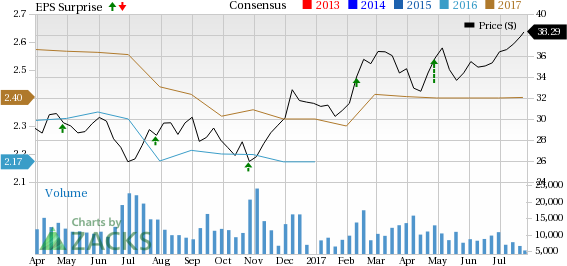

CBRE Group Inc. (NYSE:CBG) reported second-quarter 2017 adjusted earnings per share of 65 cents, beating the Zacks Consensus Estimate of 53 cents. The figure also marked a 25% increase from the prior-year quarter tally of 52 cents.

Results reflect strength in regional services business and solid organic growth in global occupier outsourcing business, and benefit from cost control efforts. The company also raised its adjusted earnings per share outlook for full-year 2017.

On a GAAP basis, earnings per share came in at 58 cents, ahead of the prior-year quarter earnings per share of 36 cents.

The company posted revenues of around $3.34 billion, missing the Zacks Consensus Estimate of $3.36 billion. However, revenues were higher than the year-ago number of around $3.21 billion. Moreover, fee revenues were up 3% (6% in local currency) year over year to $2.2 billion.

Quarter in Detail

CBRE Group’s largest business segment – The Americas – reported 4% rise in revenues from the prior-year quarter to $1.86 billion (up 5% in local currency), while Asia Pacific (APAC) witnessed 17% increase in revenues to $420.6 million (17% in local currency), with solid growth across the region, particularly in Greater China, Japan and Singapore.

Although, Europe, the Middle East & Africa (EMEA) revenues rose 8% in local currency, the figure was flat at $954.7 million after conversion to the U.S. dollars.

In the Global Investment Management segment, revenues totaled $92.8 million, down 3% (up 1% in local currency) year over year, while the Development Services segment reported revenues of $17.2 million, down 4% year over year.

Notably, in the second quarter, the company signed 103 total contracts, including 44 client expansions.

Liquidity

CBRE exited second-quarter 2017 with cash and cash equivalents of $535.7 million, down from $762.6 million as of Dec 31, 2016.

2017 Outlook

CBRE Group raised its outlook for 2017 adjusted earnings per share to $2.53–$2.63, which at the mid-point indicates a 12% increase for full-year 2017. The Zacks Consensus Estimate for the same is currently pegged at $2.40.

Our Viewpoint

We are encouraged with the better-than-expected result of CBRE Group in the second quarter. The company’s extensive real estate products and services offerings and outsourcing business, strategic in-fill acquisitions, transformational deals, and healthy balance sheet are anticipated to drive its results. However, uneasiness in certain economies and unfavorable foreign currency movement remain concerns for the company.

CBRE Group currently carries a Zacks Rank #2 (Buy). You can see the complete list of today’s Zacks #1 Rank (Strong Buy) stocks here.

Investors interested in the real estate industry can also consider other similarly-ranked stocks like Henderson Land Development Company Limited (OTC:HLDCY) , Jones Lang LaSalle Incorporated (NYSE:JLL) and Invitation Homes Inc. (NYSE:INVH) .

Currently, Henderson Land Development Company, JLL and Invitation Homes have expected long-term EPS growth rates of 5.2%, 11.5% and 8.0%, respectively.

More Stock News: Tech Opportunity Worth $386 Billion in 2017

From driverless cars to artificial intelligence, we've seen an unsurpassed growth of high-tech products in recent months. Yesterday's science-fiction is becoming today's reality. Despite all the innovation, there is a single component no tech company can survive without. Demand for this critical device will reach $387 billion this year alone, and it's likely to grow even faster in the future.

Zacks has released a brand-new Special Report to help you take advantage of this exciting investment opportunity. Most importantly, it reveals 4 stocks with massive profit potential. See these stocks now>>

Jones Lang LaSalle Incorporated (JLL): Free Stock Analysis Report

Henderson Land Development Co. (HLDCY): Free Stock Analysis Report

CBRE Group, Inc. (CBG): Free Stock Analysis Report

Invitation Home Inc. (INVH): Free Stock Analysis Report

Original post

Zacks Investment Research