Yesterday and today in Asia, we had not one, not two, but four central bank decisions on our agenda. Those were the SNB, the BoE, the ECB, and the BoJ, with all of them sounding more hawkish, or less dovish, than expected.

Pound, Euro, Franc, and Yen, Gain after Their Bank’s Decisions

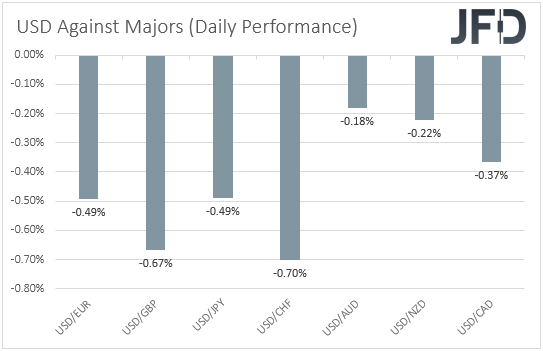

The US dollar slid against all the other major currencies on Thursday and during the Asian morning Friday, losing the most ground versus CHF, GBP, EUR, and JPY.

At first glance, the weakening of the US dollar and the strengthening of the British pound suggest a risk-on trading, while the strengthening of the franc and the yen point otherwise. However, taking a closer look, we see that the leading gainers were the currencies of the respective central banks, which announced their monetary policy decisions yesterday and today in Asia.

First, we had the SNB, which proceeded with no changes in its policy settings nor the accompanying statement. Officials reiterated for the umpteenth time that the Swiss franc remains highly valued and that they remain willing to intervene in the FX market as necessary.

In the past, those statements were expected, and thus, the market reaction was minimal. However, this time around, with EUR/CHF falling notably due to the uncertainty the new COVID-related restrictive measures pose on European economies, some participants may have been expecting Swiss officials to strengthen their wording with regards to preventing the franc from gaining more.

Thus, the outcome came as a disappointment to them, and that’s why the franc kept marching north, ending the day as the leading gainer among the majors.

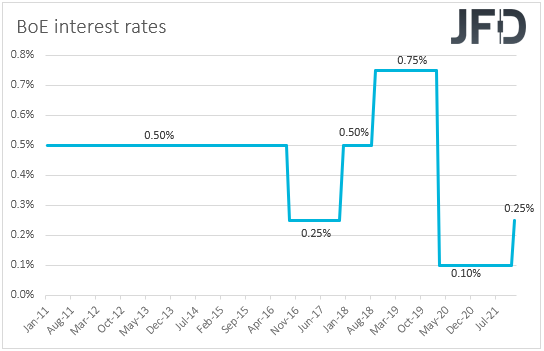

Then, it was the BoE’s turn, with British officials surprising the markets for the second time in six weeks. At the November gathering, market participants were assigned an 80% chance for a rate increase, and instead, policymakers refrained from acting.

Now, the financial community was confident that due to the increasing COVID cases and the new restrictive measures in the UK, the bank might prefer to wait for a few more months before acting. Again, the bank surprised investors and decided to push the hike button, lifting interest rates to 0.25% from 0.10%.

The Policy Committee voted 8-1 for raising rates, with the only dissenter being Silvana Tenreyro. In our view, this suggests that the Committee as a whole is more concerned over high inflation rather than a potential economic slowdown.

After all, the bank pointed to the likelihood of more modest tightening, with Governor Bailey adding that it is unclear whether Omicron would ease or add to inflationary pressures. According to media, investors are now pricing in three more quarter-point increases until September 2022, which suggests that the pound could stay supported for a while more, even against the US dollar.

Remember that the Fed has yet to deliver its first rate increase, while it sees three hikes until the end of next year. So, at the moment, market pricing regarding BoE rates is more aggressive. However, aggressive expectations leave ample room for disappointment as well.

