Over the years we have posted an aggregate central bank balance sheet chart on our website. The current chart includes only three central banks: the European Central Bank (ECB), the Federal Reserve (Fed) and the Bank of Japan (BOJ). We send thanks to our good friend Paul Horne for asking about this update.

In our earlier iterations of this series, we included the Swiss National Bank (SNB). That was during the years in which SNB had a currency-exchange-rate policy cap of 1.2 Swiss francs to the euro. We included the SNB at that time because the actions of Switzerland were indirectly supporting the expansion of the ECB’s monetary activity. The SNB would intervene in the foreign currency markets, buy euros and create new francs in order to pay for them. That is how they maintained the 1.2 to 1 ratio whenever market forces pressed that limit.

Switzerland abandoned that policy as of January 15, 2015. Its central bank is now internally focused on the country. The Swiss franc underwent an abrupt and dramatic change in value and is now one of the strongest currencies in the world. The SNB policy is focused on zero interest rates. Non-Swiss depositors in Swiss banks face negative interest rates. That’s correct: they pay for the privilege of parking their cash in the bank. Nearly half of the Swiss sovereign debt yield curve is trading at negative interest rates. Certain Swiss corporate bonds are trading at negative interest rates (Nestle, for example). That’s right: the bondholder pays the company for the privilege of placing cash in the debt of the company. This is with a seasoned issue. We shall see if it will also apply to new issues. It may. In Switzerland, the interest rate is at zero or below zero. Some analysts believe the SNB will now try to manage a “soft” franc-euro cap at 1 or 1.05 or so. We shall see. But we are not adding Switzerland back to the central bank chart series today.

The Bank of England (BOE) had a different reason for losing its place in our updated central bank balance sheet series. Last year, the BOE changed policy and is not fully transparent regarding its activities. This was a sad day in the history of central banking. For 150 years, the United Kingdom had maintained a policy of transparency. Essentially our British central banking friends have said, “We are not going to tell you everything anymore.” So at Cumberland, we dropped the BOE from our chart because we cannot get current and transparent information. That leaves us with three major central banks. We are now tracking their cumulative size and posting that information on our website in its regular place. The three remaining banks are still a huge force in global central banking. They, and those currencies that link to them in one way or another, define the majority of the capital markets of the world.

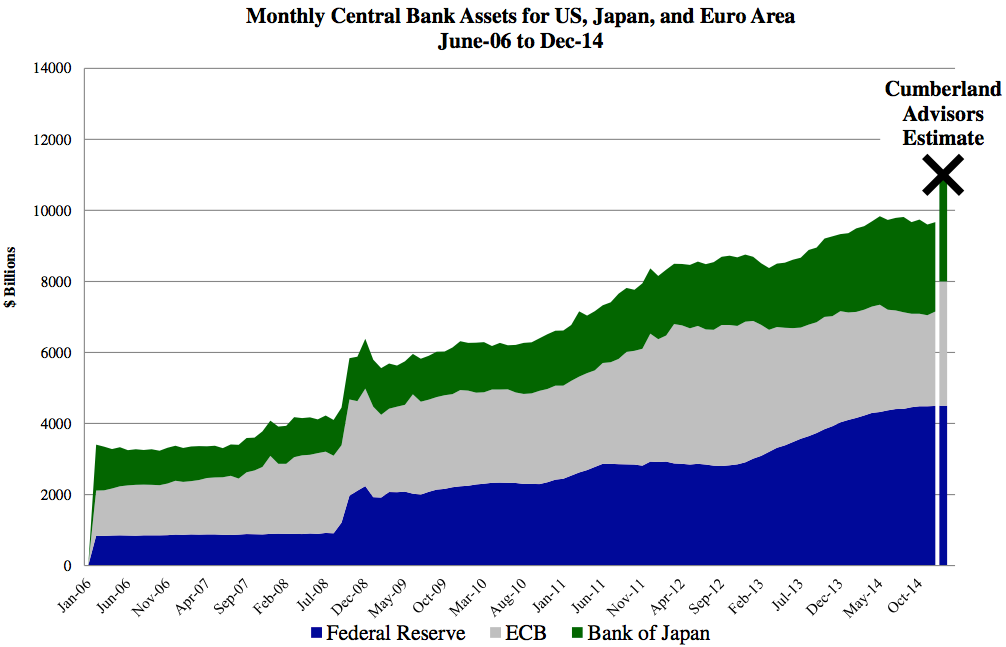

Readers may note that, prior to the financial crisis, the combined size of the dollar-based central bank (our Fed), the yen-based central bank (the BOJ) and the euro-based central bank (the ECB) was under $3 trillion equivalent. Present policy projections in the Eurozone, Japan and the US suggest that one trillion additional euros will be added in Europe; there will be some large number of additional yen in Japan; and our Fed will be at a neutral position or “on hold.”

