Bridging the PLM/ERP gap

Cenit AG (XETRA:CSHG) is a Stuttgart-based software value-added reseller and consulting company specialising in PLM (Product Lifecycle Management) and EIM (Enterprise Information Management) solutions. The recent focus on the development of own software in the PLM division (+5.7% y-o-y in FY14) is likely to accelerate sales and drive margin expansion toward the EBIT target of 10%. At the same time, the PLM division should continue to offset the slower growth in the EIM business. Scope for margin expansion, top-tier clients and a strong track record support the premium rating.

Focus on proprietary software development

CENIT AG plans to dedicate increasing resources to expanding the successful own software division (11% of FY13 sales), where we believe the company’s competitive advantage lies in the close partnerships with both Dassault and SAP as well as in the industrial know-how: the company boasts a tier 1 customer base in the four primary verticals, where it operates: automotive (Porsche, BMW), aerospace (Airbus, Boeing), engineering (Komatsu, Alston, Bobst) and banking (UBS, Allianz, Basler).

Margin expansion: FY16 EBIT target of 10%

Proprietary software sales have historically been the company’s highest margin business (EBIT margins of between 15% and 20%). Ultimately, the higher software sales content is likely to help the company reach its longer-term target FY16 EBIT margin of 10% in FY16. In the interim, the recent cost-saving measures should offset the higher R&D spend. Importantly, the company has also been able to renegotiate some commission agreements and reposition the lower-margin EIM unit, which we expect to result in significant cost savings in FY14.

Valuation: Margin expansion potential supports premium

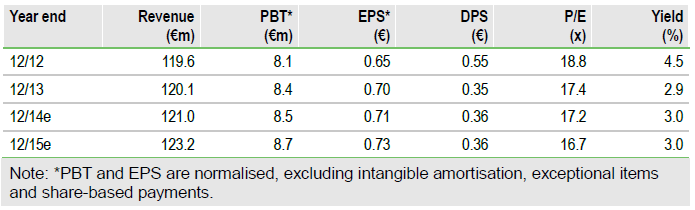

At a P/E FY14 and FY15 of 17.2x and 16.7x, respectively, the company is at a premium to peers. However, these forecasts are struck at our very conservative FY14 and FY15 EBIT margin estimates of 7.0% and 7.1%. If the company reaches the FY16 10% EBIT margin target, it is likely to generate FY16 EPS of at least €1 – 46% higher than our FY13 EPS estimate, implying an undemanding 2016 P/E of c 11.5x. The company’s free cash flow and dividend yields of 7% and 3% respectively, strong balance sheet, long-term track record and a recovery in the German manufacturing market should additionally continue to support the valuation.'

To Read the Entire Report Please Click on the pdf File Below