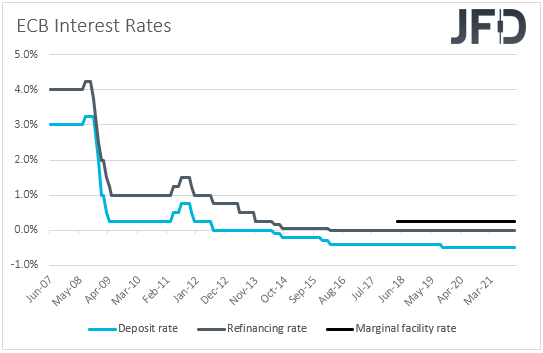

Thus, if the BoE appears a bit more concerned over COVID at one of its upcoming meetings, the pound could come under intense selling interest. Soon after the BoE, we had the ECB announcement. This bank decided to keep all three of its interest rates unchanged as was widely anticipated and announced that it would end the pandemic emergency purchase program (PEPP) in March.

However, due to the renewed uncertainty triggered by the fresh COVID-related lockdowns across the bloc, they decided to extend the reinvestment horizon for the PEPP but also to compensate by doubling the monthly pace of the asset purchase program (APP) for the second quarter.

Given that there was a battle between the doves and the hawks within the Council, it seems that this may have been the common ground. The doves were concerned with regards to the broader economic outlook and the implications of COVID, while the hawks were concerned over extremely high inflation.

The reaction in the euro was to the upside, perhaps as some market participants have been expecting the bank to extend its PEPP program amid this uncertainty, or possibly to increase the pace of APP purchase by more than they did. Thus the actual decision came as a disappointment to them.

However, in our view, the outcome still suggests that, at least for now, the ECB remains accommodative. Although officials are expected to slow down the APP in Q3 and bring it back to the current pace in Q4, they maintained flexibility to adjust all their instruments as appropriate.

So, if the economic outlook darkens further due to the new restrictions, we cannot rule out maintaining the double pace of APP purchases for longer or even resume the PEPP. Thus, even if the euro continues to strengthen for a while more, we see its upside being limited, especially against the pound and the dollar. The central banks are expected to keep tightening their respective policies much faster than the ECB.

Finally, during the Asian session, we got the BoJ decision. This bank kept its main policy tools unchanged. Namely, it maintained the short-term interest rate target at -0.1% and the Japan 10-Year JGB yield target around 0%.

However, it tapered its corporate bond and commercial paper buying, a scaling-back move of its pandemic relief measures. This, combined with the fact that other major central banks appear more concerned over inflation than another potential economic slowdown, allowed the yen to march higher as well.

