The Congressional Budget Office is out with its annual review of Social Security. It’s a long report – here’s all you need to know:

This result is no surprise. SS’s finances deteriorate every year. What I found interesting is the extent of the deterioration. 2013 was the best year since 2008 for the broad economy. We had fairly steady growth in the economy, and the job market improved significantly. But the red ink at SS rose very rapidly.

In 2012 a ‘fix’ for SS would have required an immediate and permanent tax increase of 1.95%. A year later the cost of the fix has risen to 3.36%. That’s a 70% deterioration in twelve months. To right the SS ship a payroll tax increase equal to $180B would be required for 2014, and that higher tax rate would have to be sustained forever. A tax increase of this magnitude would sink the economy into a recession that the country would struggle to get out of.

The deteriorating outlook, and another year of inaction, has brought the blow-up date for SS a bit closer to today. CBO has an interesting time line for when this might happen:

In CBO’s simulations, in which most of the key demographic and economic factors in the analysis were varied on the basis of historical patterns, the trust fund ratio falls to zero in 2029

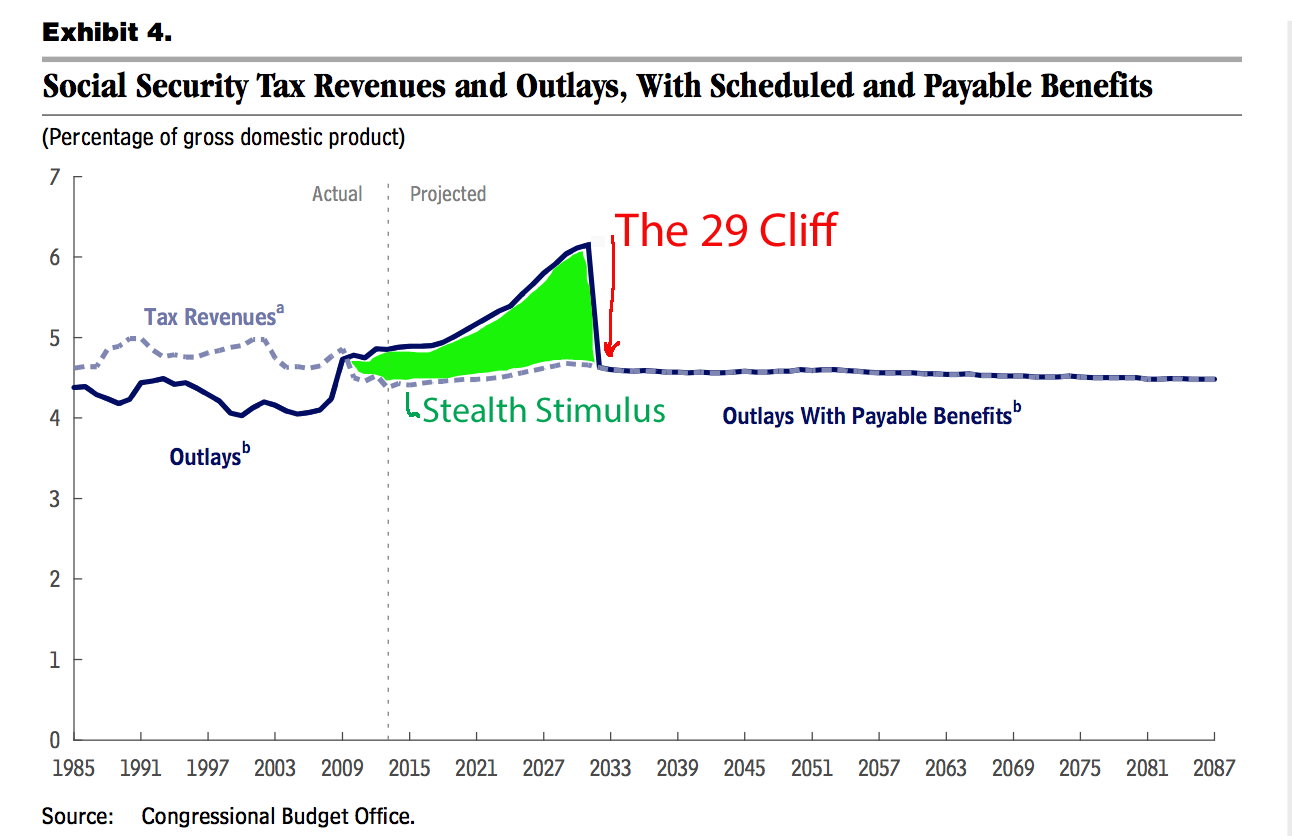

2029? One hundred years after the last crash and depression we will face a self imposed crisis. When the Trust Fund ratio falls to zero current law requires that all benefits are cut across-the-board by 25%. As it is set up today, there is a huge cliff that the economy will fall over – and that cliff is now just fifteen years away. A chart of the cliff:

When the Trust Fund is running dry in 29′ SS will be paying out at a rate equal to 6% of GDP. The 25% drop in benefits would translate into an immediate (and permanent) drop in consumption of 1.5% of GDP. That’s a pretty steep cliff to go over.

