We issued an updated research report on Celgene Corporation (NASDAQ:CELG) on May 15, 2017.

Celgene is a biopharmaceutical company focused on the discovery, development and commercialization of drugs targeting cancer and inflammatory diseases through next-generation solutions in protein homeostasis, immuno-oncology, epigenetic, immunology and neuro-inflammation.

Celgene’s key growth engine is Revlimid. Revlimid, an oral immunomodulatory drug, is currently approved for several indications including MM, myelodysplastic syndromes (MDS) and mantle cell lymphoma (MCL). The drug performed well in the first quarter and combated the deterrents of uneven buying patterns and coverage gap challenges. Continued momentum in the core indication, label expansion and global launches are likely to help the product to boost the top line.

Market share gains in key markets and longer treatment duration are contributing to the drug’s growth. Meanwhile, Celgene is working on expanding Revlimid’s label further. Revlimid received FDA approval for use as a maintenance treatment in NDMM patients after they receive an autologous stem-cell transplant. The drug was also approved in the EU for the same. NDMM market share continues to grow outside of the U.S., with a positive uptake both in the EU and in Japan.

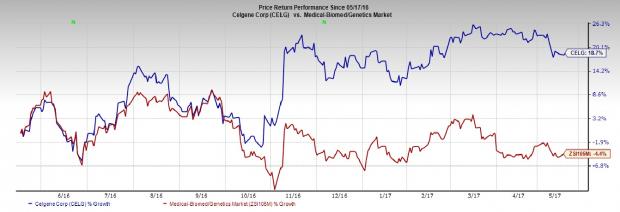

Celgene’s share price movement shows that the stock outperformed the Zacks classified Medical-Biomedical and Genetics industry in the past year. Specifically, the stock gained 18.7.% during this period, compared with a decline of 4.4% for the industry.

Celgene is also currently working on label expansion of drugs like Pomalyst/Imnovid, Abraxane and Otezla among others, which is encouraging. Pomalyst/Imnovid is being evaluated in multiple combination studies in relapsed/refractory MM.

Meanwhile, Celgene has a robust pipeline. Interesting candidates include GED-0301 (phase III – Crohn’s disease, phase II – UC), CC-486 (phase III – high-risk MDS, phase II – NSCLC), enasidenib (phase III – relapsed/refractory AML – regulatory application filed in the U.S.) and luspatercept (phase III – lower-risk MDS and beta-thalassemia).

Successful development and subsequent approval of these candidates will be a huge boost for the company. The NDA for Idhifa was granted Priority Review with a Prescription Drug User Fee Act (PDUFA) action date of Aug 30.

While Revlimid sales continue to be impressive, we are concerned about the company’s dependence on the product for growth. Lower-than-expected sales of the drug could adversely impact the company’s growth prospects. On the other hand, Otezla sales in the first quarter were impacted by managed care dynamics that drove lower total marketplace prescriptions for psoriasis therapies in the first quarter.

Higher gross to net adjustment related to new contracts with several large payers that were implemented in January and a modest decline in inventory levels also impacted sales. Moreover, the hematology, oncology, inflammation and immunology markets are dominated by several major players like AbbVie (NYSE:ABBV) and Amgen (NASDAQ:AMGN) , among others.

Zacks Rank & Key Pick

Celgene currently carries a Zacks Rank #3 (Hold).

A better-ranked stock in the healthcare sector is VIVUS, Inc. (NASDAQ:VVUS) which currently sports a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

VIVUS’ loss per share estimates narrowed from 502 cents to 39 cents for 2017 over the last 60 days. The company posted positive earnings surprises in all of the four trailing quarters, with an average beat of 233.69%.

5 Trades Could Profit "Big-League" from Trump Policies

If the stocks above spark your interest, wait until you look into companies primed to make substantial gains from Washington's changing course.

Today Zacks reveals 5 tickers that could benefit from new trends like streamlined drug approvals, tariffs, lower taxes, higher interest rates, and spending surges in defense and infrastructure. See these buy recommendations now >>

AbbVie Inc. (ABBV): Free Stock Analysis Report

VIVUS, Inc. (VVUS): Free Stock Analysis Report

Celgene Corporation (CELG): Free Stock Analysis Report

Amgen Inc. (AMGN): Free Stock Analysis Report

Original post