As a result, one year from now the three central banks will reach an equivalent size of approximately $11 trillion. Since the financial crisis unfolded, these three central banks will have nearly quadrupled the size of their asset holdings and extended the duration by between two and three times. Nowhere in history have we seen such activity in a continuously applied policy.

At the same time we see no inflation looming ahead to worry us. We see gradual and accelerating economic recovery in the US. We see some slight recovery that may be coming in Europe. And Japan is still struggling with deflationary forces. It is hard to make an assumption about robust global growth. It is not there.

For seven years we have heard pundits on financial television claim, “Central banks are printing all this money; we are going to have a big inflation; interest rates will rise in the economy; and the markets will go in the tank.” The opposite is happening. Last week an “expert” offered the latest rendition of the same song he has been singing for 7 years. Another claimed we will get hyperinflation. And another declared that a huge debt crisis is coming. Maybe one of them will be right before the end of this century.

Scare tactics sell subscriptions to newsletters. They get attention in the media. They alarm investors. These pundits do not have to manage portfolios. They manage punditry. And they sell their newsletter.

At Cumberland, we manage portfolios. We publish what we believe and what our research suggests to us. We do it after we make the portfolio moves since our clients come first and our readers, who are not clients, must wait. We have to decide what to buy or sell or hold for a client and when to do it. We are on the firing line every day. We do not manage central bank or government policy. We do not make it. We just try to make sense out of what appears to be a very confusing set of policies that are impacting markets. All 35 of us at Cumberland work on this every day.

Here Is What We See

The US recovery is showing some signs of gaining strength. It is a gradual recovery process and it will continue to be so in 2015. It is very unlikely that the Fed will act in any way to derail this fragile but improving economic recovery. In Europe we now have a massive quantitative easing program underway. It is at an incipient stage and will last through the end of 2016. And in Japan, QE on a mammoth scale continues unabated.

All of this is bullish for asset prices, which will rise on an ongoing basis for all the reasons we have discussed over the years. Volatility will be high but the main trend will be up in asset pricing. At Cumberland Advisors, we remain fully invested in the US stock market using a selection of ETFs that we think will capture the construction necessary in a strong-dollar-oriented time.

In our international ETF accounts, over half is in currency hedge selections. We use a number of those ETFs to capture selections, currencies, countries and the mix of weights. We remain optimistic on financial markets. We are pessimistic on the quality of the governance that we see worldwide.

And we are very concerned about the geopolitical risk that we see in so many areas and countries. Today’s horrible news of auto da fe (death by fire) exemplifies this risk as the newest version of a consummately evil force has used religion to justify murder.

Our bond accounts are managed with a careful eye on getting paid. We do our own credit work on top of the analysis we see from the credit rating agencies. There is little room for credit risk at low interest rates. Item by item must be examined. We also have some ongoing hedging of interest rate risk. The time will come when the downward trend in rates is over. It is not clear that it has arrived. No one will “ring a bell” at the low. Those hedges are a protective device when the eventual turn comes.

Note that we once thought a 4% yield on a 10-year US Treasury would be the generational low. That was many years ago. We may even see a 1% yield on the 10-year Treasury. We will have more to say about that in a future commentary. We do NOT know how low rates will go. Pundits who predict otherwise are speculating. No one knows how this whole scenario of zero interest rates or negative interest rates will eventually play out.

We do not like the alarmist punditry we see every day. We debate it in the media when the opportunity presents itself. The only truthful answer for a professional to give in these extraordinary times is, “I do not know.”

What Do We Know?

We know what the interest rates are right now. We can see them in the marketplace. We know what the future interest rates are predicted to be when we look at market-based pricing. We know what the forward curves are saying. That does not make them right, nor does it make them wrong. It does represent the beliefs and behaviors of real-money bettors making real-money bets on what the future will hold.

They are saying lower rates for longer. They are saying zero interest rates in a lot of places. They are saying that negative interest rates are an expanding phenomenon around the globe. About $4 trillion in various forms of high grade sovereign debt is now trading at an interest rate below zero.

We remain fully invested and seek upwardly biased asset pricing. And we remain favorable towards the correct (in our view) composition of bonds with appropriate hedges and volatility dampening characteristics. Let me add that the highest grade, US dollar paying, tax-free municipal bond is presently one of the greatest relative bargains in the world.

One More Thing

We reserve our right to change this quickly if circumstances change. Enjoy the chart. It will be updated regularly.

David R. Kotok, Chairman and Chief Investment Officer.