So we are fifteen years away from a real problem, and no one is doing anything about it. Nothing will be done in 2014 as it is an election year. I doubt that any real fixes to SS will be made until after Obama is out of the White House. The result of inaction will be that the cost of the fix rises. By 2017 it will be damn near impossible to stabilize the system in the then remaining years before the cliff is hit.

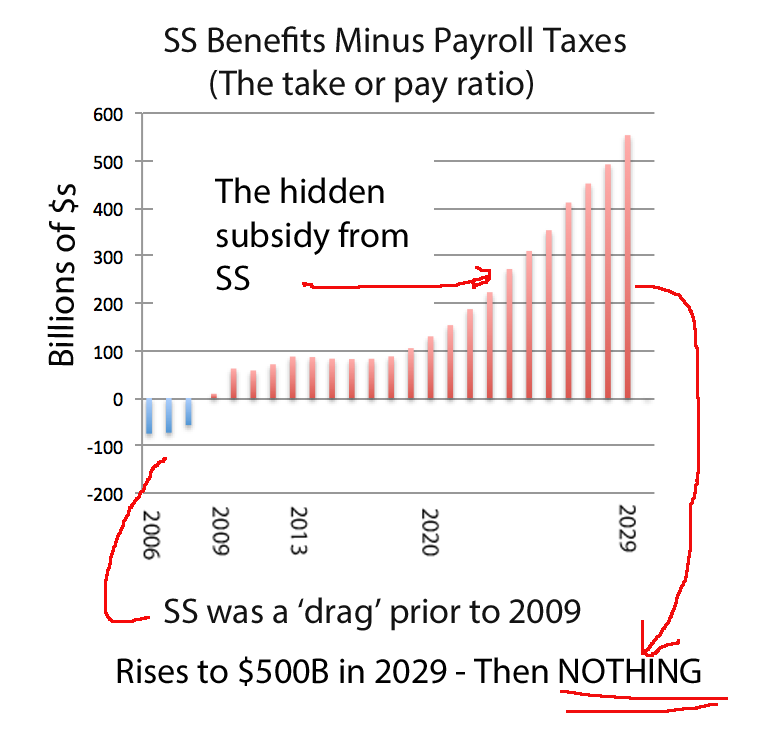

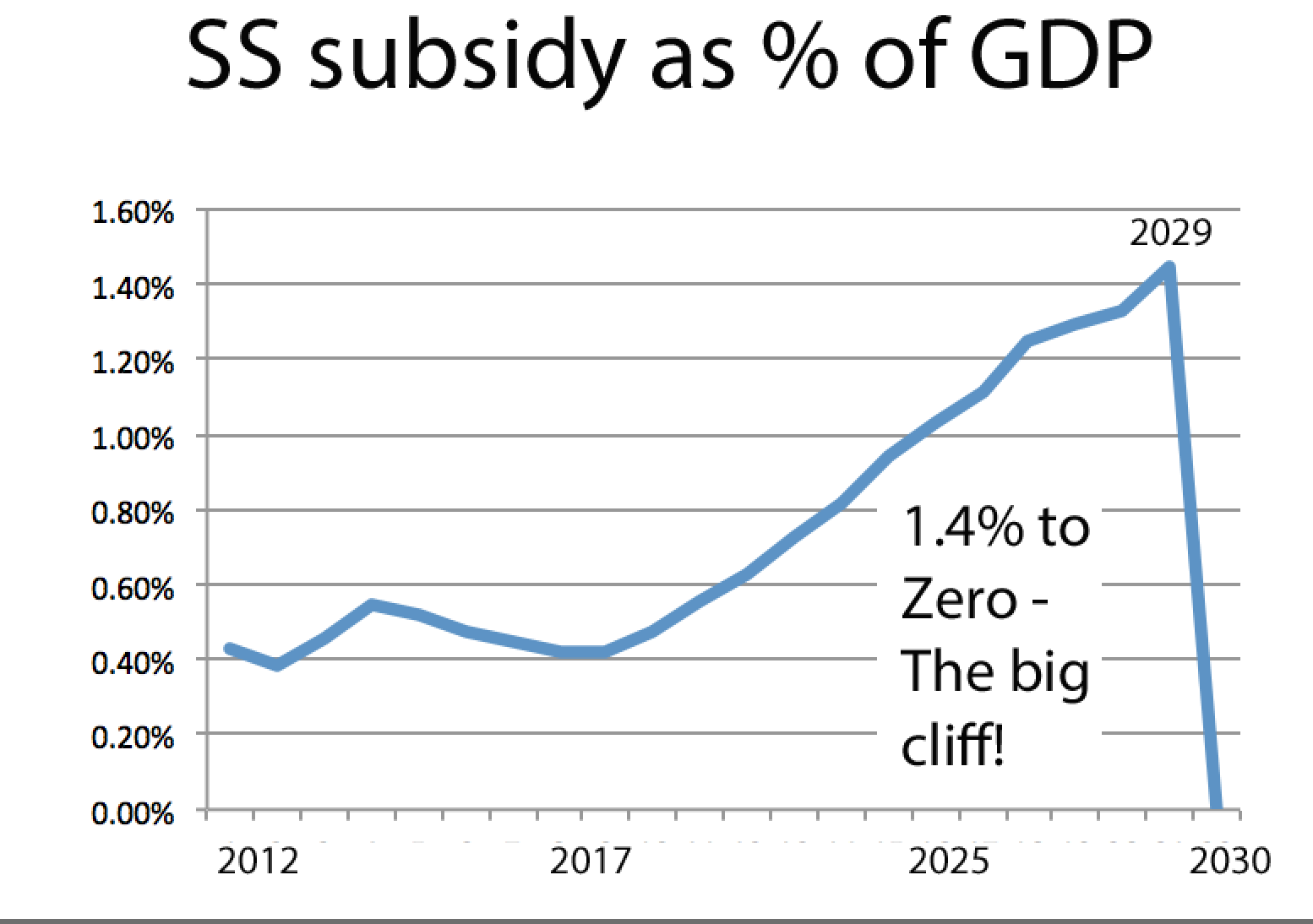

Social Security has morphed into an interesting economic stimulus that I don’t believe anyone has focused on. For 2013 the amount of the hidden stimulus is $87B (0.5% of GDP) but the size of the annual boost is going to grow very quickly over the remainder of this decade. In the final year before the blow-up it grows to $550B (1.4% of GDP)

In 2013 SS will collect $727B in payroll taxes and pay out $816B in benefits (~$90B difference). Both the taxes and the benefits have a 1-1 consequence on consumer spending. The fact that SS is no longer pay-go on a cash basis means that it has to dip into the Trust Fund to fund the difference. When the TF redeems its IOUs, it forces the Treasury to issue more Debt to the Public (dollar for dollar increase). But Total Debt remains the same, and there is no consequence of this form of deficit spending on the Budget (intergovernmental transfers are not included in the deficit calculation).

A few charts on the Take-or-Pay based on numbers from the 2013 Social Security report to congress:

These are big numbers. If there are no adjustments to SS this hidden stimulus will have a significant consequence. In the years just prior to the 2029 crash the stimulus will be a substantial portion of the YoY GDP grow. But then the music just stops – from one year to the next there will be a huge contraction as the stealth deficit spending ends and benefits are cut by 25%.

Yes, all of these things are still far into the future. And yes, the thought of eliminating the hiding stimulus anytime soon is not politically (or economically) feasible. But the reality is that the SS Cliff is surely going to be realized in the now foreseeable future. D.C. knows that the future is now on a glide path into the side of a mountain, but it ‘feels so good’ to do nothing, that nothing will be done. The history books will not look kindly on this neglect.

Note: Elizabeth Warren (D -Mass) has been leading a liberal/progressive debate on expanding SS. She wants to increase payouts (a step that would move 2029 to 2025). When the history books do write about this, they will point to the likes of Warren, and say that she led the charge to a disaster. I don’t think these people have a clue what SS is doing, and what will surely happen in the relatively near future.

