CBRE Group, Inc. (NYSE:CBG) is slated to report second-quarter 2017 results on Jul 27, before the market opens.

Last quarter, this Los Angeles, CA-based commercial real estate services and investment firm delivered a 30.3% positive earnings surprise. Results indicated better-than-expected growth in revenues.

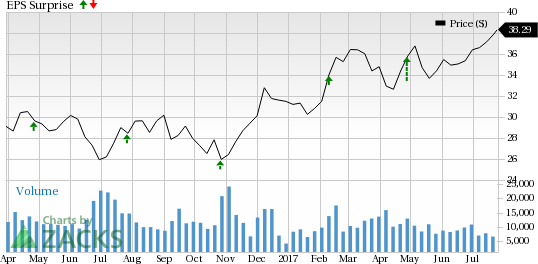

In fact, CBRE has a decent record of earnings surprise, having surpassed estimates in all of the trailing four quarters, with a positive average surprise of 13.5%. The graph below depicts this surprise history:

CBRE’s shares have rallied 21.6% year to date, outperforming the industry’s gain of 13.5%.

Let’s see how things are shaping up for this announcement.

Factors to Consider

CBRE’s broad range of real estate products and services, and an extensive knowledge of domestic and international real estate markets are likely to drive its top-line growth in the to-be-reported quarter. Moreover, the global economy continues to expand at a modest pace, while commercial real estate market fundamentals remain sound. These, in turn, will likely boost the company’s growth in the quarter. Amid these, it is likely to experience improvement in leasing, property sales and outsourcing business.

Also, strategic in-fill acquisitions play a key role in expanding the geographic coverage and enhancing CBRE’s service offerings, which are anticipated to prove conducive to the company’s growth. It is also expected to experience improvement in operational efficiencies in the quarter under review.

Nevertheless, stiff competition from international, regional and local players, along with unfavorable foreign currency, is predicted to mar the company’s top-line performance to some extent.

In addition, CBRE’s activities during the quarter could not gain adequate analyst confidence. Consequently, the Zacks Consensus Estimate for the second quarter remained unchanged at 53 cents, over the past seven days.

Earnings Whispers

Our proven model does not conclusively show that CBRE will likely beat estimates this season. This is because a stock needs to have both a positive Earnings ESP and a Zacks Rank #1 (Strong Buy), 2 (Buy) or at least 3 (Hold) for this to happen. However, that is not the case here as you will see below.

Zacks ESP: The Earnings ESP for CBRE is 0.00%. This is because the Most Accurate estimate of 53 cents matches the Zacks Consensus Estimate. You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Zacks Rank: CBRE’s Zacks Rank #2 increases the predictive power of ESP. However, we also need to have a positive ESP to be confident of an earnings beat.

Stocks That Warrant a Look

Here are a few stocks in the real estate sector that you may want to consider, as our model shows that these have the right combination of elements to report a positive surprise this time around:

Jones Lang LaSalle Incorporated (NYSE:JLL) , expected to release earnings on Aug 2, has an Earnings ESP of +9.66% and a Zacks Rank #2.

Invitation Homes Inc. (NYSE:INVH) , likely to release second-quarter results on Aug 10, has an Earnings ESP of +4.17% and a Zacks Rank #2. You can see the complete list of today’s Zacks #1 Rank stocks here.

LGI Homes, Inc. (NASDAQ:LGIH) , expected to release quarterly numbers on Aug 8, has an Earnings ESP of +3.94% and a Zacks Rank #1.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

LGI Homes, Inc. (LGIH): Free Stock Analysis Report

Jones Lang LaSalle Incorporated (JLL): Free Stock Analysis Report

CBRE Group, Inc. (CBG): Free Stock Analysis Report

Invitation Home Inc. (INVH): Free Stock Analysis Report

Original post

Zacks Investment Research