Centene Inc. (NYSE:CNC) reported third-quarter 2017 adjusted net income per share of $1.35, which beat the Zacks Consensus Estimate by 8%. Earnings also improved 20.5% year over year, primarily on the back of higher revenues.

Operational Update

For the quarter, total revenues grew 10% to $11.9 billion year over year, primarily driven by growth in the Health Insurance Marketplace business in 2017 and expansions and new programs in many states in 2016 and 2017.This was partially offset by the moratorium of the Health Insurer Fee in 2017 and lower membership in the commercial business in California. Revenues surpassed the Zacks Consensus Estimate of $11.8 billion by 1%.

At the end of the quarter, managed care membership of 12.3 million reflected an increase of 8% from the third quarter of 2016.

Health Benefit Ratio (HBR) for the quarter was 88% compared with 87% in the prior-year quarter. This improvement of 100 basis points (bps) was a result of new and expanded health plans with higher HBR, an increase in higher acuity members and a premium rate reduction for California Medicaid Expansion effective Jul 1, 2017.

In the third quarter, adjusted selling, general and administrative expenses ratio was 8.9%, down 20 bps year over year. This improvement reflects the leveraging of expenses over higher revenues in 2017. Total operating expenses of $11.5 billion increased 9.5% from the prior-year quarter.

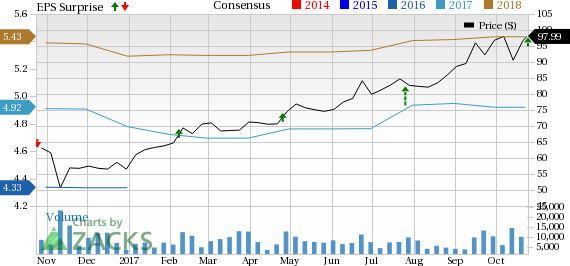

Centene Corporation Price, Consensus and EPS Surprise

Financial Update

As of Sep 30, 2017, Centene had cash and cash equivalents of $4.3 billion, up 8.9% from 2016 year end.

Total assets of $22 billion grew 8.9% from 2016 year end.

As of Sep 30, 2017, Centene’s long-term debt totaled $4.7 billion, up 1.4% from 2016 year end.

For the first nine months of 2017, cash inflow from operations was $1,039 million compared with $259 million in the prior-year period.

2017 Guidance

Centene expects adjusted earnings per diluted share to be in the range of $4.86-$5.04 against the previously guided range of $4.70-$5.06.

Total revenues are expected to be in the range of $47.4-48.2 billion compared with the earlier guidance of $46.4-$47.2 billion.

HBR is expected in the range of 87-87.4%, unchanged from the previous guidance.

Adjusted Selling, General & Administrative expense ratio is expected in the range of 9.3-9.7%, unchanged from the previous guidance.

Diluted shares outstanding is expected be between 176.3 million and 177.3 million.

Zacks Rank and Performance of Other Peers

Centene currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Among other players in the Medical sector that have reported their third-quarter earnings so far, Abbott Laboratories. (NYSE:ABT) , Johnson & Johnson. (NYSE:JNJ) and UnitedHealth Group Incorporated (NYSE:UNH) beat their respective Zacks Consensus Estimate.

Today's Stocks from Zacks' Hottest Strategies

It's hard to believe, even for us at Zacks. But while the market gained +18.8% from 2016 - Q1 2017, our top stock-picking screens have returned +157.0%, +128.0%, +97.8%, +94.7%, and +90.2% respectively.

And this outperformance has not just been a recent phenomenon. Over the years it has been remarkably consistent. From 2000 - Q1 2017, the composite yearly average gain for these strategies has beaten the market more than 11X over. Maybe even more remarkable is the fact that we're willing to share their latest stocks with you without cost or obligation.

Johnson & Johnson (JNJ): Free Stock Analysis Report

Abbott Laboratories (ABT): Free Stock Analysis Report

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post