- English (UK)

- English (India)

- English (Canada)

- English (Australia)

- English (South Africa)

- English (Philippines)

- English (Nigeria)

- Deutsch

- Español (España)

- Español (México)

- Français

- Italiano

- Nederlands

- Português (Portugal)

- Polski

- Português (Brasil)

- Русский

- Türkçe

- العربية

- Ελληνικά

- Svenska

- Suomi

- עברית

- 日本語

- 한국어

- 简体中文

- 繁體中文

- Bahasa Indonesia

- Bahasa Melayu

- ไทย

- Tiếng Việt

- हिंदी

CBO On SS – Another 29′ Crash?

Published 12/20/2013, 01:45 AM

Updated 07/09/2023, 06:31 AM

CBO On SS – Another 29′ Crash?

Latest comments

Loading next article…

Install Our App

Risk Disclosure: Trading in financial instruments and/or cryptocurrencies involves high risks including the risk of losing some, or all, of your investment amount, and may not be suitable for all investors. Prices of cryptocurrencies are extremely volatile and may be affected by external factors such as financial, regulatory or political events. Trading on margin increases the financial risks.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

Before deciding to trade in financial instrument or cryptocurrencies you should be fully informed of the risks and costs associated with trading the financial markets, carefully consider your investment objectives, level of experience, and risk appetite, and seek professional advice where needed.

Fusion Media would like to remind you that the data contained in this website is not necessarily real-time nor accurate. The data and prices on the website are not necessarily provided by any market or exchange, but may be provided by market makers, and so prices may not be accurate and may differ from the actual price at any given market, meaning prices are indicative and not appropriate for trading purposes. Fusion Media and any provider of the data contained in this website will not accept liability for any loss or damage as a result of your trading, or your reliance on the information contained within this website.

It is prohibited to use, store, reproduce, display, modify, transmit or distribute the data contained in this website without the explicit prior written permission of Fusion Media and/or the data provider. All intellectual property rights are reserved by the providers and/or the exchange providing the data contained in this website.

Fusion Media may be compensated by the advertisers that appear on the website, based on your interaction with the advertisements or advertisers.

© 2007-2025 - Fusion Media Limited. All Rights Reserved.