Meeting targets, paying dividends, lowest costs

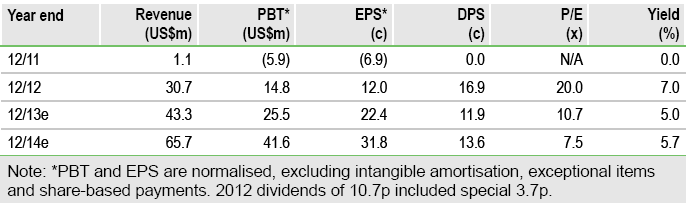

Central Asia Metals Plc's, (CAML) H113 production was in line with its full-year production target of 10kt copper cathode. Attributable (60%) gross revenue was US$21.2m from the sale of 5,035t at an average realised copper price of US$6,996/t. All-in costs of production remain in the lowest quartile for the industry at US$1.06/Ib, providing significant leeway during periods of copper price weakness. Continuing with its policy of returning value to shareholders, CAML will pay a 4p/share interim dividend (equal to 25% of attributable revenues) on 15 November 2013. An impairment of US$13.6m has been recorded for its non-core Mongolian assets, reducing their carrying value to zero, resulting in an H113 net loss of US$5.1m. We refrain from drawing comparison with 2012 production results as H113 is the first full six-month period when Kounrad has operated at steady state levels.

Western dumps yielding similar Cu recoveries to east

CAML has already notified the market that its pilot-scale testing of the much larger sulphidic western dumps has indicated potential copper recoveries of 40-45%, ie similar to recovery rates at the eastern dumps. This is due to higher degrees of natural oxidation (by bacterial action) of the sulphide and mixed dumps since their creation in the Soviet era 70-80 years ago.

Costs: Comfortably within lowest quartile

CAML’s H113 direct cash cost of production (C1 equivalent) is US$0.76/Ib. Even factoring in its other overheads (Kazakh MET tax, Balkhash G&A, depreciation, distribution and selling costs), it still ranks only sixth cheapest at US$1.06/Ib. We also consider that all its peers carry by-product credits, where CAML has none.

Valuation: Potential £1.66 per share (fully diluted)

Following the interims we adjust our model for a slight 7% increase in G&A costs from US$6.25m to US$6.70m for FY13, an 8.2% increase in all-in operating costs from US$2,167/t to US$2,344/t (largely due to cost and increased consumption of electricity due to a particularly harsh Kazakh winter). The average copper price received was 11.8% lower at US$6,996/t (vs FY12 of US$7,935/t). This results in our per share valuation remaining at £1.66, based on only the oxide material being re-treated to 2029 (the last year of operation under this scenario), a 10% discount rate and copper prices of US$3.21/Ib for 2013, and US$2.96/Ib long term. Our valuation assumes successful completion of the SAT deal in Q114, with CAML accounting for 100% of Kounrad’s profits from 1 January 2014.

To Read the Entire Report Please Click on the pdf File Below.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

Central Asia Metals: Potential £1.66 Per Share

Published 10/15/2013, 07:37 AM

Updated 07/09/2023, 06:31 AM

Central Asia Metals: Potential £1.66 Per Share

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.