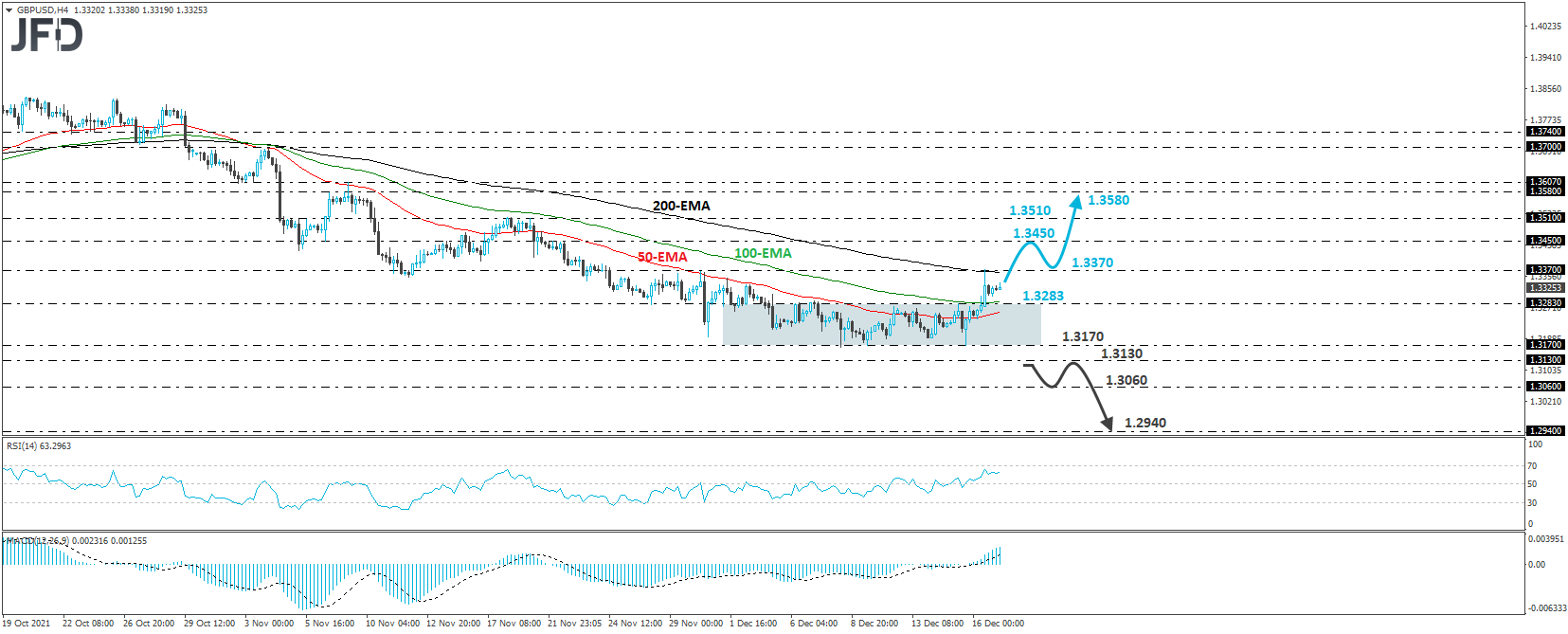

GBP/USD – Technical Outlook

GBP/USD rallied today after the BoE surprisingly hiked interest rates for the first time since the outbreak of the coronavirus pandemic. The rate broke the upper bound of the sideways range it’s been trading within since Dec. 3 to hit resistance near the high of Nov. 30, at around 1.3370. We believe that the short-term outlook has turned positive for now with that in mind.

A break above 1.3370 could pave the way towards the high of Nov. 22, at 1.3450, where another break could target the 1.3510 area, which prevented the rate from moving further north between Nov. 18 and 19. If that zone cannot withstand the pressure, its break may pave the way towards the 1.3580/1.3607 area, marked by the highs of Nov. 8 and 9, respectively.

The outlook could turn negative again upon a break below the lower end of the range, at around 1.3170. This will confirm a forthcoming lower low on the 4-hour and daily charts and encourage the bears to push the action towards the 1.3130, marked by the low of Dec. 11, 2020.

A break lower could carry more significant bearish implications, perhaps paving the way towards the 1.3060 zone, marked by the inside swing high of Oct. 28, where another dip could see scope for declines towards the low of Nov. 5, 2020.

EUR/JPY – Technical Outlook

EUR/JPY traded higher after the ECB decision but hit resistance at 129.65, and then it pulled back to settle near the 128.45 zone. Overall, the pair remains above the prior downside resistance line taken from the high of Oct. 29 and above a newly established one, drawn from the low of Dec. 3. This suggests that another round of buying could be possible.

If indeed, the bulls decide to retake charge, we would expect them to aim for another test near the 129.65 zone, or even the round number of 130.00, marked by the high of Nov. 19. Another break, above 130.00, could extend the recovery towards the 130.60 zone, marked by the peak of Nov. 15.

On the downside, we would like to see an apparent dip below 127.37 before we start examining the bearish case. This will confirm a forthcoming lower low on the daily chart and may initially pave the way towards the 126.45 barrier, marked by the low of Feb. 9. Slightly lower lies the low of Feb. 4, at 126.10, the break of which could allow declines towards the low of Jan. 27, at 125.60.