Central Banks Take Center Stage

This week, both the FOMC and Bank of Japan will share centre stage along with Australia’s Q2 CPI data print, which will vie for the spotlight.

The Federal Reserve’s Conundrum

A decline in rates was masterfully steered by the Federal Reserve Board throughout Q2, which saw risk sentiment skyrocket and provided investors with a post-Brexit buffer. That the Fed’s will hold interest rates on Wednesday is almost a given, so the primary debate in the markets is that of forward guidance.

The Fed may acknowledge an improved US economic landscape, but remain mum on policy so as not to tip prevailing fragile sentiment. Misleading the markets could create a gas meets flame scenario, similar to the effect produced by past Federal Open Market Committee (FOMC) statements.

A balanced assessment will be viewed by traders as leaning hawkish and a strong USD reaction is likely, as the market has priced in the probability of a December rate hike. A September rate hike is highly unlikely as the US elections occur in November. A hawkish scenario also leaves scope for repricing in the 2017-2018 economic calendar, which presently projects a flat interest rate curve.

Bank of Japan -The Table’s Set

The market has excessive expectations that the Bank of Japan (BOJ) will cut interest rates by expanding asset purchases from ¥80 to ¥90 trillion, thereby reducing interest rates to -0.2 percent from -0.1 percent. The tail risk is that if the BOJ remains firm this month, it will cause a knee-jerk risk implosion in the markets, sending stock prices plummeting and catapulting the yen higher.

Yen: Lingering Doubt

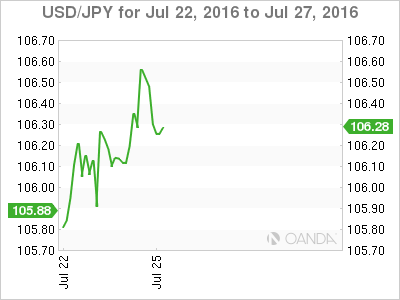

Rumours have it that there are dissenters within the BOJ ranks that believe current monetary policy is adequate to achieve their inflation mandate. Regardless, USD/JPY is grinding higher in early trade this morning, ignorant of the headlines.

Intense speculation as to the size of a fiscal stimulus package, with some estimates as high as 30 trillion yen, saw the USD/JPY pair move on the back of this speculation to 106.25 levels, settling in at just above 106 throughout the London and New York sessions.

Scope for disappointment exists, even if the BOJ meets preliminary market expectations. Yet, the cacophony of comments and debate about ‘helicopter money’ is tempering the USD/JPY in the run-up and adding an unneeded level of confusion to the BOJ’s decision on Friday. The prospects of the well signalled massive fiscal stimulus, along with a more positive US outlook suggests the USD/JPY should remain well supported.

Japanese trade data for Exports beat expectations this morning at -7.4% versus market expectations of -11.4%, however, exports to major trading partners including the US and China, came in lower for the fourth consecutive month due to a strengthening yen. While this may imply some comfort buffer for Japan policymakers, the data is unlikely to dissuade from the current mandate.

Australian Dollar-Desperately Seeking Inflation

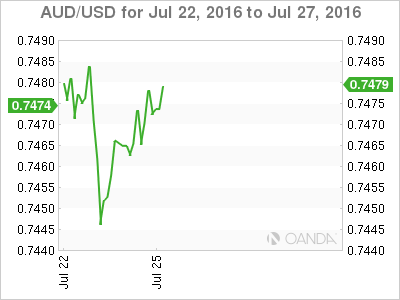

Last week proved a tough one for the Australian dollar, as market bulls cut rate expectations on the back of tepid economic data and the RBA minutes. Strong US economic data also reignited debate of a December US rate hike.

However, much of the recent bearish bias has been predicted on the result of Q2 CPI data, which will likely affect near-term AUD/USD direction. Print of 0.4% would validate traders rate-cut expectations, while a weaker headline of below 0.4% will imply the possibility of additional interest rate cuts beyond August.

If that happens before RBA Governor Glenn Stevens impending departure, it could send the AUD toppling. Nonetheless, buffered by positive risk sentiment, the AUD bounced off at the 0.7450 level, in spite of the USD’s strengthening on the broader G10 space.

The AUD found little reprieve however, as commodities including gold, copper and oil prices retreated. Current AUD sentiment is centred on interest rates, especially as the prospect of a policy divergence between the RBA and the Federal Reserve Board gains momentum.

Today, the AUD opened quietly, but I suspect the next 48 hours will be more about pre-CPI positioning and that the downtrend will remain intact in the lead up to this week’s FOMC.

Commodities -DXY Weighs Heavy

While base metals staged a recent recovery on prospects of additional monetary stimulus from China, copper prices fell under pressure from a stronger USD and rising production in China.

Oil prices remain slippery. Bulging inventories are weighing negatively on prices as fourteen more US oil rigs have come online; a worrisome signal as the inventory builds in the midst of the peak driving season in the USA.

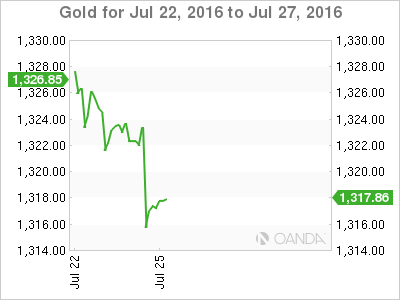

Gold prices have fallen as Brexit concerns ease and US rate hike expectations rise. When interest rates rise, it becomes more expensive to warehouse gold and the return diminishes.

Yuan- Modus Operandi

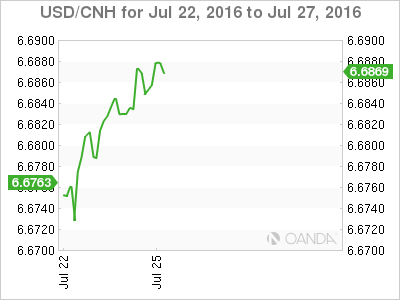

The year’s longest run of weekly losses against the yuan has ended, with the PBOC reverting to its old tactic of stablising the yuan with state-owned Bank intervention. This has flamed debate about the mainland’s commitment to permitting market forces to dictate the currency’s peg.

Conspiracy theorists pointed to the proximity of the G-20 meeting as to why the PBOC has drawn a line in the sane for Yuan devaluation at 6.70. This is a concerning move if, as it seems clear, the intention is to kerb capital outflow rather than to position a weaker yuan to tackle waning exports.

This week will be light for the yuan, marked by Wednesday’s consumer confidence and industrial profit reports. Unsurprisingly, the PBOC peg came in this morning with a weaker yuan midpoint setting of 6.6860 vs. 6.6669. USD/CNH is powering through 6.6900.

Ringgit -Remains Rocky

The ringgit should remain vulnerable ahead of this week’s FOMC amid broader USD strength. Also, energy prices remain soft and increasing political risk from 1MDB headlines should continue to weigh on investor sentiment. However, the overall EM Asia space is in a good spot as the chase for yield is expected to resume in this carry happy Global Low-interest rate environment

G-20 -No Smoking Gun

Not unexpectedly Brexit was the dominate theme for this weekend’s G-20 meeting amidst the rise of antiglobalisation in the west. But overall it concluded with no smoking gun and left Traders will few fires to deal with at this morning Auckland Foreign Exchange market open.