Celgene Corporation (NASDAQ:CELG) announced data from phase III trial, RELIEF, on dermatology drug Otezla in a late-breaking oral presentation at the 2018 American Academy of Dermatology ("AAD") Annual Meeting.

The phase III randomized, placebo-controlled, double-blind study, RELIEF, is evaluating Otezla twice daily (“BID”) in 207 patients with active Behçet’s Disease who were previously treated with at least one topical or systemic medication.

The primary endpoint was the area under the curve (“AUC”) for a number of oral ulcers at week 12, while the secondary objectives of the study included changes from baseline in pain of oral ulcers, Behçet’s Syndrome Activity Score, Behçet’s Disease Current Activity Index and Behçet’s Disease quality of life score at week 12.

Data from the study showed statistically significant reductions in oral ulcers with Otezla versus placebo through week 12.

Consequently, Celgene plans to submit supplemental New Drug Applications for Otezla BID for the treatment of active Behçet’s Disease with oral ulcers in the United States and Japan in the second half of this year. The company also plans to submit a type II Variation to the Marketing Authorization Application in EU in 2019.

Otezla is already approved for the treatment of patients with moderate to severe plaque psoriasis who are candidates for phototherapy or systemic therapy in the United States and for the treatment of adults with active psoriatic arthritis.

Sales of Otezla have increased in the fourth quarter after a slowdown in the third.

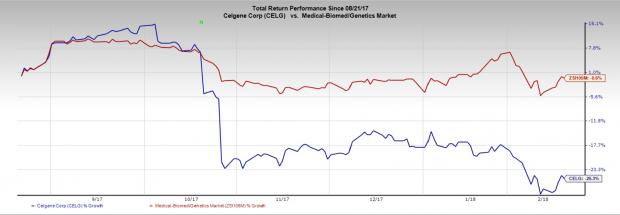

Celgene’s stock has tumbled 25.3% in the last six months compared with the industry’s slip of 0.6%.

Celgene suffered a series of setbacks over the last few months. The company suffered a setback when a late stage study on its lead cancer drug Revlimid in combination with Rituxan failed. The stock was hit earlier after a phase III trial, REVOLVE, (CD-002) on pipeline candidate GED-0301 in Crohn’s disease and the extension trial, SUSTAIN (CD-004) was discontinued.

The threat of generic competition is also looming large on Revlimid forcing Celgene to look for acquisitions. In January 2018, Celgene announced plans to acquire Juno Therapeutics (NASDAQ:JUNO) for $87 per share in cash, or a total of approximately $9 billion, net of cash and marketable securities acquired. The former already owns approximately 9.7% of outstanding shares of Juno. The CAR-T therapy space was in the spotlight in 2017 as the FDA approved the first CAR-T therapy, Novartis’ (NYSE:NVS) Kymriah for the treatment of patients up to 25 years of age with B-cell precursor acute lymphoblastic leukemia that is refractory or in second or later relapse stage.

Zacks Rank & Key Pick

Celgene carries a Zacks Rank #4 (Sell).

A better-ranked stock from the health care space is Exelixis (NASDAQ:EXEL) , sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Exelixis’ earnings per share estimates have moved up from 73 cents to 77 cents for 2018 over the last 60 days. The company delivered positive earnings surprise in the last four quarters, with an average beat of 572.92%.

Breaking News: Cryptocurrencies Now Bigger than Visa

The total market cap of all cryptos recently surpassed $700 billion – more than a 3,800% increase in the previous 12 months. They’re now bigger than Morgan Stanley (NYSE:MS), Goldman Sachs (NYSE:GS) and even Visa! The new asset class may expand even more rapidly in 2018 as new investors continue pouring in and Wall Street becomes increasingly involved.

Zacks has just named 4 companies that enable investors to take advantage of the explosive growth of cryptocurrencies via the stock market.

Click here to access these stocks >>

Novartis AG (NVS): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Exelixis, Inc. (EXEL): Free Stock Analysis Report

Juno Therapeutics, Inc. (JUNO): Free Stock Analysis Report

Original post

Zacks Investment Research