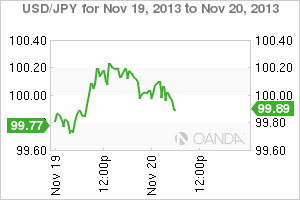

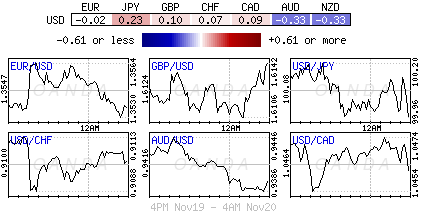

Talk, talk and more talk is all thats leading Capital Markets at the moment. Central bank rhetoric has dominated the forex markets this calendar year. Rather than gold being the lead financial story for 2013, its first loss in thirteen years, why can we not have Central Banks? They have successfully handcuffed the market, reducing both volume and volatility throughout this year. Expect this theme to roll over into the New-Year allowing investors to stick with last years trading plan, at least for a short while. USD/JPY" border="0" height="200" width="300">

USD/JPY" border="0" height="200" width="300">

The 'mighty' buck came under renewed threat after helicopter Bernanke's comments yesterday. The dollar pushed to fresh weekly lows, but has since been able claw some of those losses back. "Thick-as-thieves"- the outgoing Fed chief Bernanke struck a familiar dovish tone, one close to that of Ms. Janet Yellen's testimony last week, reiterating that interest rates may remain near-zero for considerable time after bond buying ends, and possibly well after unemployment declines to less than +6.5%. The Fed's transparent messaging system continues to insist, "tapering is not tightening."  EUR/JPY" border="0" height="200" width="300">

EUR/JPY" border="0" height="200" width="300">

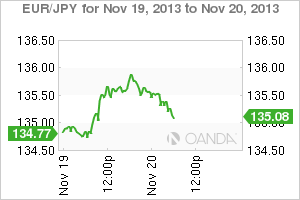

Bernanke continues to imply that the Fed remains extremely data-dependent without a clear outlook for the start of the taper, noting the FOMC would only start to slow bond buys if labor market and inflation align with its projections. His speech yesterday did not directly address the timetable for the Fed’s retreat, but in combination with other recent remarks by Fed officials, it is clear that Fed officials have not ruled out a change in policy as soon as December. However, that said data dependent remains questionable. Global officials have to get their timing of reducing liquidity spot on otherwise interest rate differentials will undo all of that good work. EUR/USD" border="0" height="200" width="300">

EUR/USD" border="0" height="200" width="300">

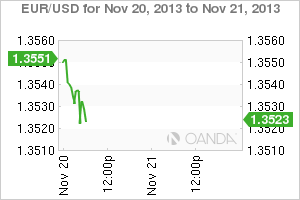

The market has to digest more QE and negative rate talk from the ECB. It seems that the communication doors are firmly wide open – "transparent speak." Euro officials are implying that they will do anything to fulfill its inflation mandate. Asmussen rhetoric has been focusing on negative interest rates, while Constancio (Portugal) and Praet (Germany) have been favoring QE talk. Tomorrow and Friday this market will play host to a plethora of Euro policy speakers, including Draghi. Do not be surprised to see the ECB reiterate its willingness or readiness to take further actions on low inflation – "providing the rational to take the deposit rate negative and adopting QE." It seems that the ECB's preferred weapon of delivery will be of "surprise" – just like the last rate cut. The fixed income market is only tentatively pricing in the possibility of immediate change in policy. The last time they did this they got burnt. GBP/USD" border="0" height="200" width="300">

GBP/USD" border="0" height="200" width="300">

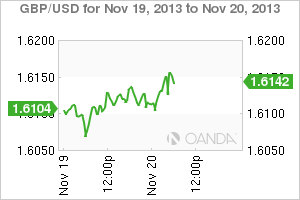

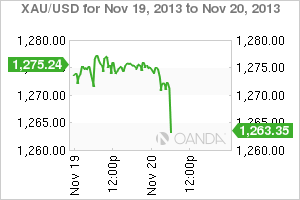

The BoE's MPC meeting minutes for November revealed that UK policy makers were concerned about the strength of the country's economic recovery, highlighting risks in the Euro-zone and of over indebted consumers cutting their spending (a global phenomena). Despite the pickup in the economy this year, "there were uncertainties in the durability of the recovery." Any further economic setbacks from the Euro-zone will have a direct impact on the UK's progressive recovery. The MPC voted unanimously to keep both the BoE's main interest rate unchanged (+0.5%) and the bond buying program at +£375b. Officials will not consider raising interest rates until UK unemployment falls to +7% from +7.6%. The "Old Lady's quarterly forecasts showed that policy makers do not expect this to happen until around mid-2015.  XAU/USD" border="0" height="200" width="300">

XAU/USD" border="0" height="200" width="300">

The Fed will also be expected to leave its footprint on Capital Market landscape later today. Investors are looking to the FOMC minutes for any explanation regarding the degree to which policymakers were more comfortable with the prevailing rate environment in October, especially after the October 30 statement "dropped references to elevated mortgage rates and tightening financial conditions." Investors will be expected to take their cues from this afternoon's release, but before that there will be a few Fed speakers possible obstructing progress. New York Fed President Dudley (voter, dove) will speak at 10 a.m. on the economy, while St. Louis Fed President Bullard (voter, dove) speaks on the economy and monetary policy at 12:10 p.m.

Even US fundamental data is not projected to make a big splash this morning. The market expects the October headline CPI to be a tad softer on the month, which would bring year-over-year CPI close to a four-year low. The headline and core retail sales are slated to show little changed month-over-month. The outlier could be existing home sales. Analysts are looking for a similar drop to last month (-3.6%), however this could widen. Despite the fundamental unease, investors remain somewhat bullish on the USD. Any upside surprises in US data could push market expectations in favor of a December tapering decision once again.

Original post

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Bank Talk Prevents Dollar Moves

Published 11/20/2013, 07:14 AM

Updated 07/09/2023, 06:31 AM

Central Bank Talk Prevents Dollar Moves

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.