Have you been eager to see how CBRE Group, Inc. (NYSE:CBG) performed in Q4 in comparison with the market expectations? Let’s quickly scan through the key facts from this Los Angeles, CA-based, real estate operation firm’s earnings release this morning:

An Earnings Beat

CBRE Group came out with adjusted earnings per share of 99 cents, beating the Zacks Consensus Estimate of 93 cents.

Results reflect growth in occupier outsourcing and leasing fee revenue.

How Was the Earnings Surprise Trend?

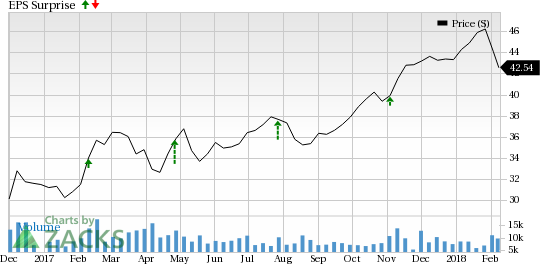

CBRE Group has a decent earnings surprise history. Before posting an earnings beat in Q4, the company delivered positive surprises in all the four trailing quarters, as shown in the chart below.

Overall, the company surpassed the Zacks Consensus Estimate by an average of 22.3% in the trailing four quarters.

Revenue Came In Higher Than Expected

CBRE Group posted revenues of around $4.3 billion, which beat the Zacks Consensus Estimate of $4.1 billion. It also compared favorably with the year-ago tally of $3.8 billion.

Key Developments to Note

CBRE Group expects full-year 2018 adjusted earnings per share in the band of $3.00-$ 3.15, denoting a projected increase of 13% at the midpoint.

What Zacks Rank Says

CBRE Group currently has a Zacks Rank #3 (Hold). However, since the latest earnings performance is yet to be reflected in the estimate revisions, the rank is subject to change. While things apparently look favorable, it all depends on what sense the just-released report makes to the analysts.

You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Check back later for our full write up on this CBRE Group earnings report!

Will You Make a Fortune on the Shift to Electric Cars?

Here's another stock idea to consider. Much like petroleum 150 years ago, lithium power may soon shake the world, creating millionaires and reshaping geo-politics. Soon electric vehicles (EVs) may be cheaper than gas guzzlers. Some are already reaching 265 miles on a single charge.

With battery prices plummeting and charging stations set to multiply, one company stands out as the #1 stock to buy according to Zacks research.

It's not the one you think.

See This Ticker Free >>

CBRE Group, Inc. (CBG): Free Stock Analysis Report

Original post

Zacks Investment Research