Centene Inc. (NYSE:CNC) reported second-quarter 2017 adjusted net income per share of $1.59, which beat the Zacks Consensus Estimate by 22.3%. Earnings also improved 23.2% year over year, primarily on the back of higher revenues.

Operational Update

For the quarter, total revenue grew 10% to $12 billion year over year, primarily driven by growth in the Health Insurance Marketplace business in 2017 and expansions and new programs in many of the states in 2016 and 2017.This was partially offset by lower membership in the commercial business in California. Revenues also surpassed the Zacks Consensus Estimate of $11.6 billion by 2.6%.

At the end of the quarter, managed care membership of 12.2 million reflected an increase of 7% from the second quarter of 2016.

Health Benefit Ratio (HBR) for the quarter was 86.3% compared with 86.6% in the prior-year quarter. This deterioration of 30 basis points (bps) was due to growth in the Health Insurance Marketplace business, which operates at a lower HBR

In the second quarter, adjusted selling, general and administrative expenses ratio was 9.3%, up 30 bps year over year. This deterioration was due to higher variable compensation expenses based on performance of the business in 2017 and increased business expansion costs. However, this was partially offset by higher Health Net acquisition related expenses in 2016.

Total operating expenses of $11.5 billion increased 9.5% over the prior-year quarter.

Financial Update

As of Jun 30, 2017, Centene had cash and cash equivalents of $4.4 billion, up 12.6% year over year.

Total assets of $21.8 billion grew 8% year over year at the end of the second quarter.

As of Jun 30, 2017, Centene’s long-term debt totaled $4.7 billion, up 1.4% year over year.

At the end of the reported quarter, cash flow used in operations was $306 million. This cash outflow stemmed from to an increase in premium and related receivables of approximately $750 million. This was due to the timing of June-capitation payments from several states.

However, for the first six months of 2017, cash inflow from operations was $942 million against an outflow of $223 million in the prior-year period.

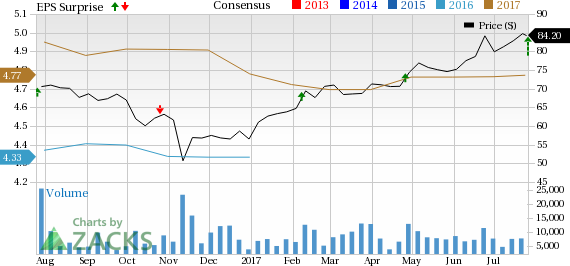

Centene Corporation Price, Consensus and EPS Surprise

2017 Guidance

For 2017, Centene expects adjusted earnings per diluted share to be in the range of $4.70–$5.06. Total revenue is expected to be in the range of $46.4 billion to $47.2 billion

Zacks Rank and Performance of Other Peers

Centene currently carries a Zacks Rank #3 (Hold).

Investors can also consider some better-ranked stocks from the medical sector like UnitedHealth Group, Inc (NYSE:UNH) , Magellan Health, Inc. (NASDAQ:MGLN) and Anthem, Inc. (NYSE:ANTM) . All of these stocks carry a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

While UnitedHealth has already reported a beat in its second-quarter results, Anthem and Magellan are slated to report their results on Jul 26 and Jul 28, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

UnitedHealth Group Incorporated (UNH): Free Stock Analysis Report

Magellan Health, Inc. (MGLN): Free Stock Analysis Report

Anthem, Inc. (ANTM): Free Stock Analysis Report

Centene Corporation (CNC): Free Stock Analysis Report

Original post

Zacks Investment Research