in the value of the AUD had done enough to stymie things; it appears not and we now foresee another 25bps of cuts to Aussie interest rates at the bank’s September meeting; this will take the rate to a record low of 2.5% and will mark a 2.25% cut in rates since November 2011.

Our bearishness on the AUD remains, needless to say and in the near-term it looks very likely to break below the 0.90 level against the USD and above the 1.70 level in GBPAUD.

A few hours before the Fed announcement tomorrow we will get the provisional Q2 GDP for the US economy. It is expected to be around the 1.0% annualized mark, compared to 1.8% in Q1; a stark reminder of the effects of the sequestration that saw job losses and a huge dip in government spending.

I will also be looking to see what the Fed’s preferred inflation scale, PCE, is looking like; there is little chance that inflation is moving higher and still remains, in my eyes, a barrier to QE tapering.

The overall mood in the markets, however is one of caution and, as such, your typical havens of USD, JPY and CHF have been in demand in the past 24hrs.

The most interesting data today will be from the Eurozone with Spain’s Q2 GDP due to show a contraction of 1.8% lower compared to this time a year ago, a fall of 0.1% on the quarter. US consumer confidence may give USD a shove higher this afternoon following Friday’s better than expected increase in the University of Michigan confidence number.