Celanese Corporation (NYSE:CE) will increase the list and off-list selling prices of Methyl Isobutyl Ketone (MIBK) and Methyl Isobutyl Carbinol (MIBC) by 5 cents in North and South America. The price hike will be effective from Feb 1, 2018 or as contracts permit.

Celanese is taking appropriate pricing actions amid a volatile raw material pricing environment. Celanese has underperformed the industry over the last six months. The company’s shares have moved up around 10.6% over this period compared with roughly 17.3% gain recorded by the industry.

Celanese kept its earnings streak alive with a beat in third-quarter 2017. The company logged adjusted earnings per share of $1.93 in the reported quarter, up 15.6% from $1.67 reported a year ago. The figure was slightly above the Zacks Consensus Estimate of $1.92.

The company expects business and productivity momentum to offset fourth-quarter seasonality. Celanese is optimistic that it can grow its adjusted earnings per share for 2017 toward the top end of its earlier announced guidance range of 9-11%.

Celanese’s strategic measures including operational cost savings through productivity actions and pricing initiatives are likely to lend support to its earnings in 2017. The company is also poised to gain from growth initiatives that include acquisitions.

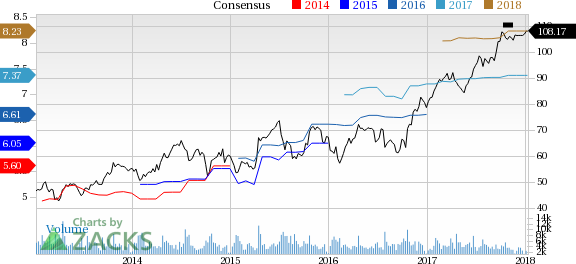

Celanese Corporation Price and Consensus

Zacks Rank & Stocks to Consider

Celanese carries a Zacks Rank #3 (Hold).

Some better-ranked stocks in the basic materials space are Kronos Worldwide Inc. (NYSE:KRO) , Koppers Holding Inc. (NYSE:KOP) and Huntsman Corporation (NYSE:HUN) , all sporting a Zacks Rank #1 (Strong Buy). You can see the complete list of today’s Zacks #1 Rank stocks here.

Kronos Worldwide has expected long-term earnings growth of 5%. Its shares have skyrocketed 105.9% yearly.

Koppers has expected long-term earnings growth of 18%. Shares of the company have rallied 25.3% yearly.

Huntsman has expected long-term earnings growth of 8%. Its shares have soared 74.6% year to date.

Wall Street’s Next Amazon (NASDAQ:AMZN)

Zacks EVP Kevin Matras believes this familiar stock has only just begun its climb to become one of the greatest investments of all time. It’s a once-in-a-generation opportunity to invest in pure genius.

Click for details >>

Celanese Corporation (CE): Free Stock Analysis Report

Kronos Worldwide Inc (KRO): Free Stock Analysis Report

Koppers Holdings Inc. (KOP): Free Stock Analysis Report

Huntsman Corporation (HUN): Free Stock Analysis Report

Original post

Zacks Investment Research